Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 8E

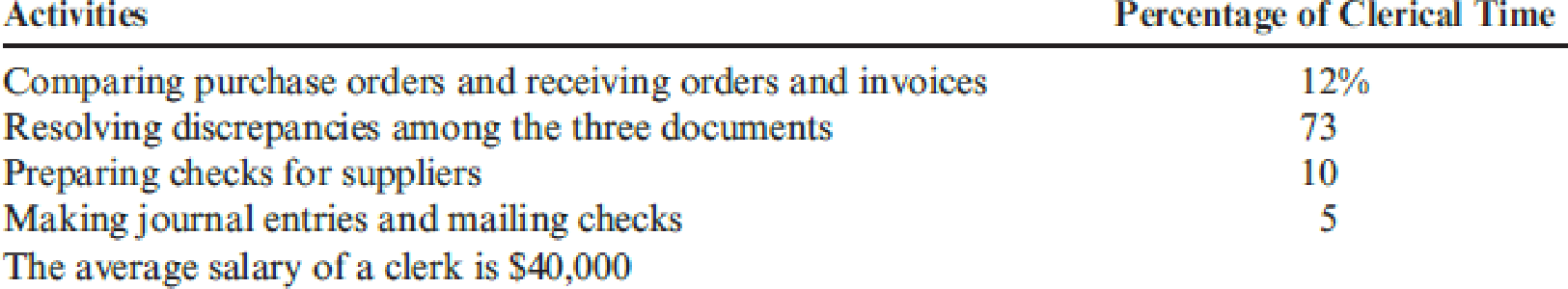

Thayne Company has 30 clerks that work in its Accounts Payable Department. A study revealed the following activities and the relative time demanded by each activity:

Required:

Classify the four activities as value-added or non-value-added, and calculate the clerical cost of each activity. For non-value-added activities, indicate why they are non-value-added.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The Gray Company has a staff of five clerks in its general accounting department. Three clerks who work during the day perform sundry accounting tasks; the two clerks who work in the evening are responsible for (1) collecting the cost data for the various jobs in process, (2) verifying manufacturing material and labor reports, and (3) supplying production reports to the supervisors by the next morning.

The salaries of these two clerks who work at night should be classified as:

A) Period costs.

B) Direct costs.

C) Product costs.

D) Indirect costs.

E) Variable Costs.

Within a company is a (micro)economy that is monitored by the accounting procedures. In terms of the accounts, the various departments "produce" costs, some of which are internal and some of which are direct costs. This problem shows how an open Leontief model can be used to determine departmental costs. The sales department of an auto dealership charges 10% of its total monthly costs to the service department, and the service department charges 20% of its total monthly costs to the sales department. During a given month, the direct costs are $88,200 for sales and $29,400 for service. Find the total costs (in dollars) of each department. (Round your answers to the nearest whole number.)

sales department $

service department $

Draper Bank uses activity-based costing to determine the cost of servicing customers. Thereare three activity pools: teller transaction processing, check processing, and ATM transactionprocessing. The activity rates associated with each activity pool are $3.50 per teller transaction,$0.12 per canceled check, and $0.10 per ATM transaction. Corner Cleaners Inc. (a customer ofDraper Bank) had 12 teller transactions, 100 canceled checks, and 20 ATM transactions duringthe month. Determine the total monthly activity-based cost for Corner Cleaners Inc. during themonth.

Chapter 12 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 12 - What are the two dimensions of the activity-based...Ch. 12 - What is driver analysis? What role does it play in...Ch. 12 - What is activity analysis? Why is this approach...Ch. 12 - What are value-added activities? Value-added...Ch. 12 - What are non-value-added activities?...Ch. 12 - Identify and define four different ways to manage...Ch. 12 - What is a kaizen standard? Describe the kaizen and...Ch. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQ

Ch. 12 - Prob. 11DQCh. 12 - Prob. 12DQCh. 12 - Prob. 13DQCh. 12 - Describe a financial-based responsibility...Ch. 12 - Describe an activity-based responsibility...Ch. 12 - Cicleta Manufacturing has four activities:...Ch. 12 - Assume that at the beginning of 20x2, Cicleta...Ch. 12 - Gordon Company produces custom-made machine parts....Ch. 12 - Foy Company has a welding activity and wants to...Ch. 12 - Uchdorf Manufacturing just completed a study of...Ch. 12 - Harvey Company produces two models of blenders:...Ch. 12 - Prob. 7ECh. 12 - Thayne Company has 30 clerks that work in its...Ch. 12 - Suppose that clerical erroreither Thaynes or the...Ch. 12 - Refer to Exercise 12.8. Suppose that clerical...Ch. 12 - Prob. 11ECh. 12 - For Situations 1 through 6, provide the following...Ch. 12 - Maquina Company produces custom-made machine...Ch. 12 - Sanford, Inc., has developed value-added standards...Ch. 12 - Refer to Exercise 12.14. Suppose that for 20x2,...Ch. 12 - Jane Erickson, manager of an electronics division,...Ch. 12 - For each of the following situations, two...Ch. 12 - Which of the following are examples of...Ch. 12 - A company is spending 70,000 per year for...Ch. 12 - Which of the following is likely to be used to...Ch. 12 - Activity-based management includes both process...Ch. 12 - The activity of moving materials uses four...Ch. 12 - Joseph Fox, controller of Thorpe Company, has been...Ch. 12 - Baker, Inc., supplies wheels for a large bicycle...Ch. 12 - Novo, Inc., wants to develop an activity flexible...Ch. 12 - Prob. 26PCh. 12 - Tom Young, vice president of Dunn Company (a...Ch. 12 - Bienestar, Inc., has two plants that manufacture a...Ch. 12 - Kelly Gray, production manager, was upset with the...Ch. 12 - Douglas Davis, controller for Marston, Inc.,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardBig Mikes, a large hardware store, has gathered data on its overhead activities and associated costs for the past 10 months. Nizam Sanjay, a member of the controllers department, believes that overhead activities and costs should be classified into groups that have the same driver. He has decided that unloading incoming goods, counting goods, and inspecting goods can be grouped together as a more general receiving activity, since these three activities are all driven by the number of receiving orders. The 10 months of data shown below have been gathered for the receiving activity. Required: 1. Prepare a scattergraph, plotting the receiving costs against the number of purchase orders. Use the vertical axis for costs and the horizontal axis for orders. 2. Select two points that make the best fit, and compute a cost formula for receiving costs. 3. Using the high-low method, prepare a cost formula for the receiving activity. 4. Using the method of least squares, prepare a cost formula for the receiving activity. What is the coefficient of determination?arrow_forward

- Customers as a Cost Object Morrisom National Bank has requested an analysis of checking account profitability by customer type. Customers are categorized according to the size of their account: low balances, medium balances, and high balances. The activities associated with the three different customer categories and their associated annual costs are as follows: Additional data concerning the usage of the activities by the various customers are also provided: Required: (Note: Round answers to two decimal places.) 1. Calculate a cost per account per year by dividing the total cost of processing and maintaining checking accounts by the total number of accounts. What is the average fee per month that the bank should charge to cover the costs incurred because of checking accounts? 2. Calculate a cost per account by customer category by using activity rates. 3. Currently, the bank offers free checking to all of its customers. The interest revenues average 90 per account; however, the interest revenues earned per account by category are 80, 100, and 165 for the low-, medium-, and high-balance accounts, respectively. Calculate the average profit per account (average revenue minus average cost from Requirement 1). Then calculate the profit per account by using the revenue per customer type and the unit cost per customer type calculated in Requirement 2. 4. CONCEPTUAL CONNECTION After the analysis in Requirement 3, a vice president recommended eliminating the free checking feature for low-balance customers. The bank president expressed reluctance to do so, arguing that the low-balance customers more than made up for the loss through cross-sales. He presented a survey that showed that 50% of the customers would switch banks if a checking fee were imposed. Explain how you could verify the presidents argument by using ABC.arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Box Springs estimates there will be four orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardGolding Bank provided the following data about its resources and activities for its checking account process: Required: 1. Calculate the capacity cost rate for the checking account process. 2. Calculate the activity rates for the four activities. If the total number of statements issued was 20,000, calculate the cost of the issuing statements activity. 3. What if process improvements decreased the number of customer inquiries, leading to a 10 percent reduction in check processing hours and a 10,000 reduction in total resource costs? Update all the activity rates for these changes in operating conditions.arrow_forward

- Please use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardGeneva, Inc., makes two products, X and Y, that require allocation of indirect manufacturing costs. The following data were compiled by the accountants before making any allocations: The total cost of purchasing and receiving parts used in manufacturing is 60,000. The company uses a job-costing system with a single indirect cost rate. Under this system, allocated costs were 48,000 and 12,000 for X and Y, respectively. If an activity-based system is used, what would be the allocated costs for each product?arrow_forwardCorazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forward

- Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 80,000. b. Requisitioned raw materials to production, 80,000. c. Distributed direct labor costs, 10,000. d. Factory overhead costs incurred, 60,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 225,000, on account.arrow_forwardLansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forwardVargas, Inc., produces industrial machinery. Vargas has a machining department and a group of direct laborers called machinists. Each machinist is paid 25,000 and can machine up to 500 units per year. Vargas also hires supervisors to develop machine specification plans and to oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee three machinists, at most. Vargass accounting and production history reveal the following relationships between units produced and the costs of direct labor and supervision (measured on an annual basis): Required: 1. Prepare two graphs: one that illustrates the relationship between direct labor cost and units produced, and one that illustrates the relationship between the cost of supervision and units produced. Let cost be the vertical axis and units produced the horizontal axis. 2. How would you classify each cost? Why? 3. Suppose that the normal range of activity is between 2,400 and 2,450 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 400 units. How much will the cost of direct labor increase (and how will this increase be realized)? Cost of supervision?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

alue Chain Analysis EXPLAINED | B2U | Business To You; Author: Business To You;https://www.youtube.com/watch?v=SI5lYaZaUlg;License: Standard Youtube License