Inventories March 1 March 31 Materials $204,000 $187,580 Work in process 423,440 495,810 Finished goods 569,460 598,300 Direct labor $3,400,000 Materials purchased during March 2,590,020 Factory overhead incurred during March: Indirect labor 310,850 Machinery depreciation 204,000 Heat, light, and power 170,000 Supplies 33,900 Property taxes 29,140 Miscellaneous costs 44,400 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

Inventories March 1 March 31 Materials $204,000 $187,580 Work in process 423,440 495,810 Finished goods 569,460 598,300 Direct labor $3,400,000 Materials purchased during March 2,590,020 Factory overhead incurred during March: Indirect labor 310,850 Machinery depreciation 204,000 Heat, light, and power 170,000 Supplies 33,900 Property taxes 29,140 Miscellaneous costs 44,400 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter1: Introduction To Cost Accounting

Section: Chapter Questions

Problem 9P: Glasson Manufacturing Co. produces only one product. You have obtained the following information...

Related questions

Question

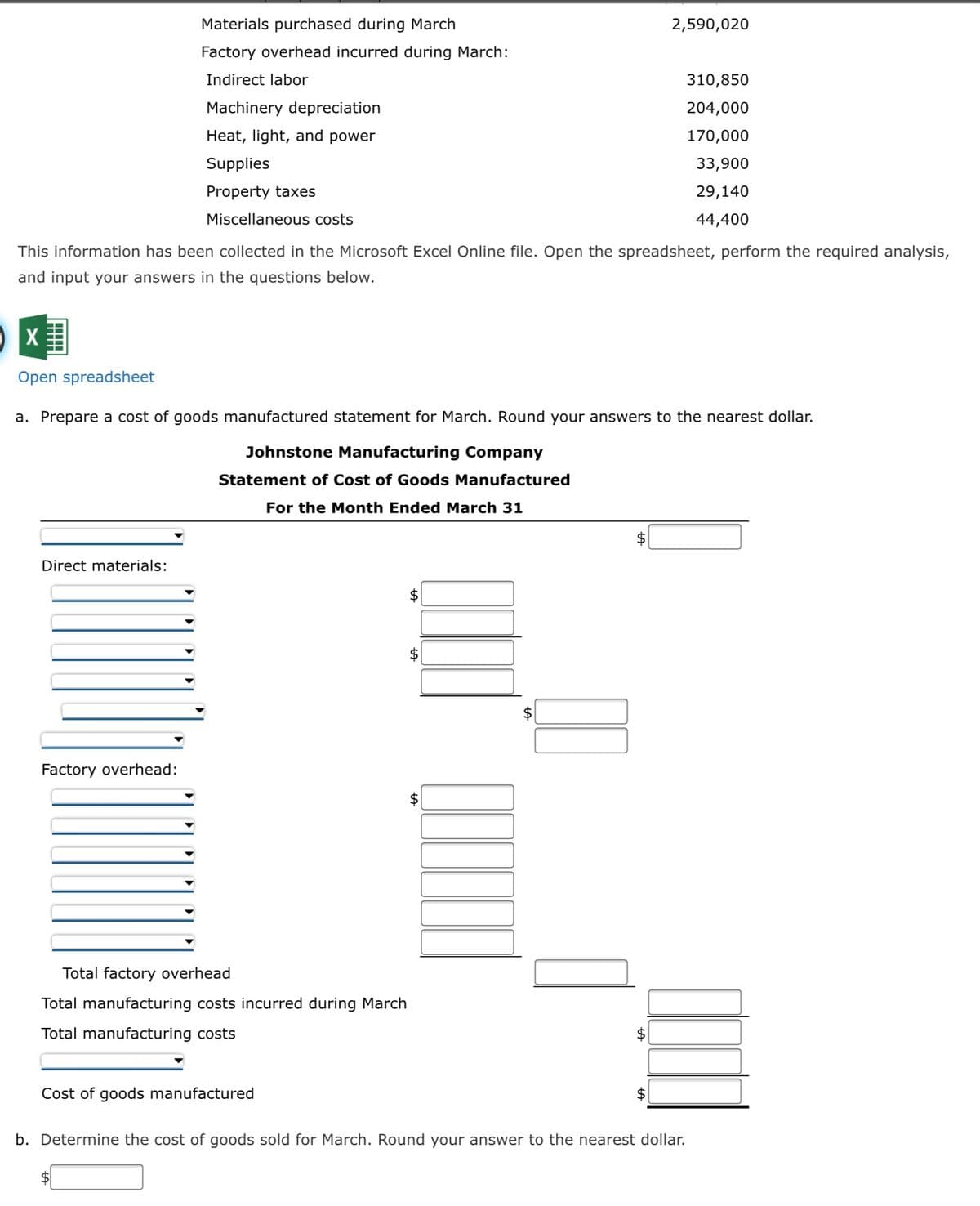

Transcribed Image Text:Materials purchased during March

2,590,020

Factory overhead incurred during March:

Indirect labor

310,850

Machinery depreciation

204,000

Heat, light, and power

170,000

Supplies

33,900

Property taxes

29,140

Miscellaneous costs

44,400

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis,

and input your answers in the questions below.

Open spreadsheet

a. Prepare a cost of goods manufactured statement for March. Round your answers to the nearest dollar.

Johnstone Manufacturing Company

Statement of Cost of Goods Manufactured

For the Month Ended March 31

2$

Direct materials:

$

Factory overhead:

Total factory overhead

Total manufacturing costs incurred during March

Total manufacturing costs

2$

Cost of goods manufactured

$

b. Determine the cost of goods sold for March. Round your answer to the nearest dollar.

$

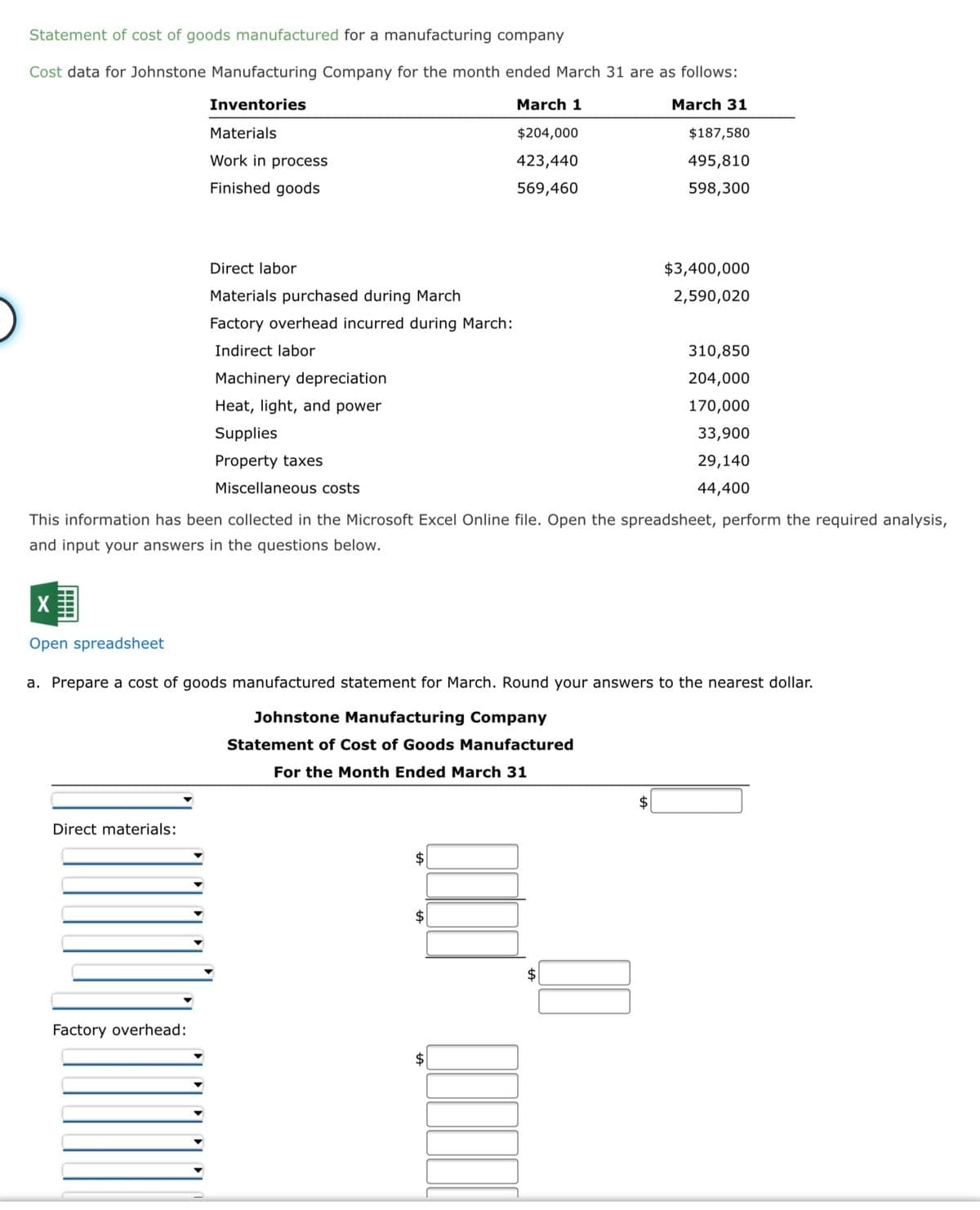

Transcribed Image Text:Statement of cost of goods manufactured for a manufacturing company

Cost data for Johnstone Manufacturing Company for the month ended March 31 are as follows:

Inventories

March 1

March 31

Materials

$204,000

$187,580

Work in process

423,440

495,810

Finished goods

569,460

598,300

Direct labor

$3,400,000

Materials purchased during March

2,590,020

Factory overhead incurred during March:

Indirect labor

310,850

Machinery depreciation

204,000

Heat, light, and power

170,000

Supplies

33,900

Property taxes

29,140

Miscellaneous costs

44,400

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis,

and input your answers in the questions below.

Open spreadsheet

a. Prepare a cost of goods manufactured statement for March. Round your answers to the nearest dollar.

Johnstone Manufacturing Company

Statement of Cost of Goods Manufactured

For the Month Ended March 31

Direct materials:

2$

$

2$

Factory overhead:

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning