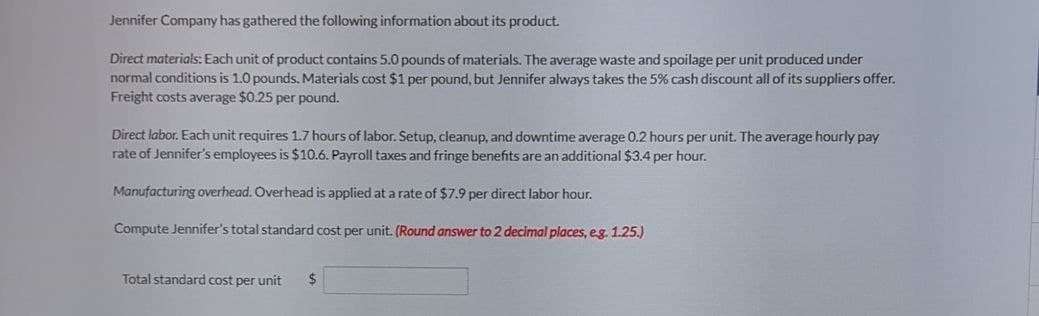

Jennifer Company has gathered the following information about its product. Direct materials: Each unit of product contains 5.0 pounds of materials. The average waste and spoilage per unit produced under normal conditions is 1.0 pounds. Materials cost $1 per pound, but Jennifer always takes the 5% cash discount all of its suppliers offer. Freight costs average $0.25 per pound. Direct labor. Each unit requires 1.7 hours of labor. Setup, cleanup, and downtime average 0.2 hours per unit. The average hourly pay rate of Jennifer's employees is $10.6. Payroll taxes and fringe benefits are an additional $3.4 per hour. Manufacturing overhead. Overhead is applied at a rate of $7.9 per direct labor hour. Compute Jennifer's total standard cost per unit. (Round answer to 2 decimal places, e.g. 1.25.) Total standard cost per unit $

Jennifer Company has gathered the following information about its product. Direct materials: Each unit of product contains 5.0 pounds of materials. The average waste and spoilage per unit produced under normal conditions is 1.0 pounds. Materials cost $1 per pound, but Jennifer always takes the 5% cash discount all of its suppliers offer. Freight costs average $0.25 per pound. Direct labor. Each unit requires 1.7 hours of labor. Setup, cleanup, and downtime average 0.2 hours per unit. The average hourly pay rate of Jennifer's employees is $10.6. Payroll taxes and fringe benefits are an additional $3.4 per hour. Manufacturing overhead. Overhead is applied at a rate of $7.9 per direct labor hour. Compute Jennifer's total standard cost per unit. (Round answer to 2 decimal places, e.g. 1.25.) Total standard cost per unit $

Chapter8: Standard Costs And Variances

Section: Chapter Questions

Problem 2EB: Salley is developing material and labor standards for her company. She finds that it costs $0.55 per...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Jennifer Company has gathered the following information about its product.

Direct materials: Each unit of product contains 5.0 pounds of materials. The average waste and spoilage per unit produced under

normal conditions is 1.0 pounds. Materials cost $1 per pound, but Jennifer always takes the 5% cash discount all of its suppliers offer.

Freight costs average $0.25 per pound.

Direct labor. Each unit requires 1.7 hours of labor. Setup, cleanup, and downtime average 0.2 hours per unit. The average hourly pay

rate of Jennifer's employees is $10.6. Payroll taxes and fringe benefits are an additional $3.4 per hour.

Manufacturing overhead. Overhead is applied at a rate of $7.9 per direct labor hour.

Compute Jennifer's total standard cost per unit. (Round answer to 2 decimal places, e.g. 1.25.)

Total standard cost per unit $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning