Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 32E

Use the following information for Exercises 11-31 and 11-32:

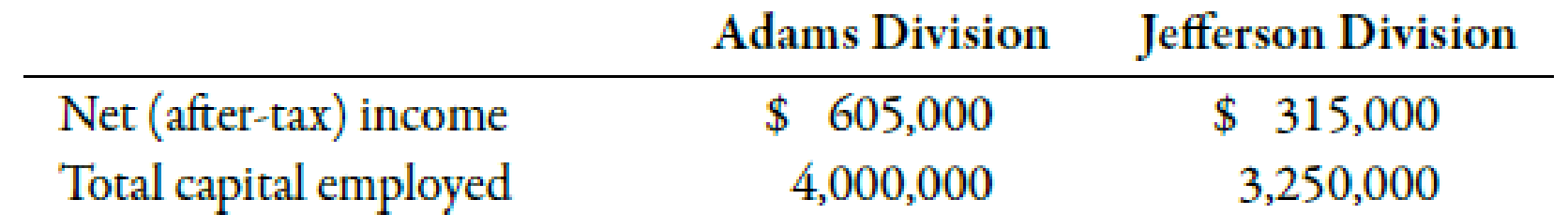

Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year’s results:

Washington’s actual cost of capital was 12%.

Exercise 11-32 Residual Income

Refer to the information for Washington Company above. In addition, Washington Company’s top management has set a minimum acceptable

Required:

- 1. Calculate the residual income for the Adams Division.

- 2. Calculate the residual income for the Jefferson Division.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

GGX is the general manager of the Jung Division, and his performance is measured using the residual income method. GGX is reviewing the following forecasted information for the division for next year.

Category

Amount (thousands)

Working capital

P 1,800

Revenue

30,000

Plant and equipment

17,200

To establish a standard of performance for the division’s manager using the residual income approach, four scenarios are being considered. Scenario 1 assumes an imputed interest charge of 12% and a target residual income of P1,500,000. Scenario 2 assumes an imputed interest charge of 15% and a target residual income of P2,000,000. Scenario 3 assumes an imputed interest charge of 18% and a target residual income of P1,250,000. Scenario 4 assumes an imputed interest charge of 10% and a target residual income of P2,500,000. What is the residual income for scenario 2?

Mr. Sy is the general manager of the XXX Division, and his performance is measured using the residual income method. Mr. Sy is reviewing the following forecasts to his division for the next year:Category AmountsWorking Capital P 1,800,000Revenue 30,000,000Plant and Equipment 17,200,000If the imputed interest charge is 15% and Mr. Sy wants to achieve a residual income of P2,000,000 what will costs (total expenses) have to be in order to achieve the targeted residual income?

The QRY Division of ABC Corp. generated a residual income of $400,000 and a return on investment of 34% with average annual assets of $4,000,000. What was the target rate of return the company used to calculate the XYZ Division's residual income?

Chapter 11 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 11 - Discuss the differences between centralized and...Ch. 11 - Prob. 2DQCh. 11 - Explain why firms choose to decentralize.Ch. 11 - What are margin and turnover? Explain how these...Ch. 11 - What are the three benefits of ROI? Explain how...Ch. 11 - What is residual income? What is EVA? How does EVA...Ch. 11 - Can residual income or EVA ever be negative? What...Ch. 11 - What is transfer price?Ch. 11 - Prob. 9DQCh. 11 - (Appendix 11A) What is the Balanced Scorecard?

Ch. 11 - (Appendix 11A) Describe the four perspectives of...Ch. 11 - The practice of delegating authority to...Ch. 11 - Which of the following is not a reason for...Ch. 11 - A responsibility center in which a manager is...Ch. 11 - A responsibility center in which a manager is...Ch. 11 - If sales and average operating assets for Year 2...Ch. 11 - If sales and average operating assets for Year 2...Ch. 11 - The key difference between residual income and EVA...Ch. 11 - It ROI for a division is 15% and the company's...Ch. 11 - Prob. 9MCQCh. 11 - Prob. 10MCQCh. 11 - (Appendix 11A) Which of the following is a...Ch. 11 - (Appendix 11A) The length of time it takes to...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Prob. 16BEACh. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Prob. 21BEBCh. 11 - Calculating Transfer Price Teslum Inc. has a...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Types of Responsibility Centers Consider each of...Ch. 11 - Margin, Turnover, Return on Investment Pelak...Ch. 11 - Margin, Turnover, Return on Investment, Average...Ch. 11 - Return on Investment, Margin, Turnover Data follow...Ch. 11 - Residual Income The Avila Division of Maldonado...Ch. 11 - Economic Value Added Falconer Company had net...Ch. 11 - Use the following information for Exercises 11-31...Ch. 11 - Use the following information for Exercises 11-31...Ch. 11 - Prob. 33ECh. 11 - Use the following information for Exercises 11-33...Ch. 11 - Prob. 35ECh. 11 - (Appendix 11A) Cycle Time and Velocity Prakesh...Ch. 11 - (Appendix 11A) Cycle Time and Velocity Lasker...Ch. 11 - (Appendix 11A) Manufacturing Cycle Efficiency...Ch. 11 - (Appendix 11A) Manufacturing Cycle Efficiency...Ch. 11 - Return on Investment and Investment Decisions...Ch. 11 - Return on Investment, Margin, Turnover Ready...Ch. 11 - Return on Investment for Multiple Investments,...Ch. 11 - Return on Investment and Economic Value Added...Ch. 11 - Transfer Pricing GreenWorld Inc. is a nursery...Ch. 11 - Prob. 45PCh. 11 - Prob. 46PCh. 11 - (Appendix 11A) Cycle Time, Velocity, Conversion...Ch. 11 - (Appendix 11A) Balanced Scorecard The following...Ch. 11 - (Appendix 11A) Cycle Time and Velocity,...Ch. 11 - Prob. 50C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardThe following selected data pertain to the Argent Division for last year: Required: 1. How much is the residual income? 2. How much is the return on investment? (Rounded to four significant digits.)arrow_forwardThe condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forward

- The income statement comparison for Forklift Material Handling shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the return on investment. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the residual income for each year. Explain how this compares to your findings in part C.arrow_forwardBanyan Industries has two divisions, a tax rate of 30%, and a minimum rate of return of 20%. Division A has a weighted average cost of Capital of 9.5% and is looking at a new project that will generate a profit of $1,200,000 from a machine that costs $4,000,000. Division B has a weighted average cost of capital of 9.5% and is looking at a new project that will generate a profit of $1,350,000 from a machine that costs $5,000.000. A. Calculate the EVA for each of Banyans divisions. B. Calculate the RI for each of Banyans division. C. If Banyan uses EVA to evaluate the projects, which division has the better project and by how much? D. If Banyan uses RI, which division has the better project and by how much? E. What are some of the reasons for the similarity or difference that you found in the use of EVA versus RI?arrow_forwardUse the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-31 Economic Value Added Refer to the information for Washington Company above. Required: 1. Calculate the EVA for the Adams Division. 2. Calculate the EVA for the Jefferson Division. 3. CONCEPTUAL CONNECTION Is each division creating or destroying wealth? 4. CONCEPTUAL CONNECTION Describe generally the types of actions that Washingtons management team could take to increase Jefferson Divisions EVA?arrow_forward

- The income statement comparison for Rush Delivery Company shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the ROI. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the RI for each year. Explain how this compares to your findings in part C.arrow_forwardRefer to the data given in Exercise 10.8. Required: 1. Compute the residual income for each of the opportunities. (Round to the nearest dollar.) 2. Compute the divisional residual income (rounded to the nearest dollar) for each of the following four alternatives: a. The Espresso-Pro is added. b. The Mini-Prep is added. c. Both investments are added. d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of residual income, which alternative do you think the divisional manager will choose? 3. Based on your answer in Requirement 2, compute the profit or loss from the divisional managers investment decision. Was the correct decision made?arrow_forwardThe three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: a. Which division is making the best use of invested assets and should be given priority for future capital investments? b. b. Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. c. c. Identify opportunities for improving the companys financial performance.arrow_forward

- Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forwardCoolbrook company has the following information available for the past year:(Chart in photo below) Required:1. calculate return on Investment (ROI) and residual income for each divison for the last year2. Recalculate ROI and residual income for the division for each independent situration that follows:a.) operating income increases by 9 percentb.) operating Income decreases by 9 percentc.) The company invests 255,000 in each division, an amount that generates 106,000 additional income per division.d.) Coolbrook changes its hurdle rate to 5.26 percentarrow_forwardAssume that Division Blue has achieved a yearly operating income of $162,000 using $973,000 of invested assets. If management has set a minimum acceptable return on investment of 7%, the residual income is a. $75,112 b.$112,668 c.$93,890 d.$162,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Working capital explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XvHAlui-Bno;License: Standard Youtube License