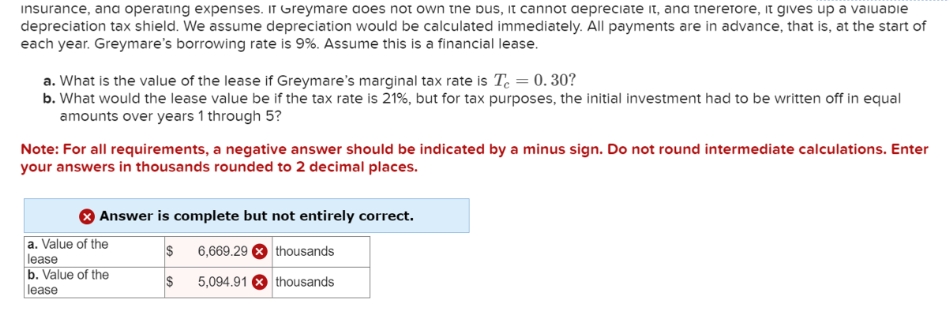

insurance, and operating expenses. IT Greymare does not own the bus, it cannot depreciate it, and therefore, it gives up a valuable depreciation tax shield. We assume depreciation would be calculated immediately. All payments are in advance, that is, at the start of each year. Greymare's borrowing rate is 9%. Assume this is a financial lease. a. What is the value of the lease if Greymare's marginal tax rate is T = 0.30? b. What would the lease value be if the tax rate is 21%, but for tax purposes, the initial investment had to be written off in equal amounts over years 1 through 5? Note: For all requirements, a negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in thousands rounded to 2 decimal places. Answer is complete but not entirely correct. a. Value of the lease $ 6,669.29 thousands b. Value of the lease $ 5,094.91 thousands

insurance, and operating expenses. IT Greymare does not own the bus, it cannot depreciate it, and therefore, it gives up a valuable depreciation tax shield. We assume depreciation would be calculated immediately. All payments are in advance, that is, at the start of each year. Greymare's borrowing rate is 9%. Assume this is a financial lease. a. What is the value of the lease if Greymare's marginal tax rate is T = 0.30? b. What would the lease value be if the tax rate is 21%, but for tax purposes, the initial investment had to be written off in equal amounts over years 1 through 5? Note: For all requirements, a negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in thousands rounded to 2 decimal places. Answer is complete but not entirely correct. a. Value of the lease $ 6,669.29 thousands b. Value of the lease $ 5,094.91 thousands

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter19: Lease Financing

Section: Chapter Questions

Problem 7MC: (1) Assume that the lease payments were actually 280,000 per year, that Consolidated Leasing is also...

Related questions

Question

Am. 131.

Transcribed Image Text:insurance, and operating expenses. IT Greymare does not own the bus, it cannot depreciate it, and therefore, it gives up a valuable

depreciation tax shield. We assume depreciation would be calculated immediately. All payments are in advance, that is, at the start of

each year. Greymare's borrowing rate is 9%. Assume this is a financial lease.

a. What is the value of the lease if Greymare's marginal tax rate is T = 0.30?

b. What would the lease value be if the tax rate is 21%, but for tax purposes, the initial investment had to be written off in equal

amounts over years 1 through 5?

Note: For all requirements, a negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter

your answers in thousands rounded to 2 decimal places.

Answer is complete but not entirely correct.

a. Value of the

lease

$

6,669.29 thousands

b. Value of the

lease

$

5,094.91 thousands

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT