You have been assigned the task of estimating the expected returns for three different stocks: A, B, and Č. Your preliminary analysis has established the historical risk premia associated with three risk factors that could potentially be included in your calculations: the excess return on a proxy for the market portfolio (MKT), and two variables capturing general macroeconomic exposures (MACRO1 and MACRO2). These values are: AMkt = 7.5%, AmACRo1 = -0.3%, and AMacro2 = 0.6%. You have also estimated the following factor loadings for all three stocks with respect to each of these potential risk factors: Stock MKT MACRO1 MACRO2 A 1.24 -0.42 0.54 -0.09 B 0.91 0.23 1.03 a) Calculate expected returns for three stocks using just the MKT risk factor. Assume a risk-free rate of 4.5%. b) Calculate the expected returns for three stocks using all three risk factors and Activate the same 4.5% risk-free rate. Go to Settin

You have been assigned the task of estimating the expected returns for three different stocks: A, B, and Č. Your preliminary analysis has established the historical risk premia associated with three risk factors that could potentially be included in your calculations: the excess return on a proxy for the market portfolio (MKT), and two variables capturing general macroeconomic exposures (MACRO1 and MACRO2). These values are: AMkt = 7.5%, AmACRo1 = -0.3%, and AMacro2 = 0.6%. You have also estimated the following factor loadings for all three stocks with respect to each of these potential risk factors: Stock MKT MACRO1 MACRO2 A 1.24 -0.42 0.54 -0.09 B 0.91 0.23 1.03 a) Calculate expected returns for three stocks using just the MKT risk factor. Assume a risk-free rate of 4.5%. b) Calculate the expected returns for three stocks using all three risk factors and Activate the same 4.5% risk-free rate. Go to Settin

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.18E

Related questions

Question

Transcribed Image Text:Document8 - Microsoft Word

File

Home

Insert

Page Layout

References

Mailings

Review

View

Zotero

ది

A Find -

AA

Cut

Calibri (Body)

- 11

- A A

Aa

=、三,年 章 T

AaBbCcDc AaBbCcDc AaBbC AaBbCc AaB AaBbCc. AaBbCcD

E Copy

a Replace

Paste

в г

U - abe x, x

I Normal

1 No Spaci..

Change

Styles

Format Painter

Heading 1

Heading 2

Title

Subtitle

Subtle Em...

A Select -

Clipboard

Font

Paragraph

Styles

Editing

Navigation

Search Document

国盟

This document does not

contain headings.

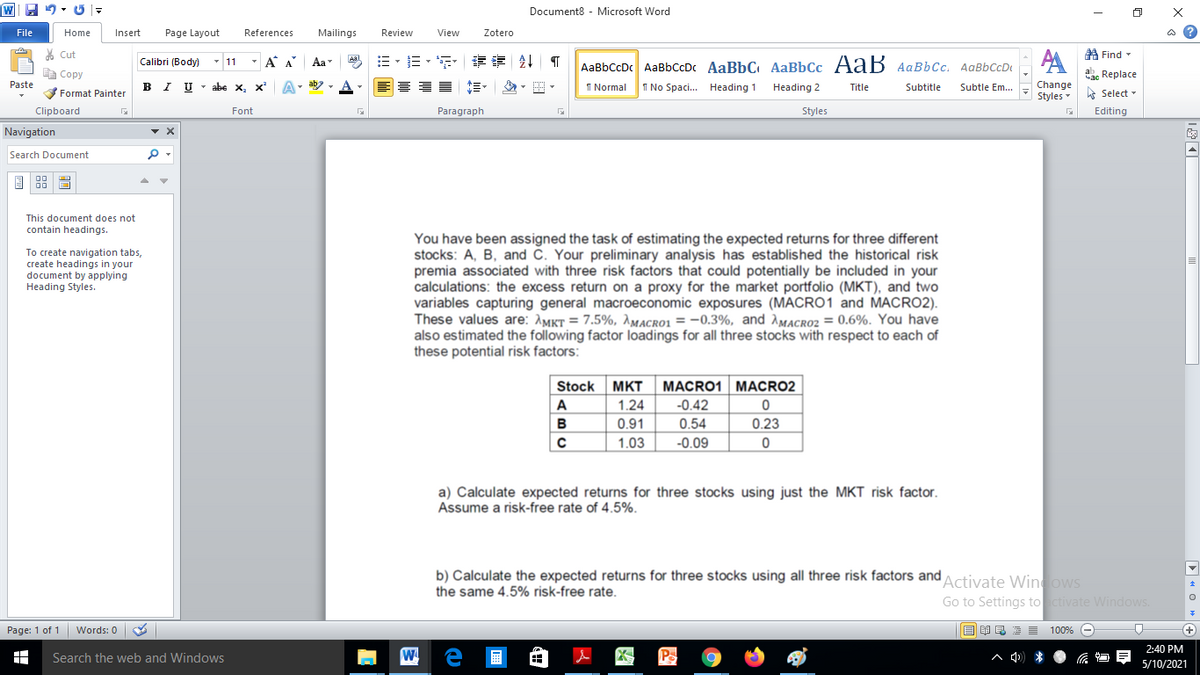

You have been assigned the task of estimating the expected returns for three different

stocks: A, B, and Č. Your preliminary analysis has established the historical risk

premia associated with three risk factors that could potentially be included in your

calculations: the excess return on a proxy for the market portfolio (MKT), and two

variables capturing general macroeconomic exposures (MACROO1 and MACRO2).

These values are: AMKt = 7.5%, AMacro1 = -0.3%, and AMacro2 = 0.6%. You have

also estimated the following factor loadings for all three stocks with respect to each of

these potential risk factors:

To create navigation tabs,

create headings in your

document by applying

Heading Styles.

Stock

MKT

MACRO1 MACRO2

A

1.24

-0.42

B

0.91

0.54

0.23

1.03

-0.09

a) Calculate expected returns for three stocks using just the MKT risk factor.

Assume a risk-free rate of 4.5%.

b) Calculate the expected returns for three stocks using all three risk factors and

the same 4.5% risk-free rate.

Activate Winows

Go to Settings to ctivate Windows.

Page: 1 of 1 Words: 0

E EI E E E 100% e

+)

2:40 PM

Search the web and Windows

W

A d) *

5/10/2021

D « O » e

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning