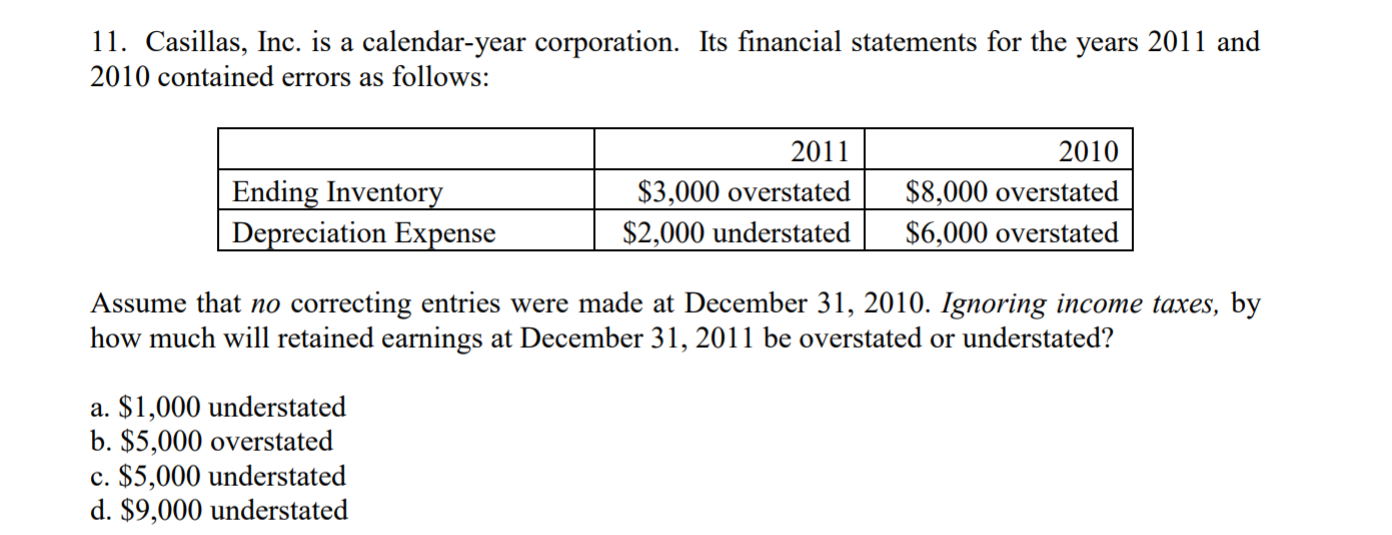

ії. Casillas, Inc. is a calendar-year corporation. Its financial statements for the years 2011 and 2010 contained errors as follows: 201141 Ending Inventory Depreciation Expense 2010 $3,000 overstated S8,000 overstated $2,000 understated| $6,000 overstated Assume that no correcting entries were made at December 31, 2010. Ignoring income taxes, by how much will retained earnings at December 31, 2011 be overstated or understated? a. $1,000 understated b. $5,000 overstated c. S5,000 understated d. $9,000 understated

ії. Casillas, Inc. is a calendar-year corporation. Its financial statements for the years 2011 and 2010 contained errors as follows: 201141 Ending Inventory Depreciation Expense 2010 $3,000 overstated S8,000 overstated $2,000 understated| $6,000 overstated Assume that no correcting entries were made at December 31, 2010. Ignoring income taxes, by how much will retained earnings at December 31, 2011 be overstated or understated? a. $1,000 understated b. $5,000 overstated c. S5,000 understated d. $9,000 understated

Chapter10: Inventory

Section: Chapter Questions

Problem 15EB: Tanke Company reported net income on the year-end financial statements of $850,200. However, errors...

Related questions

Question

Transcribed Image Text:ії. Casillas, Inc. is a calendar-year corporation. Its financial statements for the years 2011 and

2010 contained errors as follows:

201141

Ending Inventory

Depreciation Expense

2010

$3,000 overstated S8,000 overstated

$2,000 understated| $6,000 overstated

Assume that no correcting entries were made at December 31, 2010. Ignoring income taxes, by

how much will retained earnings at December 31, 2011 be overstated or understated?

a. $1,000 understated

b. $5,000 overstated

c. S5,000 understated

d. $9,000 understated

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning