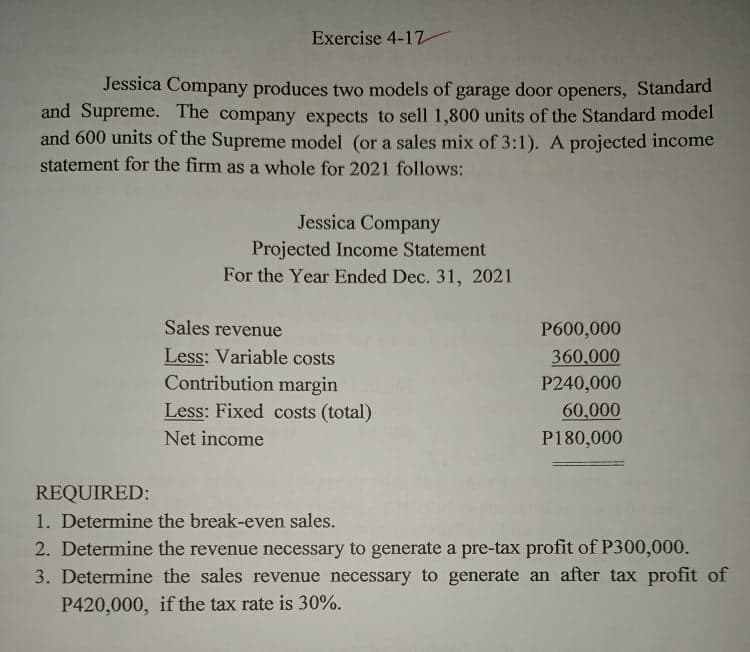

Jessica Company produces two models of garage door openers, Standard and Supreme. The company expects to sell 1,800 units of the Standard model and 600 units of the Supreme model (or a sales mix of 3:1). A projected income statement for the firm as a whole for 2021 follows: Jessica Company Projected Income Statement For the Year Ended Dec. 31, 2021 Sales revenue P600,000 Less: Variable costs Contribution margin 360,000 P240,000 Less: Fixed costs (total) 60,000 Net income P180,000 REQUIRED: 1. Determine the break-even sales. 2. Determine the revenue necessary to generate a pre-tax profit of P300,000. 3. Determine the sales revenue necessary to generate an after tax profit of P420,000, if the tax rate is 30%.

Jessica Company produces two models of garage door openers, Standard and Supreme. The company expects to sell 1,800 units of the Standard model and 600 units of the Supreme model (or a sales mix of 3:1). A projected income statement for the firm as a whole for 2021 follows: Jessica Company Projected Income Statement For the Year Ended Dec. 31, 2021 Sales revenue P600,000 Less: Variable costs Contribution margin 360,000 P240,000 Less: Fixed costs (total) 60,000 Net income P180,000 REQUIRED: 1. Determine the break-even sales. 2. Determine the revenue necessary to generate a pre-tax profit of P300,000. 3. Determine the sales revenue necessary to generate an after tax profit of P420,000, if the tax rate is 30%.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.2MBA

Related questions

Question

Transcribed Image Text:Exercise 4-17

Jessica Company produces two models of garage door openers, Standard

and Supreme. The company expects to sell 1,800 units of the Standard model

and 600 units of the Supreme model (or a sales mix of 3:1). A projected income

statement for the firm as a whole for 2021 follows:

Jessica Company

Projected Income Statement

For the Year Ended Dec. 31, 2021

Sales revenue

P600,000

Less: Variable costs

360,000

Contribution margin

Less: Fixed costs (total)

P240,000

60,000

P180,000

Net income

REQUIRED:

1. Determine the break-even sales.

2. Determine the revenue necessary to generate a pre-tax profit of P300,000.

3. Determine the sales revenue necessary to generate an after tax profit of

P420,000, if the tax rate is 30%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning