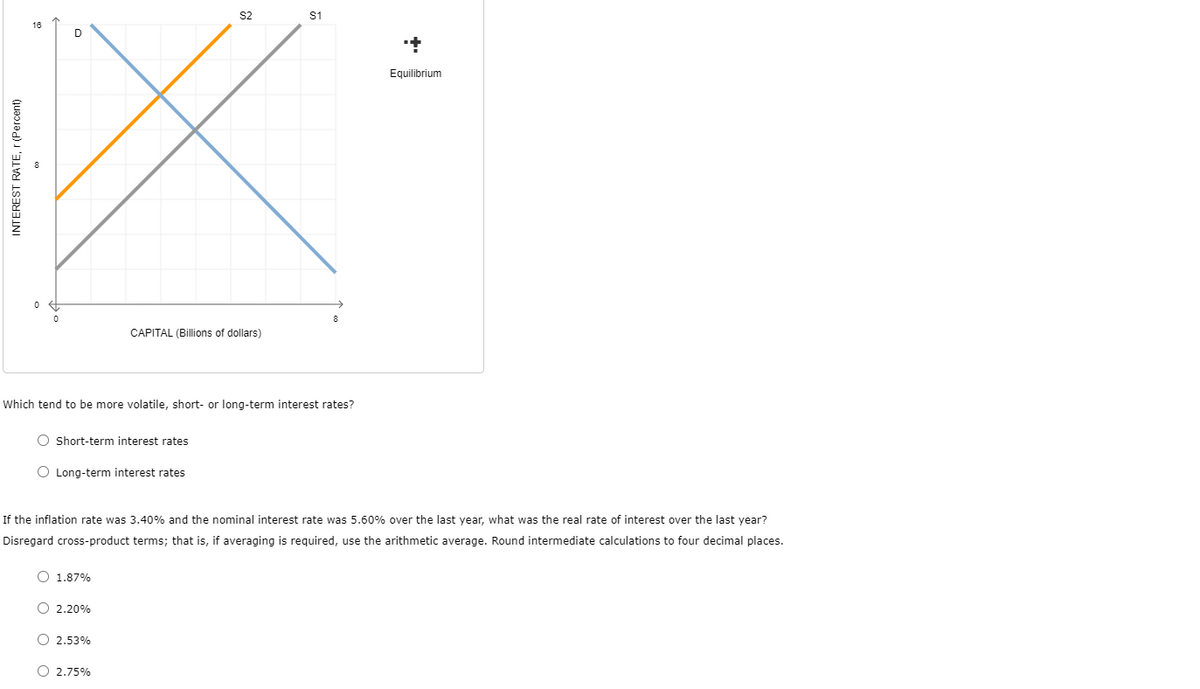

INTEREST RATE, r (Percent) O Short-term interest rates O Long-term interest rates Which tend to be more volatile, short- or long-term interest rates? O O O O O 1.87% O 2.20% S2 CAPITAL (Billions of dollars) If the inflation rate was 3.40% and the nominal interest rate was 5.60% over the last year, what was the real rate of interest over the last year? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. Round intermediate calculations to four decimal places. O 2.53% O 2.75% $1 + Equilibrium

INTEREST RATE, r (Percent) O Short-term interest rates O Long-term interest rates Which tend to be more volatile, short- or long-term interest rates? O O O O O 1.87% O 2.20% S2 CAPITAL (Billions of dollars) If the inflation rate was 3.40% and the nominal interest rate was 5.60% over the last year, what was the real rate of interest over the last year? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. Round intermediate calculations to four decimal places. O 2.53% O 2.75% $1 + Equilibrium

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Measuring The Cost Of Living

Section: Chapter Questions

Problem 9PA

Related questions

Question

Solve these 2 practice problems. Info for the 1.

Transcribed Image Text:INTEREST RATE, r (Percent)

16

co

Which

to be more

O Short-term interest rates

O Long-term interest rates

O 1.87%

O 2.20%

CAPITAL (Billions of dollars)

O 2.53%

O 2.75%

long-term

If the inflation rate was 3.40% and the nominal interest rate was 5.60% over the last year, what was the real rate of interest over the last year?

Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. Round intermediate calculations to four decimal places.

S1

rates?

**

Equilibrium

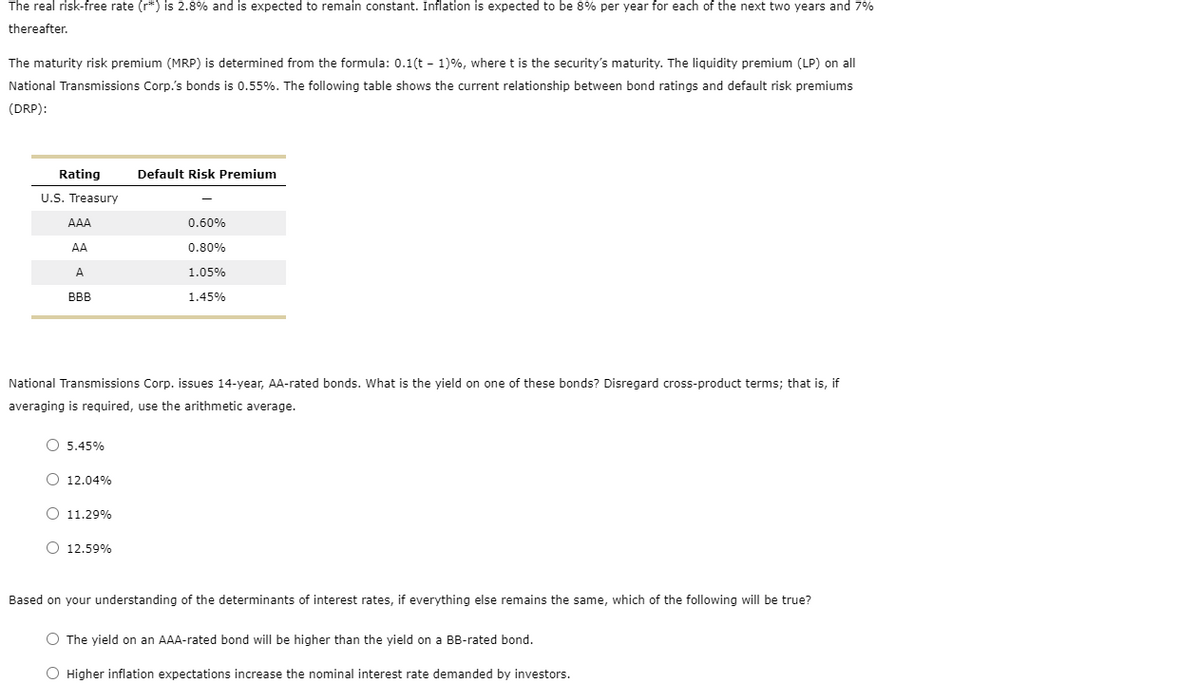

Transcribed Image Text:The real risk-free rate (r*) is 2.8% and is expected to remain constant. Inflation is expected to be 8% per year for each of the next two years and 7%

thereafter.

The maturity risk premium (MRP) is determined from the formula: 0.1(t-1) %, where t is the security's maturity. The liquidity premium (LP) on all

National Transmissions Corp.'s bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums

(DRP):

Rating

U.S. Treasury

AAA

AA

A

BBB

O 5.45%

National Transmissions Corp. issues 14-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if

averaging is required, use the arithmetic average.

O 12.04%

O 11.29%

Default Risk Premium

O 12.59%

0.60%

0.80%

1.05%

1.45%

Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true?

O The yield on an AAA-rated bond will be higher than the yield on a BB-rated bond.

O Higher inflation expectations increase the nominal interest rate demanded by investors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc