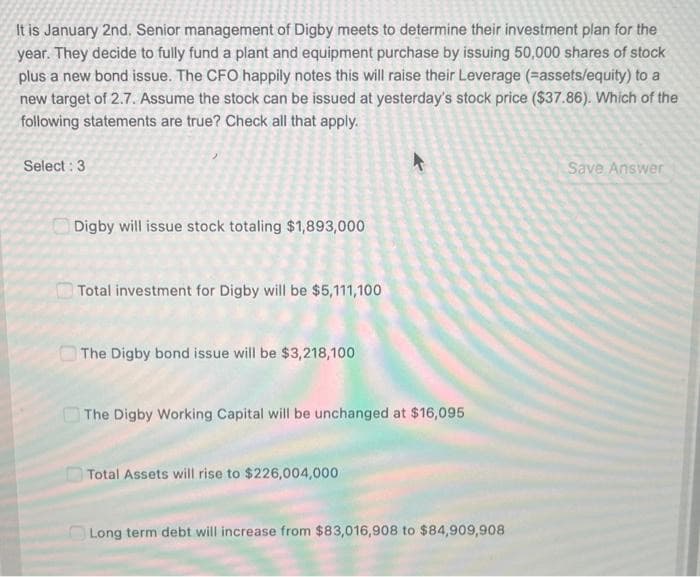

It is January 2nd. Senior management of Digby meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing 50,000 shares of stock plus a new bond issue. The CFO happily notes this will raise their Leverage (=assets/equity) to a new target of 2.7. Assume the stock can be issued at yesterday's stock price ($37.86). Which of the following statements are true? Check all that apply. Select: 3 Digby will issue stock totaling $1,893,000 Total investment for Digby will be $5,111,100 The Digby bond issue will be $3,218,100 4 The Digby Working Capital will be unchanged at $16,095 Total Assets will rise to $226,004,000 Long term debt will increase from $83,016,908 to $84,909,908 Save Answer

It is January 2nd. Senior management of Digby meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing 50,000 shares of stock plus a new bond issue. The CFO happily notes this will raise their Leverage (=assets/equity) to a new target of 2.7. Assume the stock can be issued at yesterday's stock price ($37.86). Which of the following statements are true? Check all that apply. Select: 3 Digby will issue stock totaling $1,893,000 Total investment for Digby will be $5,111,100 The Digby bond issue will be $3,218,100 4 The Digby Working Capital will be unchanged at $16,095 Total Assets will rise to $226,004,000 Long term debt will increase from $83,016,908 to $84,909,908 Save Answer

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 50P

Related questions

Question

Transcribed Image Text:It is January 2nd. Senior management of Digby meets to determine their investment plan for the

year. They decide to fully fund a plant and equipment purchase by issuing 50,000 shares of stock

plus a new bond issue. The CFO happily notes this will raise their Leverage (-assets/equity) to a

new target of 2.7. Assume the stock can be issued at yesterday's stock price ($37.86). Which of the

following statements are true? Check all that apply.

Select: 3

Digby will issue stock totaling $1,893,000

Total investment for Digby will be $5,111,100

The Digby bond issue will be $3,218,100

4

The Digby Working Capital will be unchanged at $16,095

Total Assets will rise to $226,004,000

Long term debt will increase from $83,016,908 to $84,909,908

Save Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT