Jan. 1 Apr. 1 Oct. 1 Beginning inventory Purchased Purchased 500 units 2,800 units 1,100 units @ $25 $26 During the year, Parvin sold 3,740 units of inventory at $45 per unit and incurred $16,300 of operating expenses. Parvin currentl uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate. Parvin started the period with cash of $73,500, inventory of $10,000, common stock of $59,000, and retained earnings $24,500. Required a. Prepare income statements using FIFO and LIFO. b. Determine the amount of income tax that Parvin would pay using each cost flow method. uming the cash flow from operating activities under FIFO and LIFO.

Jan. 1 Apr. 1 Oct. 1 Beginning inventory Purchased Purchased 500 units 2,800 units 1,100 units @ $25 $26 During the year, Parvin sold 3,740 units of inventory at $45 per unit and incurred $16,300 of operating expenses. Parvin currentl uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate. Parvin started the period with cash of $73,500, inventory of $10,000, common stock of $59,000, and retained earnings $24,500. Required a. Prepare income statements using FIFO and LIFO. b. Determine the amount of income tax that Parvin would pay using each cost flow method. uming the cash flow from operating activities under FIFO and LIFO.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

100%

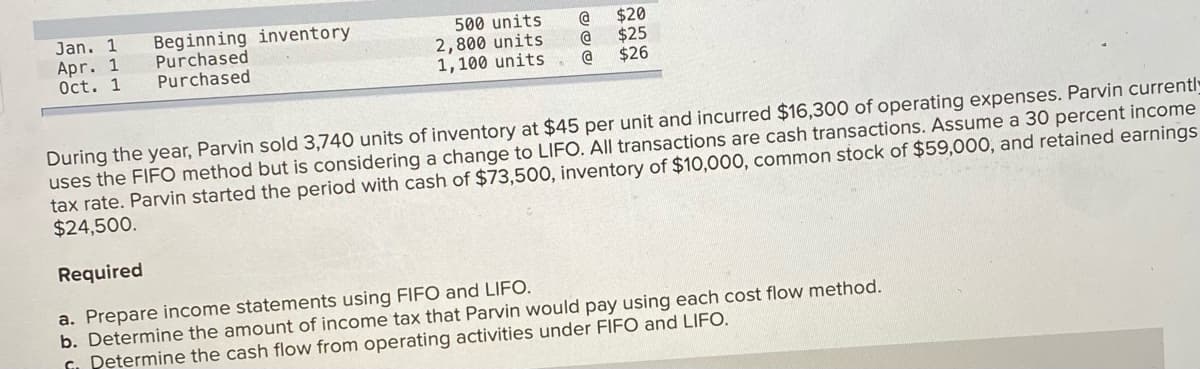

Transcribed Image Text:Jan. 1

Apr. 1

Oct. 1

Beginning inventory

Purchased

Purchased

500 units

2,800 units

1,100 units

$20

$25

$26

During the year, Parvin sold 3,740 units of inventory at $45 per unit and incurred $16,300 of operating expenses. Parvin currently

uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income

tax rate. Parvin started the period with cash of $73,500, inventory of $10,000, common stock of $59,000, and retained earnings

$24,500.

Required

a. Prepare income statements using FIFO and LIFO.

b. Determine the amount of income tax that Parvin would pay using each cost flow method.

. Determine the cash flow from operating activities under FIFO and LIFO.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning