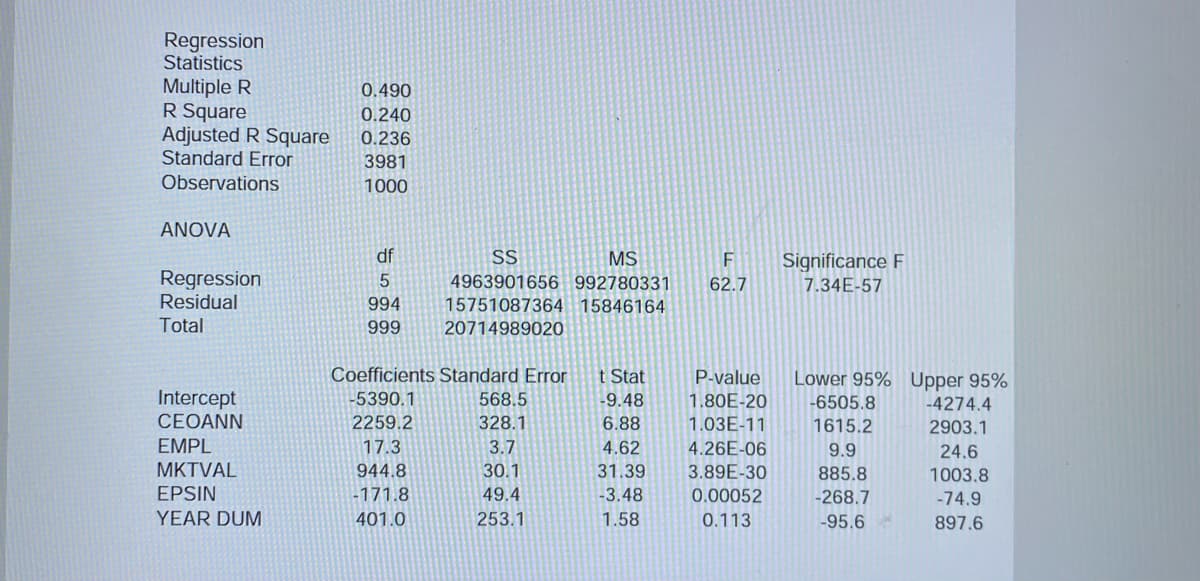

It may be a concern that market value and assets are highly correlated and hence there may be a problem with including them both as explanatory variables. The following set of output is for the regression that excludes assets from the regression above. Based on this set of output, does it seem likely that assets and market value are highly correlated, and hence does it appear that multicollinearity is a problem? Explain how you know.

It may be a concern that market value and assets are highly correlated and hence there may be a problem with including them both as explanatory variables. The following set of output is for the regression that excludes assets from the regression above. Based on this set of output, does it seem likely that assets and market value are highly correlated, and hence does it appear that multicollinearity is a problem? Explain how you know.

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section5.6: Exponential And Logarithmic Equations

Problem 68E

Related questions

Question

100%

It may be a concern that market value and assets are highly correlated and hence there may be a problem with including them both as explanatory variables. The following set of output is for the regression that excludes assets from the regression above. Based on this set of output, does it seem likely that assets and market value are highly correlated, and hence does it appear that multicollinearity is a problem? Explain how you know.

Transcribed Image Text:Regression

Statistics

Multiple R

R Square

Adjusted R Square

Standard Error

Observations

0.490

0.240

0.236

3981

1000

ANOVA

df

SS

MS

Significance F

Regression

Residual

4963901656 992780331

62.7

7.34E-57

994

15751087364 15846164

Total

999

20714989020

Coefficients Standard Error

t Stat

P-value

Lower 95% Upper 95%

Intercept

CEOANN

-5390.1

568.5

-9.48

1.80E-20

-6505.8

-4274.4

2259.2

328.1

6.88

1.03E-11

1615.2

2903.1

EMPL

17.3

3.7

4.62

4.26E-06

9.9

24.6

MKTVAL

944.8

30.1

31.39

3.89E-30

885.8

1003.8

EPSIN

-171.8

49.4

-3.48

0.00052

-268.7

-74.9

YEAR DUM

401.0

253.1

1.58

0.113

-95.6

897.6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Elementary Linear Algebra (MindTap Course List)

Algebra

ISBN:

9781305658004

Author:

Ron Larson

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Elementary Linear Algebra (MindTap Course List)

Algebra

ISBN:

9781305658004

Author:

Ron Larson

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning