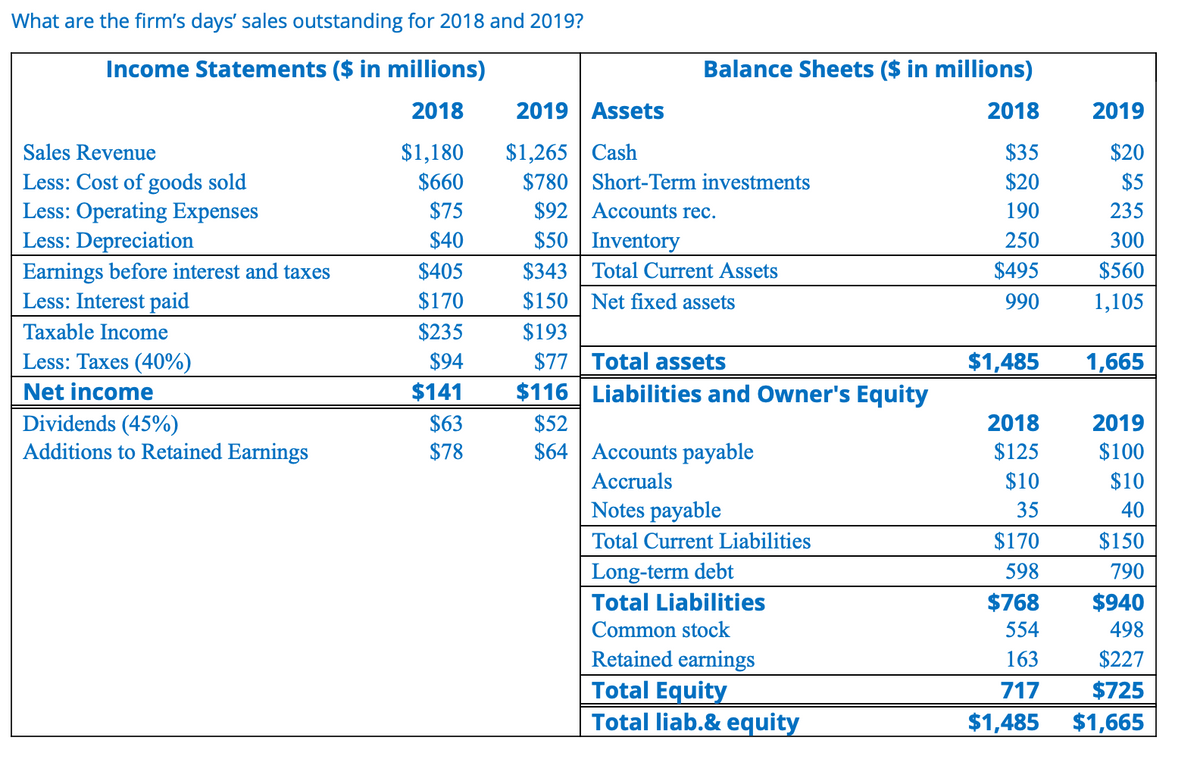

What are the firm's days' sales outstanding for 2018 and 2019? Income Statements ($ in millions) Balance Sheets ($ in millions) 2018 2019 | Assets 2018 2019 Sales Revenue $1,265 | Cash $1,180 $660 $35 $20 Less: Cost of goods sold Less: Operating Expenses Less: Depreciation Earnings before interest and taxes Less: Interest paid $780 $92 | Accounts rec. Short-Term investments $20 $5 $75 190 235 $40 $50 | Inventory 250 300 $405 $343 Total Current Assets $495 $560 $170 $150 | Net fixed assets 990 1,105 Taxable Income $235 $193 $77 Total assets $116 Liabilities and Owner's Equity Less: Taxes (40%) $94 $1,485 1,665 Net income $141 Dividends (45%) Additions to Retained Earnings $63 2018 2019 $52 $64 $78 Accounts payable $125 $100 Accruals $10 $10 Notes payable 35 40 Total Current Liabilities $170 $150 Long-term debt 598 790 Total Liabilities $768 $940 Common stock 554 498 Retained earnings Total Equity Total liab.& equity 163 $227 717 $725 $1,485 $1,665

What are the firm's days' sales outstanding for 2018 and 2019? Income Statements ($ in millions) Balance Sheets ($ in millions) 2018 2019 | Assets 2018 2019 Sales Revenue $1,265 | Cash $1,180 $660 $35 $20 Less: Cost of goods sold Less: Operating Expenses Less: Depreciation Earnings before interest and taxes Less: Interest paid $780 $92 | Accounts rec. Short-Term investments $20 $5 $75 190 235 $40 $50 | Inventory 250 300 $405 $343 Total Current Assets $495 $560 $170 $150 | Net fixed assets 990 1,105 Taxable Income $235 $193 $77 Total assets $116 Liabilities and Owner's Equity Less: Taxes (40%) $94 $1,485 1,665 Net income $141 Dividends (45%) Additions to Retained Earnings $63 2018 2019 $52 $64 $78 Accounts payable $125 $100 Accruals $10 $10 Notes payable 35 40 Total Current Liabilities $170 $150 Long-term debt 598 790 Total Liabilities $768 $940 Common stock 554 498 Retained earnings Total Equity Total liab.& equity 163 $227 717 $725 $1,485 $1,665

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 89E: Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and...

Related questions

Question

Transcribed Image Text:What are the firm's days' sales outstanding for 2018 and 2019?

Income Statements ($ in millions)

Balance Sheets ($ in millions)

2018

2019 Assets

2018

2019

$1,265 | Cash

$780 Short-Term investments

$92 | Accounts rec.

Sales Revenue

$1,180

$35

$20

$660

$20

$5

Less: Cost of goods sold

Less: Operating Expenses

Less: Depreciation

Earnings before interest and taxes

Less: Interest paid

$75

190

235

$50 Inventory

$343 Total Current Assets

$40

250

300

$405

$495

$560

$170

$150 | Net fixed assets

990

1,105

Taxable Income

$235

$193

Less: Taxes (40%)

$94

$77 Total assets

$1,485

1,665

Net income

$141

$116 Liabilities and Owner's Equity

Dividends (45%)

Additions to Retained Earnings

$63

$52

2018

2019

$78

$64 Accounts payable

$125

$100

Accruals

$10

$10

Notes payable

35

40

Total Current Liabilities

$170

$150

Long-term debt

598

790

Total Liabilities

$768

$940

Common stock

554

498

Retained earnings

Total Equity

Total liab.& equity

163

$227

717

$725

$1,485

$1,665

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning