IV. Conclusion: Based on your findings on ratio analysis and interpretation, what conclusion can you make? V. Recommendations: - What recommendations can you give to the company with regards to your findings? - What recommendations can you give to the investor with regards to your findings?

IV. Conclusion: Based on your findings on ratio analysis and interpretation, what conclusion can you make? V. Recommendations: - What recommendations can you give to the company with regards to your findings? - What recommendations can you give to the investor with regards to your findings?

Chapter5: Evaluating Operating And Financial Performance

Section: Chapter Questions

Problem 2EP

Related questions

Question

IV. Conclusion:

Based on your findings on ratio analysis and interpretation, what conclusion can you make?

V. Recommendations:

- What recommendations can you give to the company with regards to your findings?

- What recommendations can you give to the investor with regards to your findings?

Transcribed Image Text:(2016) S)

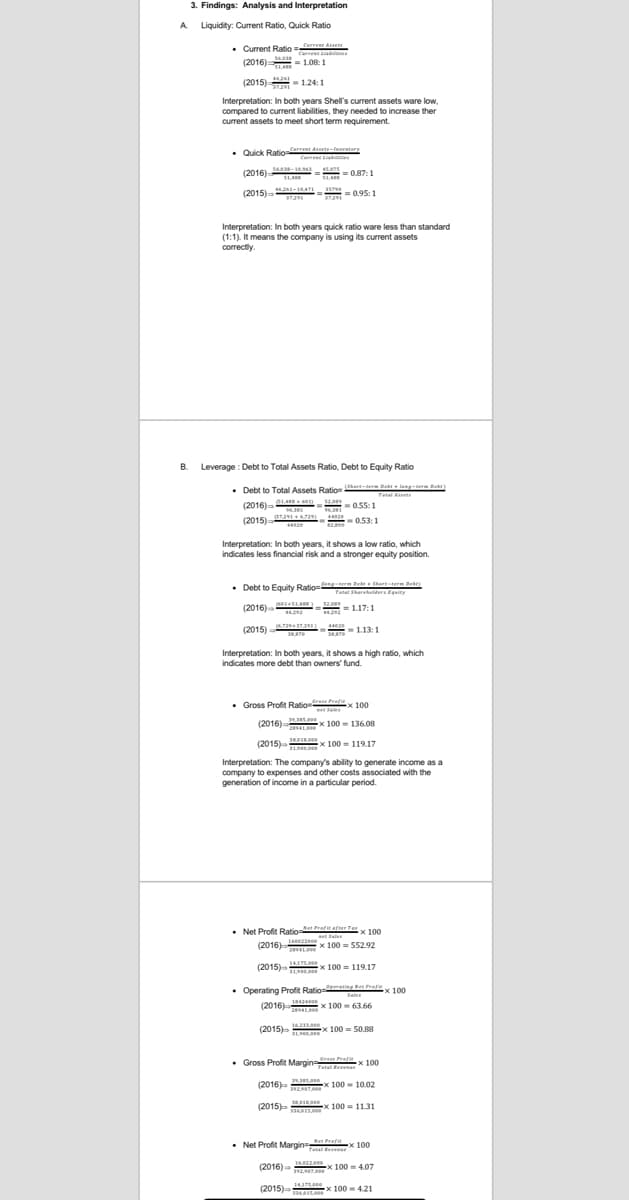

3. Findings: Analysis and Interpretation

A Liquidity: Current Ratio, Quick Ratio

• Current Ratio = te

Curre ne

(2016)

- 1.08:1

(2015)=

Interpretation: In both years Shell's current assets ware lw,

compared to current liabilities, they needed to increase ther

current assets to meet short term requirement.

• Quick Ratio

Carrent dt-luter

Currend Lianies

(2016) - 0.87:1

S1.4

(2015)

= 0.95:1

Interpretation: In both years quick ratio ware less than standard

(1:1). It means the company is using its current assets

correctly

B.

Leverage : Debt to Total Assets Ratio, Debt to Equity Ratio

hart-term Det + lang-t be)

• Debt to Total Assets Ration

(2016)

Tetal A

a

- =0.55:1

(2015)-

- 0.53:1

Interpretation: In both years, it shows a low ratio, which

indicates less financial risk and a stronger equity position.

• Debt to Equity Rationngterm e shertterm Bee

Faal Sharehaldere Eqity

(2016)

= 1.17:1

(2015)

.72

-1.13:1

Interpretation: In both years, it shows a high ratio, which

indicates more debt than owners' fund.

• Gross Profit Ratio tratia 100

(2016) Ax

100 - 136.08

(2015) x 100 - 119.17

Interpretation: The company's ability to generate income as a

company to expenses and other costs associated with the

generation of income in a particular period.

• Net Profit Ratio-rafitafterTer x 100

Sales

(2016) x 100 = S52.92

(2015) x 100 = 119.17

175.00

• Operating Profit Ratio n atx 100

Sale

(2016)

x 100 - 63.66

(2015)-

16.231e

x 100 = 50.88

Sres Profe

Gross Profit Margin

Tetal Revene

(2016) x 100 - 10.02

(2015) x 100 - 1131

• Net Profit Margin

n Profit

Tet x 100

(2016)

ZAx 100 - 4.07

32,

(2015) x 100 - 4.21

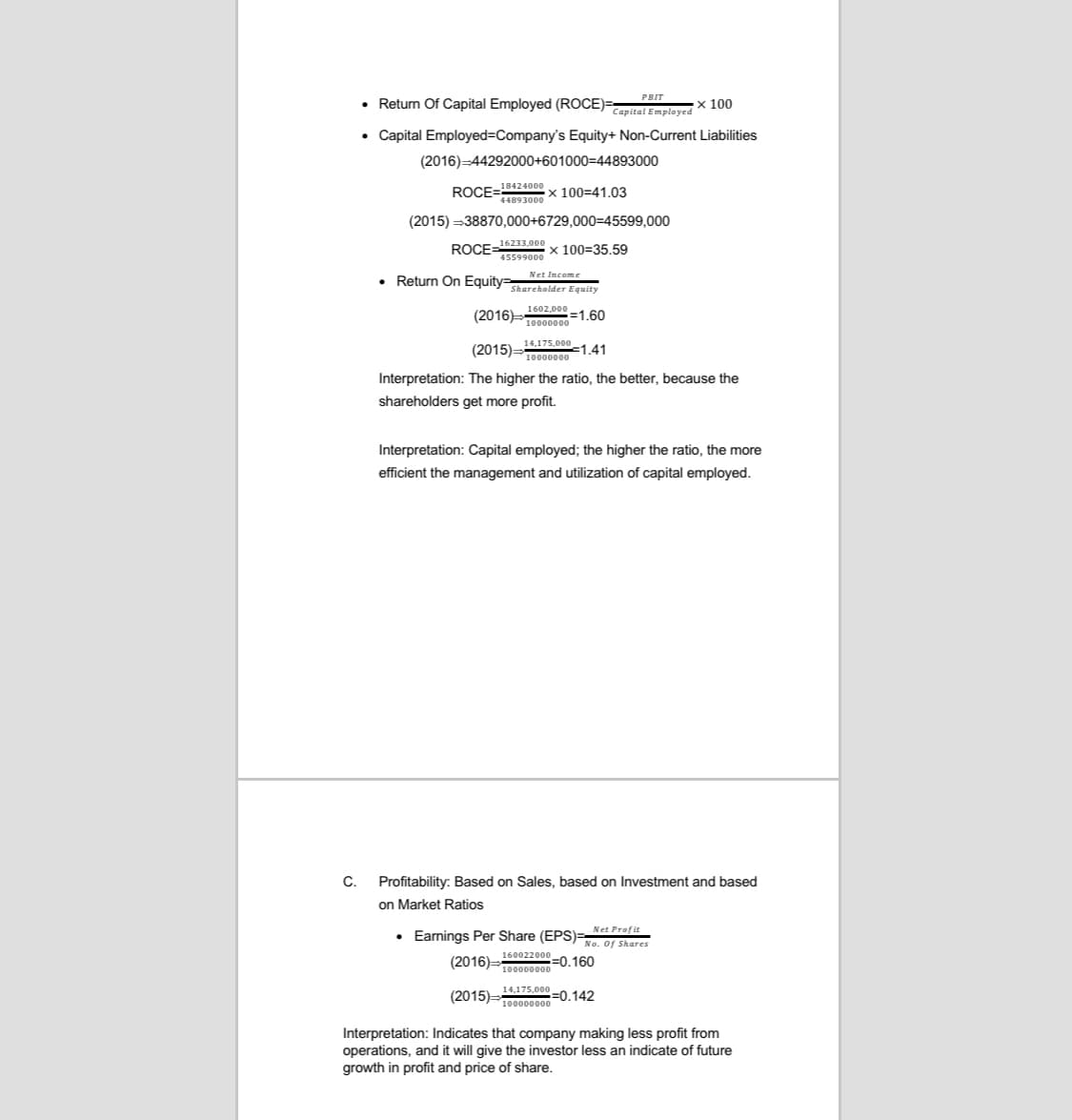

Transcribed Image Text:ROCE .

PBIT

• Return Of Capital Employed (ROCE)=

х 100

Capital Employed

• Capital Employed=Company's Equity+ Non-Current Liabilities

(2016)-44292000+601000=44893000

x 100=41.03

(2015) =38870,000+6729,000=45599,000

ROCE=16233,000 x 100=35.59

45599000

• Return On Equity=ereholder Equity

Net Income

1602,000

10000000

(2015):

14,175,000

10000000

=1,41

Interpretation: The higher the ratio, the better, because the

shareholders get more profit.

Interpretation: Capital employed; the higher the ratio, the more

efficient the management and utilization of capital employed.

C.

Profitability: Based on Sales, based on Investment and based

on Market Ratios

• Earnings Per Share (EPS)=

160022000 -0.160

Net Profit

No. of Shares

(2016)=10000000

14,175,000

(2015)=

=0.142

100000000

Interpretation: Indicates that company making less profit from

operations, and it will give the investor less an indicate of future

growth in profit and price of share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning