Jerome Company has 35 employees who work 8 hours a day and are paid hourly. On January 1, 2018, the entity began a program of granting the employees 10 days of paid vacation each year. Vacation days earned in 2018 may first be taken on January 1, 2019. Year Hourly wage Vacation days earned by each employee Vacation days used by each employee 2018 129 10 0 2019 135 10 8 2020 142.50 10 10 15. What is the vacation pay expense for 2018? a. 0 b. P361,200 c. P378,000 d. P344,400 16. What is the accrued liability on December 31, 2020? a. P474,600 b. P453,600 c. P399,000 d. P478,800 17. What is the accrued liability on December 31, 2020 assuming the policy is to accrue liability at the end of each year at the wage rate for that year? a. P474,600 b. P453,600 c. P399,000 d. P478,800 Provide SOLUTION

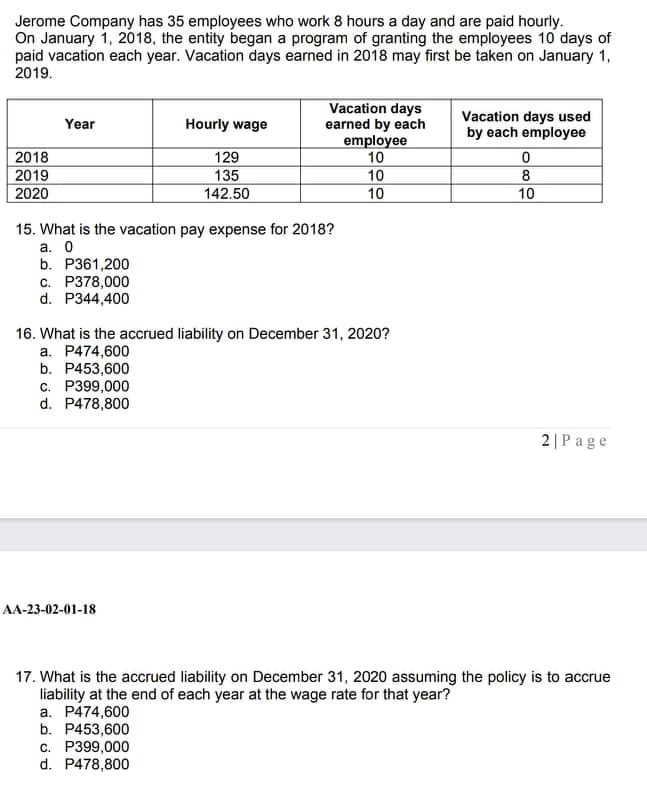

Jerome Company has 35 employees who work 8 hours a day and are paid hourly.

On January 1, 2018, the entity began a program of granting the employees 10 days of

paid vacation each year. Vacation days earned in 2018 may first be taken on January 1,

2019.

Year Hourly wage

Vacation days

earned by each

employee

Vacation days used

by each employee

2018 129 10 0

2019 135 10 8

2020 142.50 10 10

15. What is the vacation pay expense for 2018?

a. 0

b. P361,200

c. P378,000

d. P344,400

16. What is the accrued liability on December 31, 2020?

a. P474,600

b. P453,600

c. P399,000

d. P478,800

17. What is the accrued liability on December 31, 2020 assuming the policy is to accrue

liability at the end of each year at the wage rate for that year?

a. P474,600

b. P453,600

c. P399,000

d. P478,800

Provide SOLUTION

Trending now

This is a popular solution!

Step by step

Solved in 2 steps