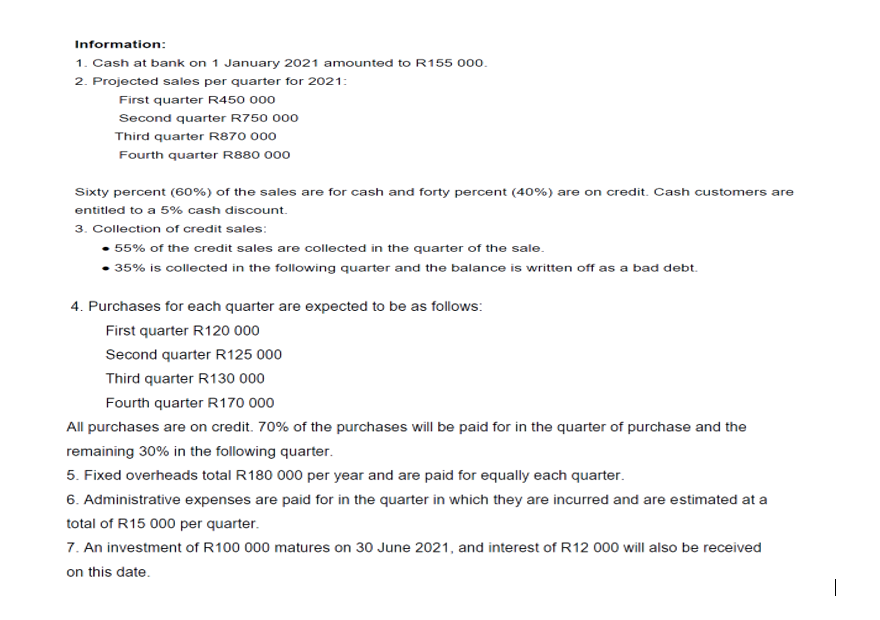

Information: 1. Cash at bank on 1 January 2021 amounted to R155 000. 2. Projected sales per quarter for 2021: First quarter R450 000 Second quarter R750 000 Third quarter R870 000 Fourth quarter R880 000 Sixty percent (60%) of the sales are for cash and forty percent (40%) are on credit. Cash customers are entitled to a 5% cash discount. 3. Collection of credit sales: 55% of the credit sales are collected in the quarter of the sale. • 35% is collected in the following quarter and the balance is written off as a bad debt. 4. Purchases for each quarter are expected to be as follows: First quarter R120 000 Second quarter R125 000 Third quarter R130 000 Fourth quarter R170 000 All purchases are on credit. 70% of the purchases will be paid for in the quarter of purchase and the remaining 30% in the following quarter. 5. Fixed overheads total R180 000 per year and are paid for equally each quarter. 6. Administrative expenses are paid for in the quarter in which they are incurred and are estimated at a total of R15 000 per quarter. 7. An investment of R100 000 matures on 30 June 2021, and interest of R12 000 will also be received on this date.

Information: 1. Cash at bank on 1 January 2021 amounted to R155 000. 2. Projected sales per quarter for 2021: First quarter R450 000 Second quarter R750 000 Third quarter R870 000 Fourth quarter R880 000 Sixty percent (60%) of the sales are for cash and forty percent (40%) are on credit. Cash customers are entitled to a 5% cash discount. 3. Collection of credit sales: 55% of the credit sales are collected in the quarter of the sale. • 35% is collected in the following quarter and the balance is written off as a bad debt. 4. Purchases for each quarter are expected to be as follows: First quarter R120 000 Second quarter R125 000 Third quarter R130 000 Fourth quarter R170 000 All purchases are on credit. 70% of the purchases will be paid for in the quarter of purchase and the remaining 30% in the following quarter. 5. Fixed overheads total R180 000 per year and are paid for equally each quarter. 6. Administrative expenses are paid for in the quarter in which they are incurred and are estimated at a total of R15 000 per quarter. 7. An investment of R100 000 matures on 30 June 2021, and interest of R12 000 will also be received on this date.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 23E: Historically, Ragman Company has had no significant bad debt experience with its customers. Cash...

Related questions

Question

100%

Prepare

Transcribed Image Text:Information:

1. Cash at bank on 1 January 2021 amounted to R155 000.

2. Projected sales per quarter for 2021:

First quarter R450 000

Second quarter R750 000

Third quarter R870 000

Fourth quarter R880 000

Sixty percent (60%) of the sales are for cash and forty percent (40%) are on credit. Cash customers are

entitled to a 5% cash discount.

3. Collection of credit sales:

55% of the credit sales are collected in the quarter of the sale.

• 35% is collected in the following quarter and the balance is written off as a bad debt.

4. Purchases for each quarter are expected to be as follows:

First quarter R120 000

Second quarter R125 000

Third quarter R130 000

Fourth quarter R170 000

All purchases are on credit. 70% of the purchases will be paid for in the quarter of purchase and the

remaining 30% in the following quarter.

5. Fixed overheads total R180 000 per year and are paid for equally each quarter.

6. Administrative expenses are paid for in the quarter in which they are incurred and are estimated at a

total of R15 000 per quarter.

7. An investment of R100 000 matures on 30 June 2021, and interest of R12 000 will also be received

on this date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub