Instructions: Calculate the following Reconciliation for Hancock, Reid, & Carson for the period ending March 31, 2021. Prepare the March bank reconciliation statement on the blank statement provided for Hancock, Reid, & Carson Ltd. according to the following information: • Royal Bank of Canada statement says the current balance is $17,864.12. There was an NSF cheque #1706 from Peter Bartrum in the amount of $1,870.54. There are bank service charges of $60.00; there are overdraft interest charges of $86.90; there is a preauthorized loan payment charge of $617.44; the bank paid Hancock, Reid & Carson Ltd. $204.12 interest on a revolving T-bill investment, and there is a charge of $54.00 for the annual rental of a safety deposit box. • Upon comparing the bank statement to the company's cheque register, you noted that the final balance in the cheque register was $16,627.01 and that cheques #588 for $198.27, #592 for $1,846.40, #596 for $374.80 and #599 for $1,320.40 are outstanding. You also noticed that the bank made an error in processing your cheque #582. The cheque was written for $46.40, but the bank processed it as $64.40.

Instructions: Calculate the following Reconciliation for Hancock, Reid, & Carson for the period ending March 31, 2021. Prepare the March bank reconciliation statement on the blank statement provided for Hancock, Reid, & Carson Ltd. according to the following information: • Royal Bank of Canada statement says the current balance is $17,864.12. There was an NSF cheque #1706 from Peter Bartrum in the amount of $1,870.54. There are bank service charges of $60.00; there are overdraft interest charges of $86.90; there is a preauthorized loan payment charge of $617.44; the bank paid Hancock, Reid & Carson Ltd. $204.12 interest on a revolving T-bill investment, and there is a charge of $54.00 for the annual rental of a safety deposit box. • Upon comparing the bank statement to the company's cheque register, you noted that the final balance in the cheque register was $16,627.01 and that cheques #588 for $198.27, #592 for $1,846.40, #596 for $374.80 and #599 for $1,320.40 are outstanding. You also noticed that the bank made an error in processing your cheque #582. The cheque was written for $46.40, but the bank processed it as $64.40.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 2AP

Related questions

Question

Transcribed Image Text:Instructions:

Calculate the following Reconciliation for Hancock, Reid, & Carson for the period

ending March 31, 2021.

Prepare the March bank reconciliation statement on the blank statement provided for

Hancock, Reid, & Carson Ltd. according to the following information:

• Royal Bank of Canada statement says the current balance is $17,864.12.

• There was an NSF cheque #1706 from Peter Bartrum in the amount of

$1,870.54.

There are bank service charges of $60.00; there are overdraft interest charges of

$86.90; there is a preauthorized loan payment charge of $617.44; the bank paid

Hancock, Reid & Carson Ltd. $204.12 interest on a revolving T-bill investment,

and there is a charge of $54.00 for the annual rental of a safety deposit box.

Upon comparing the bank statement to the company's cheque register, you

noted that the final balance in the cheque register was $16,627.01 and that

cheques #588 for $198.27, #592 for $i,846.40, #596 for $374.80 and #599 for

$1,320.40 are outstanding.

You also noticed that the bank made an error in processing your cheque #582.

The cheque was written for $46.40, but the bank processed it as $64.40.

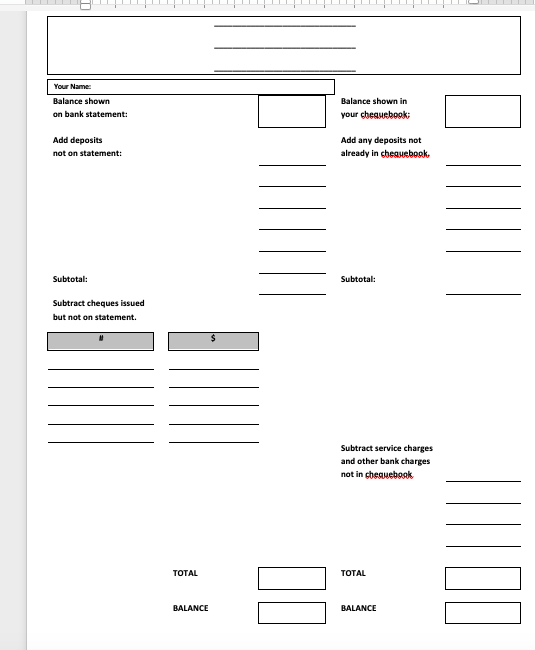

Transcribed Image Text:Your Name:

Balance shown

Balance shown in

on bank statement:

your cheauebook:

Add deposits

Add any deposits not

not on statement:

already in cheguebook,

Subtotal:

Subtotal:

Subtract cheques issued

but not on statement.

Subtract service charges

and other bank charges

not in cheauebook

TOTAL

TОTAL

BALANCE

BALANCE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning