IV. Activities: Prepare a bank recon sheet of paper. Activity 1 The bank statement of the January 2015 whereas the compa reasons have been identified for th

IV. Activities: Prepare a bank recon sheet of paper. Activity 1 The bank statement of the January 2015 whereas the compa reasons have been identified for th

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.3E

Related questions

Question

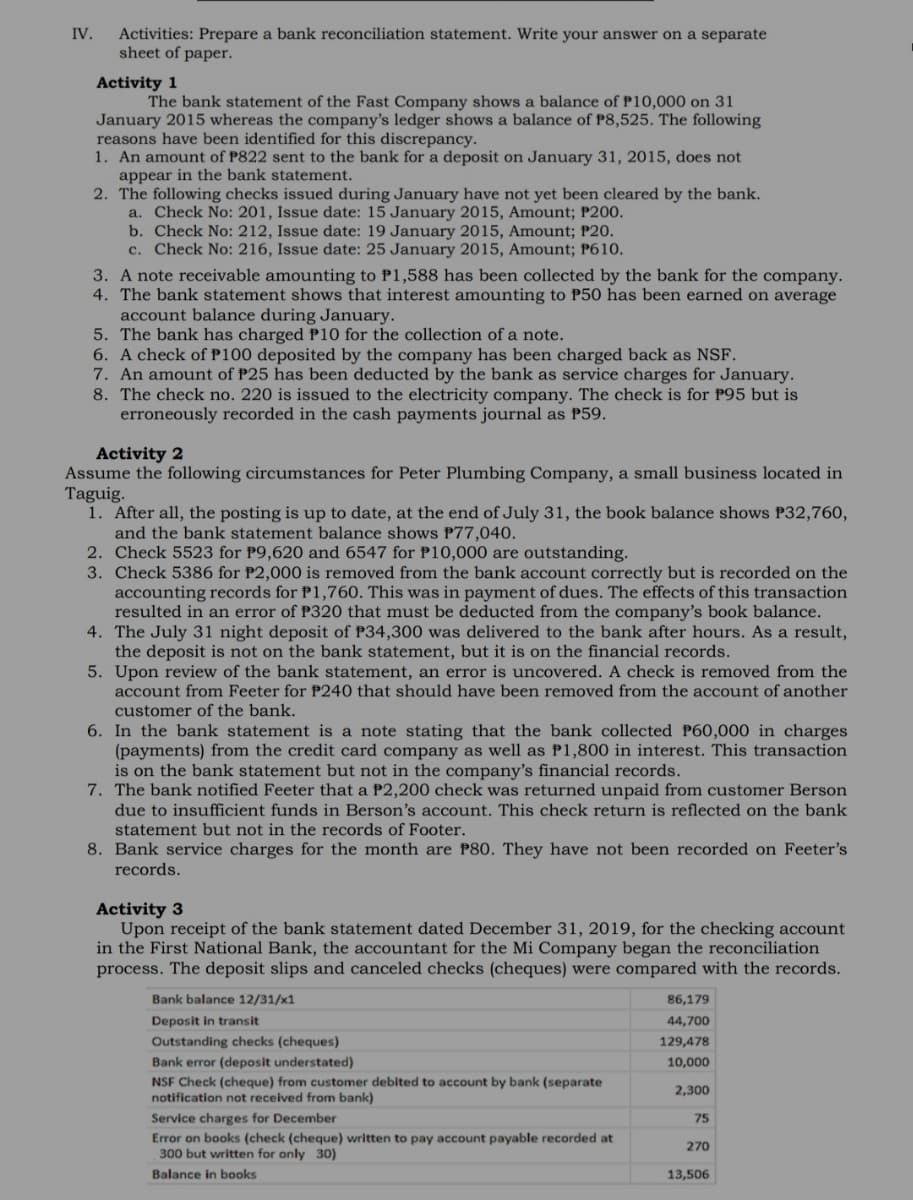

Transcribed Image Text:Activities: Prepare a bank reconciliation statement. Write your answer on a separate

sheet of paper.

IV.

Activity 1

The bank statement of the Fast Company shows a balance of P10,000 on 31

January 2015 whereas the company's ledger shows a balance of P8,525. The following

reasons have been identified for this discrepancy.

1. An amount of P822 sent to the bank for a deposit on January 31, 2015, does not

appear in the bank statement.

2. The following checks issued during January have not yet been cleared by the bank.

a. Check No: 201, Issue date: 15 January 2015, Amount; P200.

b. Check No: 212, Issue date: 19 January 2015, Amount; P20.

c. Check No: 216, Issue date: 25 January 2015, Amount; P610.

3. A note receivable amounting to P1,588 has been collected by the bank for the company.

4. The bank statement shows that interest amounting to P50 has been earned on average

account balance during January.

5. The bank has charged P10 for the collection of a note.

6. A check of P100 deposited by the company has been charged back as NSF.

7. An amount of P25 has been deducted by the bank as service charges for January.

8. The check no. 220 is issued to the electricity company. The check is for P95 but is

erroneously recorded in the cash payments journal as P59.

Activity 2

Assume the following circumstances for Peter Plumbing Company, a small business located in

Taguig.

1. After all, the posting is up to date, at the end of July 31, the book balance shows P32,760,

and the bank statement balance shows P77,040.

2. Check 5523 for P9,620 and 6547 for P10,000 are outstanding.

3. Check 5386 for P2,000 is removed from the bank account correctly but is recorded on the

accounting records for P1,760. This was in payment of dues. The effects of this transaction

resulted in an error of P320 that must be deducted from the company's book balance.

4. The July 31 night deposit of P34,300 was delivered to the bank after hours. As a result,

the deposit is not on the bank statement, but it is on the financial records.

5. Upon review of the bank statement, an error is uncovered. A check is removed from the

account from Feeter for P240 that should have been removed from the account of another

customer of the bank.

6. In the bank statement is a note stating that the bank collected P60,000 in charges

(payments) from the credit card company as well as P1,800 in interest. This transaction

is on the bank statement but not in the company's financial records.

7. The bank notified Feeter that a P2,200 check was returned unpaid from customer Berson

due to insufficient funds in Berson's account. This check return is reflected on the bank

statement but not in the records of Footer.

8. Bank service charges for the month are P80. They have not been recorded on Feeter's

records.

Activity 3

Upon receipt of the bank statement dated December 31, 2019, for the checking account

in the First National Bank, the accountant for the Mi Company began the reconciliation

process. The deposit slips and canceled checks (cheques) were compared with the records.

Bank balance 12/31/x1

86,179

Deposit in transit

44,700

Outstanding checks (cheques)

129,478

Bank error (deposit understated)

10,000

NSF Check (cheque) from customer debited to account by bank (separate

notification not received from bank)

2,300

Service charges for December

75

Error on books (check (cheque) written to pay account payable recorded at

300 but written for only 30)

270

Balance in books

13,506

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,