Item No. 22 is based on the following information: sand and IS 03 95 2011 mat After operating for eight years, the books of the partnership of Jack and Jill showed the following balances: Net Assets P 260,000 P 170,000 Jack Capital 90,000 Jill Capital P 260,000 Total Capital- 22. If liquidation takes place at this point and the assets were sold at carrying amounts, the cash settlement between the partners would be: a. Jack will receive P 130,000 and Jill will receive P 130,000. b. Jack will receive P 170,000 and Jill will receive P 90,000.50 c. Jack will receive P 180,000 and Jill will receive P 80,000. Jack will receive P 195,000 and Jill will receive P 65,000. d.

Item No. 22 is based on the following information: sand and IS 03 95 2011 mat After operating for eight years, the books of the partnership of Jack and Jill showed the following balances: Net Assets P 260,000 P 170,000 Jack Capital 90,000 Jill Capital P 260,000 Total Capital- 22. If liquidation takes place at this point and the assets were sold at carrying amounts, the cash settlement between the partners would be: a. Jack will receive P 130,000 and Jill will receive P 130,000. b. Jack will receive P 170,000 and Jill will receive P 90,000.50 c. Jack will receive P 180,000 and Jill will receive P 80,000. Jack will receive P 195,000 and Jill will receive P 65,000. d.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 9E

Related questions

Question

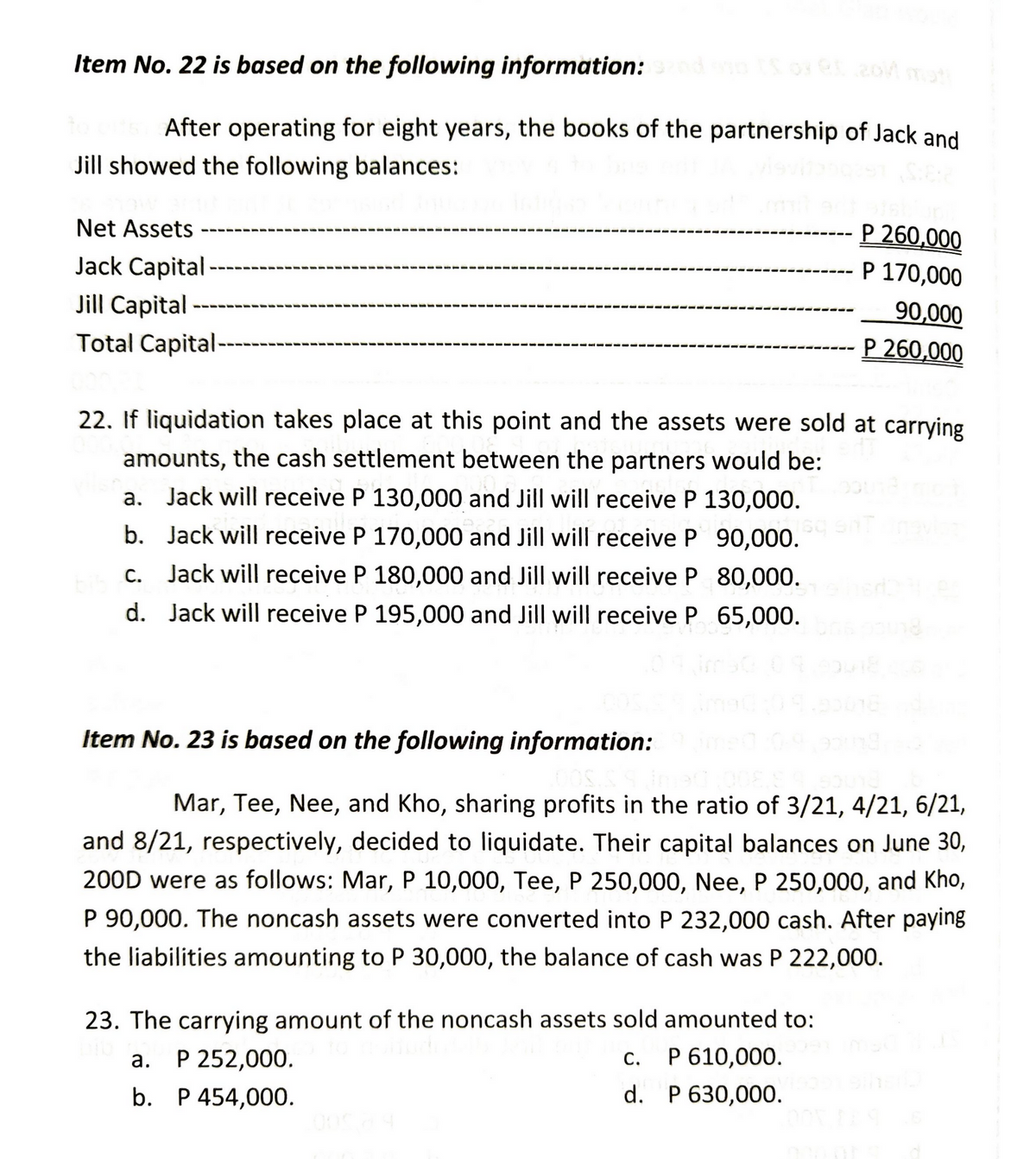

Transcribed Image Text:Item No. 22 is based on the following information: sand on IS 03 Q5 2011 mat

After operating for eight years, the books of the partnership of Jack and

Jill showed the following balances:

P 260,000

Net Assets

Jack Capital-

P 170,000

90,000

Jill Capital

Total Capital --

P 260,000

22. If liquidation takes place at this point and the assets were sold at carrying

amounts, the cash settlement between the partners would be:

a. Jack will receive P 130,000 and Jill will receive P 130,000.

b. Jack will receive P 170,000 and Jill will receive P 90,000.

c. Jack will receive P 180,000 and Jill will receive P 80,000.

d. Jack will receive P 195,000 and Jill will receive P 65,000.

Item No.23 is based on the following information:

Mar, Tee, Nee, and Kho, sharing profits in the ratio of 3/21, 4/21, 6/21,

and 8/21, respectively, decided to liquidate. Their capital balances on June 30,

200D were as follows: Mar, P 10,000, Tee, P 250,000, Nee, P 250,000, and Kho,

P 90,000. The noncash assets were converted into P 232,000 cash. After paying

the liabilities amounting to P 30,000, the balance of cash was P 222,000.

23. The carrying amount of the noncash assets sold amounted to:

C.

P 610,000.

P 252,000.

a.

b. P 454,000.

d.

P 630,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning