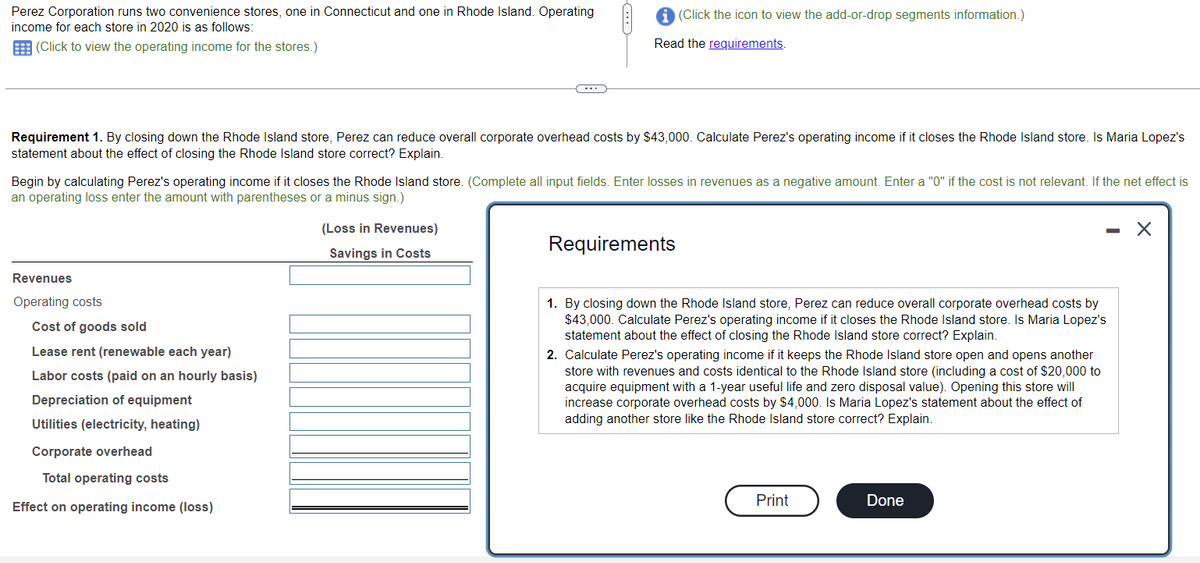

Perez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each store in 2020 is as follows: (Click to view the operating income for the stores.) Requirement 1. By closing down the Rhode Island store, Perez can reduce overall corporate overhead costs by $43,000. Calculate Perez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the Rhode Island store correct? Explain. Begin by calculating Perez's operating income if it closes the Rhode Island store. (Complete all input fields. Enter losses in revenues as a negative amount. Enter a "0" if the cost is not relevant. If the net effect is an operating loss enter the amount with parentheses or a minus sign.) Revenues Operating costs Cost of goods sold i (Click the icon to view the add-or-drop segments information.) Read the requirements. Lease rent (renewable each year) Labor costs (paid on an hourly basis) Depreciation of equipment Utilities (electricity, heating) Corporate overhead (Loss in Revenues) Savings in Costs Requirements - 1. By closing down the Rhode Island store, Perez can reduce overall corporate overhead costs by $43,000. Calculate Perez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the Rhode Island store correct? Explain. 2. Calculate Perez's operating income if it keeps the Rhode Island store open and opens another store with revenues and costs identical to the Rhode Island store (including a cost of $20,000 to acquire equipment with a 1-year useful life and zero disposal value). Opening this store will increase corporate overhead costs by $4,000. Is Maria Lopez's statement about the effect of adding another store like the Rhode Island store correct? Explain. X

Perez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each store in 2020 is as follows: (Click to view the operating income for the stores.) Requirement 1. By closing down the Rhode Island store, Perez can reduce overall corporate overhead costs by $43,000. Calculate Perez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the Rhode Island store correct? Explain. Begin by calculating Perez's operating income if it closes the Rhode Island store. (Complete all input fields. Enter losses in revenues as a negative amount. Enter a "0" if the cost is not relevant. If the net effect is an operating loss enter the amount with parentheses or a minus sign.) Revenues Operating costs Cost of goods sold i (Click the icon to view the add-or-drop segments information.) Read the requirements. Lease rent (renewable each year) Labor costs (paid on an hourly basis) Depreciation of equipment Utilities (electricity, heating) Corporate overhead (Loss in Revenues) Savings in Costs Requirements - 1. By closing down the Rhode Island store, Perez can reduce overall corporate overhead costs by $43,000. Calculate Perez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the Rhode Island store correct? Explain. 2. Calculate Perez's operating income if it keeps the Rhode Island store open and opens another store with revenues and costs identical to the Rhode Island store (including a cost of $20,000 to acquire equipment with a 1-year useful life and zero disposal value). Opening this store will increase corporate overhead costs by $4,000. Is Maria Lopez's statement about the effect of adding another store like the Rhode Island store correct? Explain. X

Chapter9: Deduct Ions: Employee And Self-employed - Related Expenses

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:Perez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating

income for each store in 2020 is as follows:

(Click to view the operating income for the stores.)

Requirement 1. By closing down the Rhode Island store, Perez can reduce overall corporate overhead costs by $43,000. Calculate Perez's operating income if it closes the Rhode Island store. Is Maria Lopez's

statement about the effect of closing the Rhode Island store correct? Explain.

Revenues

Operating costs

C

Begin by calculating Perez's operating income if it closes the Rhode Island store. (Complete all input fields. Enter losses in revenues as a negative amount. Enter a "0" if the cost is not relevant. If the net effect is

an operating loss enter the amount with parentheses or a minus sign.)

Cost of goods sold

Lease rent (renewable each year)

Labor costs (paid on an hourly basis)

Depreciation of equipment

Utilities (electricity, heating)

Corporate overhead

Total operating costs

Effect on operating income (loss)

i (Click the icon to view the add-or-drop segments information.)

Read the requirements.

(Loss in Revenues)

Savings in Costs

Requirements

1. By closing down the Rhode Island store, Perez can reduce overall corporate overhead costs by

$43,000. Calculate Perez's operating income if it closes the Rhode Island store. Is Maria Lopez's

statement about the effect of closing the Rhode Island store correct? Explain.

2. Calculate Perez's operating income if it keeps the Rhode Island store open and opens another

store with revenues and costs identical to the Rhode Island store (including a cost of $20,000 to

acquire equipment with a 1-year useful life and zero disposal value). Opening this store will

increase corporate overhead costs by $4,000. Is Maria Lopez's statement about the effect of

adding another store like the Rhode Island store correct? Explain.

Print

-

Done

X

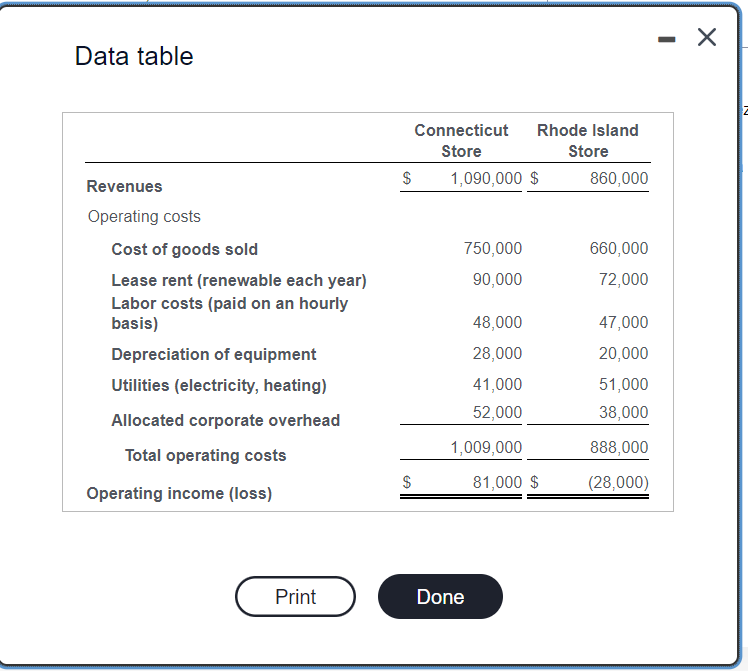

Transcribed Image Text:Data table

Revenues

Operating costs

Cost of goods sold

Lease rent (renewable each year)

Labor costs (paid on an hourly

basis)

Depreciation of equipment

Utilities (electricity, heating)

Allocated corporate overhead

Total operating costs

Operating income (loss)

Print

$

$

Connecticut Rhode Island

Store

Store

1,090,000 $

750,000

90,000

48,000

28,000

41,000

52,000

1,009,000

Done

81,000 $

860,000

660,000

72,000

47,000

20,000

51,000

38,000

888,000

(28,000)

-

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT