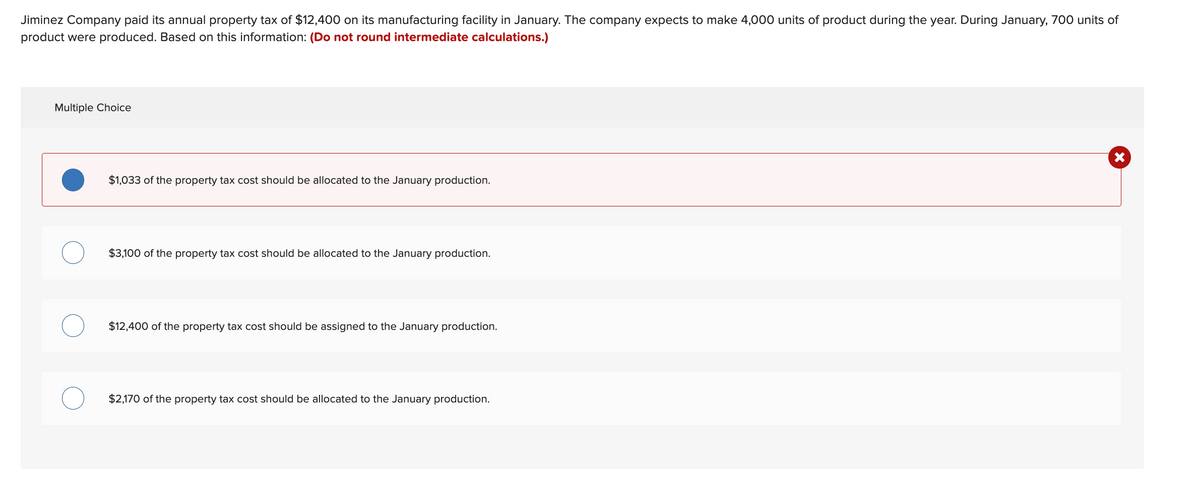

Jiminez Company paid its annual property tax of $12,400 on its manufacturing facility in January. The company expects to make 4,000 units of product during the year. During January, 700 units of product were produced. Based on this information: (Do not round intermediate calculations.) Multiple Choice $1,033 of the property tax cost should be allocated to the January production. $3,100 of the property tax cost should be allocated to the January production. $12,400 of the property tax cost should be assigned to the January production. $2,170 of the property tax cost should be allocated to the January production. O

Jiminez Company paid its annual property tax of $12,400 on its manufacturing facility in January. The company expects to make 4,000 units of product during the year. During January, 700 units of product were produced. Based on this information: (Do not round intermediate calculations.) Multiple Choice $1,033 of the property tax cost should be allocated to the January production. $3,100 of the property tax cost should be allocated to the January production. $12,400 of the property tax cost should be assigned to the January production. $2,170 of the property tax cost should be allocated to the January production. O

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 11EA: Markson and Sons leases a copy machine with terms that include a fixed fee each month plus acharge...

Related questions

Question

Transcribed Image Text:Jiminez Company paid its annual property tax of $12,400 on its manufacturing facility in January. The company expects to make 4,000 units of product during the year. During January, 700 units of

product were produced. Based on this information: (Do not round intermediate calculations.)

Multiple Choice

X

$1,033 of the property tax cost should be allocated to the January production.

$3,100 of the property tax cost should be allocated to the January production.

$12,400 of the property tax cost should be assigned to the January production.

$2,170 of the property tax cost should be allocated to the January production.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub