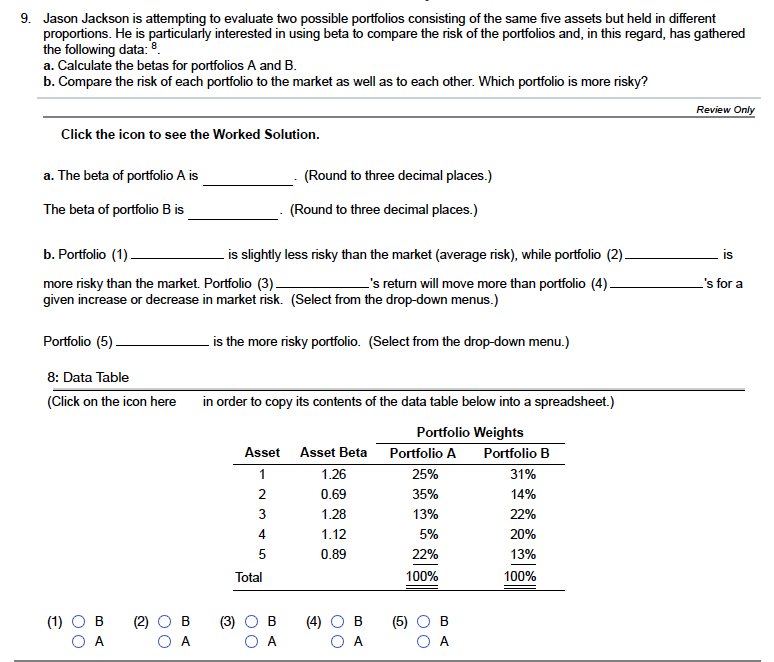

Jason Jackson is attempting to evaluate two possible portfolios consisting of the same five assets but held in different proportions. He is particularly interested in using beta to compare the risk of the portfolios and, in this regard, has gathered the following data: 8. a. Calculate the betas for portfolios A and B. b. Compare the risk of each portfolio to the market as well as to each other. Which portfolio is more risky? Review Only Click the icon to see the Worked Solution. a. The beta of portfolio A is (Round to three decimal places.) The beta of portfolio B is (Round to three decimal places.) b. Portfolio (1). .is slightly less risky than the market (average risk), while portfolio (2) more risky than the market. Portfolio (3). given increase or decrease in market risk. (Select from the drop-down menus.) L's return will move more than portfolio (4)- L's for a Portfolio (5). .is the more risky portfolio. (Select from the drop-down menu.) 8: Data Table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Portfolio Weights Asset Asset Beta Portfolio A Portfolio B 1 1.26 25% 31% 2 0.69 35% 14% 3 1.28 13% 22% 4 1.12 5% 20% 5 0.89 22% 13% Total 100% 100% (1) O B O A (4) O B O A (2) O B (3) O B (5) O B A A A

Jason Jackson is attempting to evaluate two possible portfolios consisting of the same five assets but held in different proportions. He is particularly interested in using beta to compare the risk of the portfolios and, in this regard, has gathered the following data: 8. a. Calculate the betas for portfolios A and B. b. Compare the risk of each portfolio to the market as well as to each other. Which portfolio is more risky? Review Only Click the icon to see the Worked Solution. a. The beta of portfolio A is (Round to three decimal places.) The beta of portfolio B is (Round to three decimal places.) b. Portfolio (1). .is slightly less risky than the market (average risk), while portfolio (2) more risky than the market. Portfolio (3). given increase or decrease in market risk. (Select from the drop-down menus.) L's return will move more than portfolio (4)- L's for a Portfolio (5). .is the more risky portfolio. (Select from the drop-down menu.) 8: Data Table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Portfolio Weights Asset Asset Beta Portfolio A Portfolio B 1 1.26 25% 31% 2 0.69 35% 14% 3 1.28 13% 22% 4 1.12 5% 20% 5 0.89 22% 13% Total 100% 100% (1) O B O A (4) O B O A (2) O B (3) O B (5) O B A A A

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 13QTD

Related questions

Question

Transcribed Image Text:9. Jason Jackson is attempting to evaluate two possible portfolios consisting of the same five assets but held in different

proportions. He is particularly interested in using beta to compare the risk of the portfolios and, in this regard, has gathered

the following data: ®.

a. Calculate the betas for portfolios A and B.

b. Compare the risk of each portfolio to the market as well as to each other. Which portfolio is more risky?

Review Only

Click the icon to see the Worked Solution.

a. The beta of portfolio A is

(Round to three decimal places.)

The beta of portfolio B is

(Round to three decimal places.)

b. Portfolio (1)

is slightly less risky than the market (average risk), while portfolio (2).

IS

more risky than the market. Portfolio (3)

given increase or decrease in market risk. (Select from the drop-down menus.)

L's return will move more than portfolio (4)-

's for a

Portfolio (5)-

is the more risky portfolio. (Select from the drop-down menu.)

8: Data Table

(Click on the icon here

in order to copy its contents of the data table below into a spreadsheet.)

Portfolio Weights

Asset Asset Beta Portfolio A

Portfolio B

1

1.26

25%

31%

2

0.69

35%

14%

3

1.28

13%

22%

4

1.12

5%

20%

5

0.89

22%

13%

Total

100%

100%

(1) O B

(2) O B

(3)

В

(4) O B

(5) ОВ

O A

O A

O A

O A

O A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning