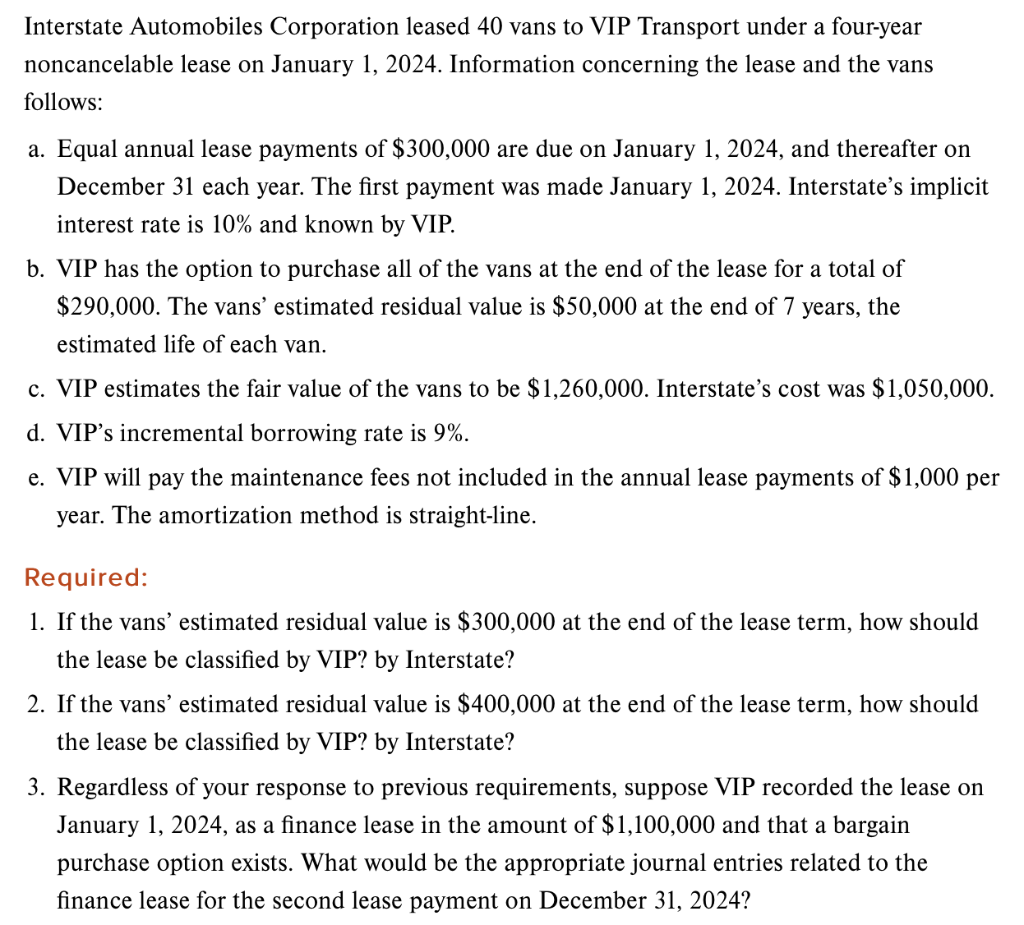

Interstate Automobiles Corporation leased 40 vans to VIP Transport under a four-year noncancelable lease on January 1, 2024. Information concerning the lease and the vans follows: a. Equal annual lease payments of $300,000 are due on January 1, 2024, and thereafter on December 31 each year. The first payment was made January 1, 2024. Interstate's implicit interest rate is 10% and known by VIP. b. VIP has the option to purchase all of the vans at the end of the lease for a total of $290,000. The vans' estimated residual value is $50,000 at the end of 7 years, the estimated life of each van. c. VIP estimates the fair value of the vans to be $1,260,000. Interstate's cost was $1,050,000. d. VIP's incremental borrowing rate is 9%. e. VIP will pay the maintenance fees not included in the annual lease payments of $1,000 per year. The amortization method is straight-line. Required: 1. If the vans' estimated residual value is $300,000 at the end of the lease term, how should the lease be classified by VIP? by Interstate? 2. If the vans' estimated residual value is $400,000 at the end of the lease term, how should the lease be classified by VIP? by Interstate? 3. Regardless of your response to previous requirements, suppose VIP recorded the lease on January 1, 2024, as a finance lease in the amount of $1,100,000 and that a bargain purchase option exists. What would be the appropriate journal entries related to the finance lease for the second lease payment on December 31, 2024?

Interstate Automobiles Corporation leased 40 vans to VIP Transport under a four-year noncancelable lease on January 1, 2024. Information concerning the lease and the vans follows: a. Equal annual lease payments of $300,000 are due on January 1, 2024, and thereafter on December 31 each year. The first payment was made January 1, 2024. Interstate's implicit interest rate is 10% and known by VIP. b. VIP has the option to purchase all of the vans at the end of the lease for a total of $290,000. The vans' estimated residual value is $50,000 at the end of 7 years, the estimated life of each van. c. VIP estimates the fair value of the vans to be $1,260,000. Interstate's cost was $1,050,000. d. VIP's incremental borrowing rate is 9%. e. VIP will pay the maintenance fees not included in the annual lease payments of $1,000 per year. The amortization method is straight-line. Required: 1. If the vans' estimated residual value is $300,000 at the end of the lease term, how should the lease be classified by VIP? by Interstate? 2. If the vans' estimated residual value is $400,000 at the end of the lease term, how should the lease be classified by VIP? by Interstate? 3. Regardless of your response to previous requirements, suppose VIP recorded the lease on January 1, 2024, as a finance lease in the amount of $1,100,000 and that a bargain purchase option exists. What would be the appropriate journal entries related to the finance lease for the second lease payment on December 31, 2024?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 2E: Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement...

Related questions

Question

Please Correct answer With Explanation

Transcribed Image Text:Interstate Automobiles Corporation leased 40 vans to VIP Transport under a four-year

noncancelable lease on January 1, 2024. Information concerning the lease and the vans

follows:

a. Equal annual lease payments of $300,000 are due on January 1, 2024, and thereafter on

December 31 each year. The first payment was made January 1, 2024. Interstate's implicit

interest rate is 10% and known by VIP.

b. VIP has the option to purchase all of the vans at the end of the lease for a total of

$290,000. The vans' estimated residual value is $50,000 at the end of 7 years, the

estimated life of each van.

c. VIP estimates the fair value of the vans to be $1,260,000. Interstate's cost was $1,050,000.

d. VIP's incremental borrowing rate is 9%.

e. VIP will pay the maintenance fees not included in the annual lease payments of $1,000 per

year. The amortization method is straight-line.

Required:

1. If the vans' estimated residual value is $300,000 at the end of the lease term, how should

the lease be classified by VIP? by Interstate?

2. If the vans' estimated residual value is $400,000 at the end of the lease term, how should

the lease be classified by VIP? by Interstate?

3. Regardless of your response to previous requirements, suppose VIP recorded the lease on

January 1, 2024, as a finance lease in the amount of $1,100,000 and that a bargain

purchase option exists. What would be the appropriate journal entries related to the

finance lease for the second lease payment on December 31, 2024?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT