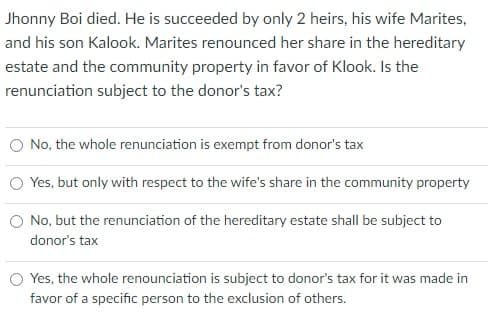

Jhonny Boi died. He is succeeded by only 2 heirs, his wife Marites, and his son Kalook. Marites renounced her share in the hereditary estate and the community property in favor of Klook. Is the renunciation subject to the donor's tax? O No, the whole renunciation is exempt from donor's tax O Yes, but only with respect to the wife's share in the community property O No, but the renunciation of the hereditary estate shall be subject to donor's tax

Jhonny Boi died. He is succeeded by only 2 heirs, his wife Marites, and his son Kalook. Marites renounced her share in the hereditary estate and the community property in favor of Klook. Is the renunciation subject to the donor's tax? O No, the whole renunciation is exempt from donor's tax O Yes, but only with respect to the wife's share in the community property O No, but the renunciation of the hereditary estate shall be subject to donor's tax

Chapter27: The Federal Gift And Estate Taxes

Section: Chapter Questions

Problem 46P

Related questions

Question

Is the renunciation subject to the donor's tax?

Transcribed Image Text:Jhonny Boi died. He is succeeded by only 2 heirs, his wife Marites,

and his son Kalook. Marites renounced her share in the hereditary

estate and the community property in favor of Klook. Is the

renunciation subject to the donor's tax?

No, the whole renunciation is exempt from donor's tax

Yes, but only with respect to the wife's share in the community property

O No, but the renunciation of the hereditary estate shall be subject to

donor's tax

Yes, the whole renounciation is subject to donor's tax for it was made in

favor of a specific person to the exclusion of others.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT