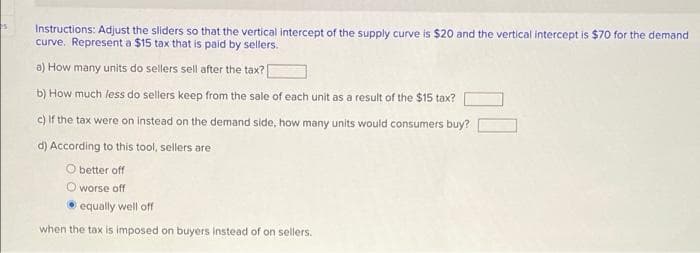

Instructions: Adjust the sliders so that the vertical intercept of the supply curve is $20 and the vertical intercept is $70 for the demand curve. Represent a $15 tax that is paid by sellers. a) How many units do sellers sell after the tax? b) How much less do sellers keep from the sale of each unit as a result of the $15 tax? c) If the tax were on Instead on the demand side, how many units would consumers buy? d) According to this tool, sellers are O better off worse off equally well off when the tax is imposed on buyers instead of on sellers.

Instructions: Adjust the sliders so that the vertical intercept of the supply curve is $20 and the vertical intercept is $70 for the demand curve. Represent a $15 tax that is paid by sellers. a) How many units do sellers sell after the tax? b) How much less do sellers keep from the sale of each unit as a result of the $15 tax? c) If the tax were on Instead on the demand side, how many units would consumers buy? d) According to this tool, sellers are O better off worse off equally well off when the tax is imposed on buyers instead of on sellers.

Chapter3: Market Demand And Supply

Section: Chapter Questions

Problem 20SQ

Related questions

Question

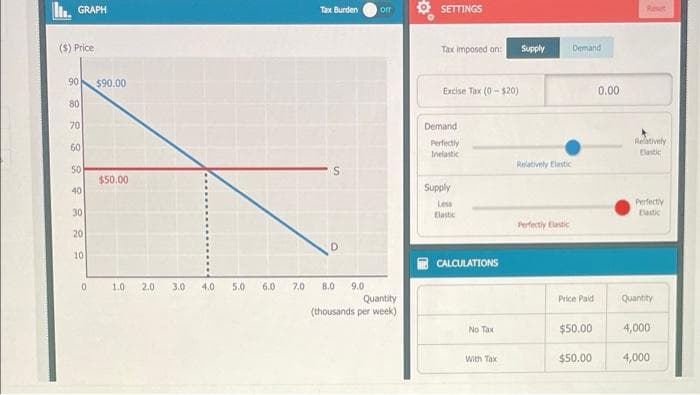

Transcribed Image Text:li, GRAPH

O SETTINGS

Tax Burden

of

Reset

($) Price

Tax imposed on:

Supply

Demand

90

$90.00

Excise Tox (0 - $20)

0.00

80

70

Demand

Perfectly

Inelastic

Relatively

Elastic

60

Relatively Elastic

$50.00

40

Supply

Less

Elastic

Perfectly

Elastic

30

Perfectly Elastic

20

10

CALCULATIONS

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

Quantity

(thousands per week)

Price Paid

Quantity

No Tax

$50.00

4,000

With Tax

$50.00

4,000

Transcribed Image Text:Instructions: Adjust the sliders so that the vertical intercept of the supply curve is $20 and the vertical intercept is $70 for the demand

curve. Represent a $15 tax that is paid by sellers.

a) How many units do sellers sell after the tax?

b) How much less do sellers keep from the sale of cach unit as a result of the $15 tax?

c) If the tax were on instead on the demand side, how many units would consumers buy?

d) According to this tool, sellers are

O better off

O worse off

equally well off

when the tax is imposed on buyers Instead of on sellers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning