Instructions Journalize the entries to record the transactions. Identify each entry by letter. OBJ, 3, 4, 5, 6 Entries for selected corporate transactions PR 13-4B Nav-Go Enterprises Inc, produces aeronautical navigation equipment. The stockholders' equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 2014, are as follows: Common Stock, $5 stated value (900,000 shares authorized, 620,000 shares issued)... .. Paid-In Capital in Excess of Stated Value-Common Stock. Retained Earnings $3,100,000 1,240,000 4,875,000 288,000 Treasury Stock (48,000 shares, at cost) The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $34,320. Mar. 15. Sold all of the treasury stock for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share. July 16. Issued the certificates for the dividend declared on June 14. share. per Oct. 30. Purchased 50,000 shares of treasury stock for $6 Dec. 30. Declared a $0.08-per-share dividend on common stock. 31. Closed the credit balance of the income summary account, $775,000. 31. Closed the two dividends accounts to Retained Earnings. Instructions 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stoc Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and nost to Counts 3-4A 2. Common Stock Jan. 7,500,000 1 Bal. Apr. 10 1,500,000 360,000 Aug. 15 9,360,000 Dec. 31 Bal. Paid-In Capital in Excess of Stated Value-Common Stock 825,000 Jan. 1 Bal. 300,000 Apr. 10 90,000 July 5 1,215,000 Dec. 31 Bal. Retained Earnings 33,600,000 1 Bal. Jan. 493,800 31 Dec. 1,125,000 31 Dec. 34,231,200 Dec. 31 Bal. Treasury Stock 450,000 450,000 Jan. 1 Bal. Nov. 23 June 6 570,000 570,000 Dec. 31 Bal. Pald-In Capital from Sale of Treasury Stock 200,000 June Stock Dividends Distributable 360.000 360,000 July Aug. 15 Stock Dividends

Instructions Journalize the entries to record the transactions. Identify each entry by letter. OBJ, 3, 4, 5, 6 Entries for selected corporate transactions PR 13-4B Nav-Go Enterprises Inc, produces aeronautical navigation equipment. The stockholders' equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 2014, are as follows: Common Stock, $5 stated value (900,000 shares authorized, 620,000 shares issued)... .. Paid-In Capital in Excess of Stated Value-Common Stock. Retained Earnings $3,100,000 1,240,000 4,875,000 288,000 Treasury Stock (48,000 shares, at cost) The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $34,320. Mar. 15. Sold all of the treasury stock for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share. July 16. Issued the certificates for the dividend declared on June 14. share. per Oct. 30. Purchased 50,000 shares of treasury stock for $6 Dec. 30. Declared a $0.08-per-share dividend on common stock. 31. Closed the credit balance of the income summary account, $775,000. 31. Closed the two dividends accounts to Retained Earnings. Instructions 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stoc Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and nost to Counts 3-4A 2. Common Stock Jan. 7,500,000 1 Bal. Apr. 10 1,500,000 360,000 Aug. 15 9,360,000 Dec. 31 Bal. Paid-In Capital in Excess of Stated Value-Common Stock 825,000 Jan. 1 Bal. 300,000 Apr. 10 90,000 July 5 1,215,000 Dec. 31 Bal. Retained Earnings 33,600,000 1 Bal. Jan. 493,800 31 Dec. 1,125,000 31 Dec. 34,231,200 Dec. 31 Bal. Treasury Stock 450,000 450,000 Jan. 1 Bal. Nov. 23 June 6 570,000 570,000 Dec. 31 Bal. Pald-In Capital from Sale of Treasury Stock 200,000 June Stock Dividends Distributable 360.000 360,000 July Aug. 15 Stock Dividends

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 4PB: Entries for selected corporate transactions Nav-Go Enterprises Inc. produces aeronautical navigation...

Related questions

Question

In this sample problem and answer, in the T accounts under

Transcribed Image Text:Instructions

Journalize the entries to record the transactions. Identify each entry by letter.

OBJ, 3, 4, 5, 6

Entries for selected corporate transactions

PR 13-4B

Nav-Go Enterprises Inc, produces aeronautical navigation equipment. The stockholders'

equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 2014, are as

follows:

Common Stock, $5 stated value (900,000 shares authorized,

620,000 shares issued)... ..

Paid-In Capital in Excess of Stated Value-Common Stock.

Retained Earnings

$3,100,000

1,240,000

4,875,000

288,000

Treasury Stock (48,000 shares, at cost)

The following selected transactions occurred during the year:

Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had

been properly recorded when declared on December 1 of the preceding fiscal

year for $34,320.

Mar. 15. Sold all of the treasury stock for $6.75 per share.

Apr. 13. Issued 200,000 shares of common stock for $8 per share.

June 14. Declared a 3% stock dividend on common stock, to be capitalized at the

market price of the stock, which is $7.50 per share.

July 16. Issued the certificates for the dividend declared on June 14.

share.

per

Oct. 30. Purchased 50,000 shares of treasury stock for $6

Dec. 30. Declared a $0.08-per-share dividend on common stock.

31. Closed the credit balance of the income summary account, $775,000.

31. Closed the two dividends accounts to Retained Earnings.

Instructions

1. Enter the January 1 balances in T accounts for the stockholders' equity accounts listed

Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stoc

Stock Dividends Distributable; Stock Dividends; Cash Dividends.

2. Journalize the entries to record the transactions, and nost to

Counts

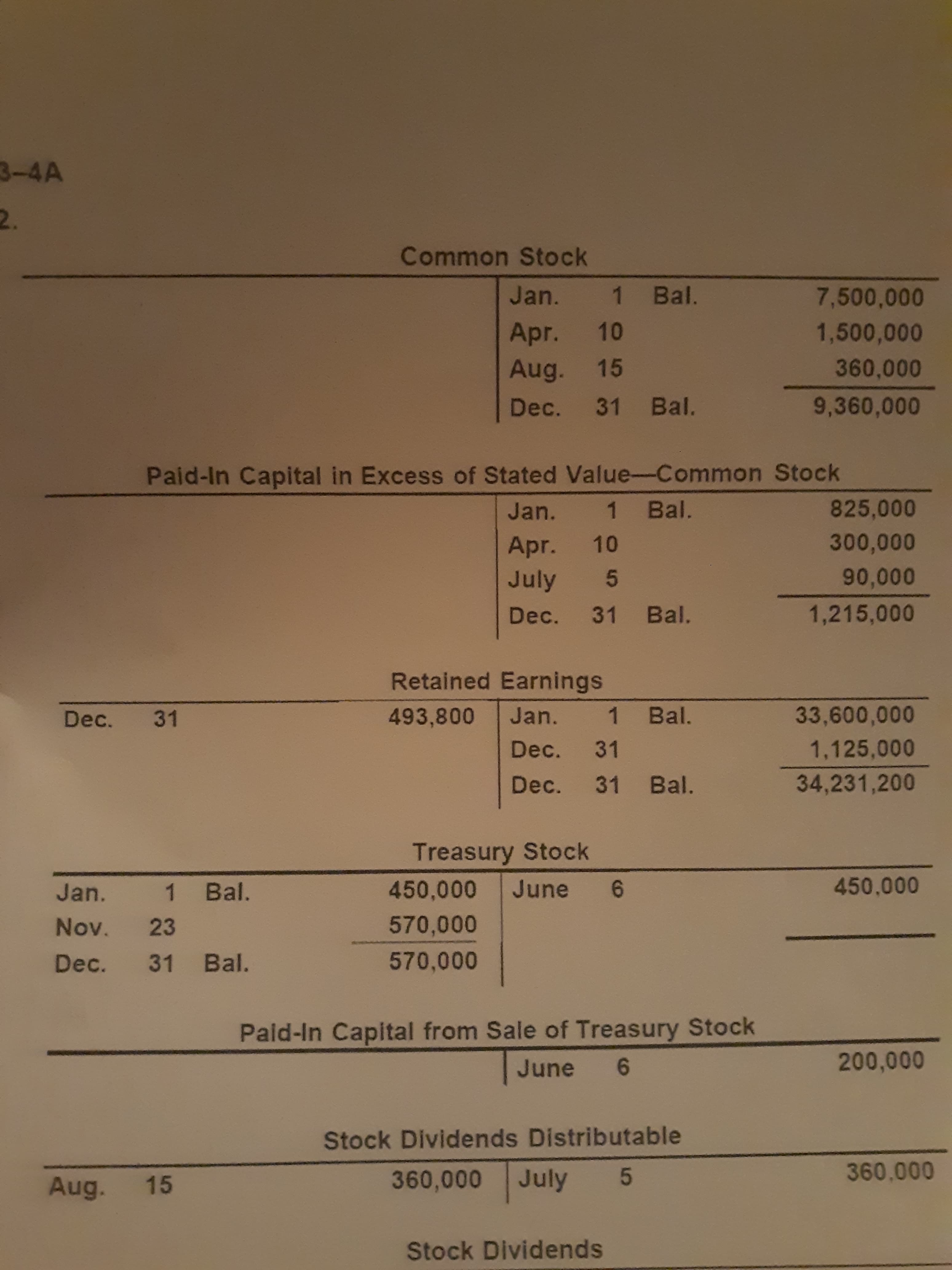

Transcribed Image Text:3-4A

2.

Common Stock

Jan.

7,500,000

1 Bal.

Apr. 10

1,500,000

360,000

Aug. 15

9,360,000

Dec. 31 Bal.

Paid-In Capital in Excess of Stated Value-Common Stock

825,000

Jan. 1 Bal.

300,000

Apr. 10

90,000

July 5

1,215,000

Dec. 31 Bal.

Retained Earnings

33,600,000

1 Bal.

Jan.

493,800

31

Dec.

1,125,000

31

Dec.

34,231,200

Dec. 31 Bal.

Treasury Stock

450,000

450,000

Jan. 1 Bal.

Nov. 23

June 6

570,000

570,000

Dec. 31 Bal.

Pald-In Capital from Sale of Treasury Stock

200,000

June

Stock Dividends Distributable

360.000

360,000 July

Aug. 15

Stock Dividends

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning