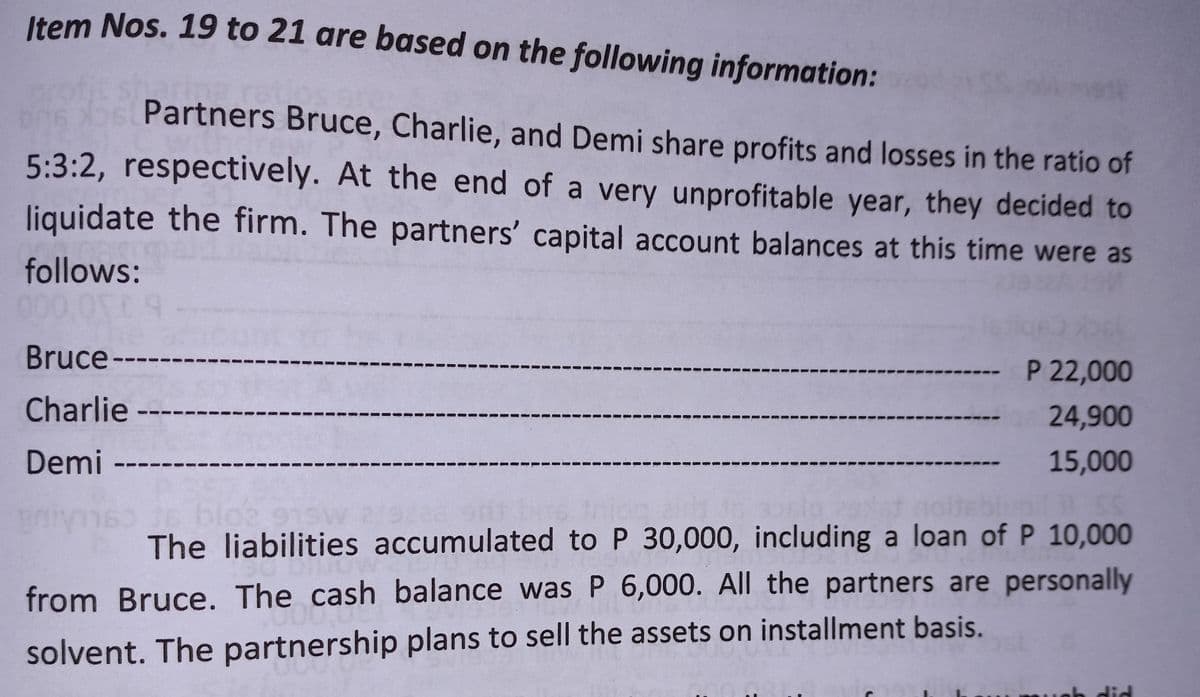

Item Nos. 19 to 21 are based on the following information: Partners Bruce, Charlie, and Demi share profits and losses in the ratio of 5:3:2, respectively. At the end of a very unprofitable year, they decided to liquidate the firm. The partners' capital account balances at this time were as follows: Bruce------- P 22,000 24,900 Charlie- Demi 15,000 The liabilities accumulated to P 30,000, including a loan of P 10,000 from Bruce. The cash balance was P 6,000. All the partners are personally solvent. The partnership plans to sell the assets on installment basis.

Item Nos. 19 to 21 are based on the following information: Partners Bruce, Charlie, and Demi share profits and losses in the ratio of 5:3:2, respectively. At the end of a very unprofitable year, they decided to liquidate the firm. The partners' capital account balances at this time were as follows: Bruce------- P 22,000 24,900 Charlie- Demi 15,000 The liabilities accumulated to P 30,000, including a loan of P 10,000 from Bruce. The cash balance was P 6,000. All the partners are personally solvent. The partnership plans to sell the assets on installment basis.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PB: The partnership of Magda and Sue shares profits and losses in a 50:50 ratio after Mary receives a...

Related questions

Question

Transcribed Image Text:Item Nos. 19 to 21 are based on the following information:

Partners Bruce, Charlie, and Demi share profits and losses in the ratio of

5:3:2, respectively. At the end of a very unprofitable year, they decided to

liquidate the firm. The partners' capital account balances at this time were as

follows:

000.000 9

Bruce-

-- P 22,000

Charlie ---

24,900

Demi-

15,000

11 SC

s

blo2 97

The liabilities accumulated to P 30,000, including a loan of P 10,000

from Bruce. The cash balance was P 6,000. All the partners are personally

solvent. The partnership plans to sell the assets on installment basis.

ich did

Transcribed Image Text:along

16M

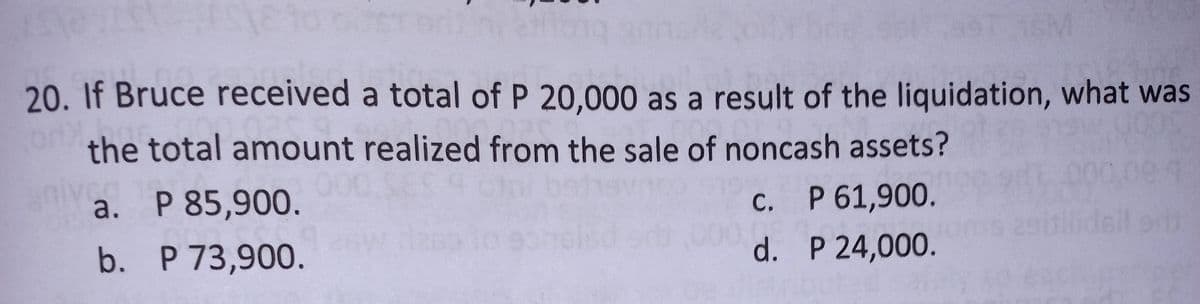

20. If Bruce received a total of P 20,000 as a result of the liquidation, what was

OPC

the total amount realized from the sale of noncash assets?

a. P 85,900.

C.

P 61,900.

b.

P 73,900.

d.

P 24,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT