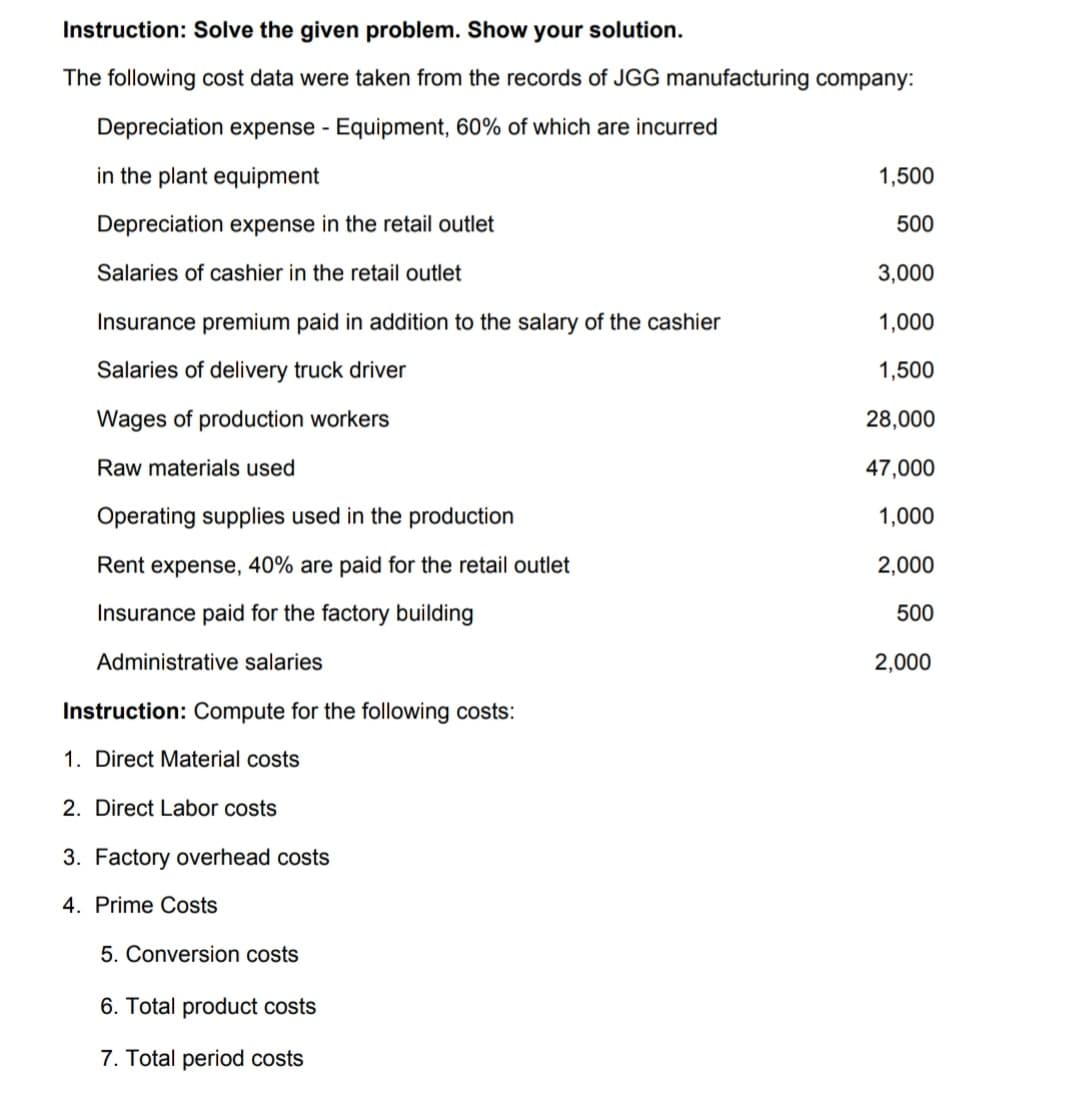

Instruction: Solve the given problem. Show your solution. The following cost data were taken from the records of JGG manufacturing company: Depreciation expense - Equipment, 60% of which are incurred in the plant equipment 1,500 Depreciation expense in the retail outlet 500 Salaries of cashier in the retail outlet 3,000 Insurance premium paid in addition to the salary of the cashier 1,000 Salaries of delivery truck driver 1,500 Wages of production workers 28,000 Raw materials used 47,000 Operating supplies used in the production 1,000 Rent expense, 40% are paid for the retail outlet 2,000 Insurance paid for the factory building 500 Administrative salaries 2,000 Instruction: Compute for the following costs: 1. Direct Material costs 2. Direct Labor costs 3. Factory overhead costs

Instruction: Solve the given problem. Show your solution. The following cost data were taken from the records of JGG manufacturing company: Depreciation expense - Equipment, 60% of which are incurred in the plant equipment 1,500 Depreciation expense in the retail outlet 500 Salaries of cashier in the retail outlet 3,000 Insurance premium paid in addition to the salary of the cashier 1,000 Salaries of delivery truck driver 1,500 Wages of production workers 28,000 Raw materials used 47,000 Operating supplies used in the production 1,000 Rent expense, 40% are paid for the retail outlet 2,000 Insurance paid for the factory building 500 Administrative salaries 2,000 Instruction: Compute for the following costs: 1. Direct Material costs 2. Direct Labor costs 3. Factory overhead costs

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 4EB: Roper Furniture manufactures office furniture and tracks cost data across their process. The...

Related questions

Question

Transcribed Image Text:Instruction: Solve the given problem. Show your solution.

The following cost data were taken from the records of JGG manufacturing company:

Depreciation expense - Equipment, 60% of which are incurred

in the plant equipment

1,500

Depreciation expense in the retail outlet

500

Salaries of cashier in the retail outlet

3,000

Insurance premium paid in addition to the salary of the cashier

1,000

Salaries of delivery truck driver

1,500

Wages of production workers

28,000

Raw materials used

47,000

Operating supplies used in the production

1,000

Rent expense, 40% are paid for the retail outlet

2,000

Insurance paid for the factory building

500

Administrative salaries

2,000

Instruction: Compute for the following costs:

1. Direct Material costs

2. Direct Labor costs

3. Factory overhead costs

4. Prime Costs

5. Conversion costs

6. Total product costs

7. Total period costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning