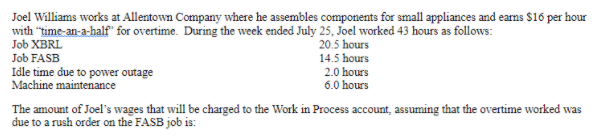

Joel Williams works at Allentown Company where he assembles components for small appliances and earns $16 per hour with "time-an-a-half" for overtime. During the week ended July 25, Joel worked 43 hours as follows: Job XBRL Job FASB 20.5 hours 14.5 hours 2.0 hours 6.0 hours Idle time due to power outage Machine maintenance The amount of Joel's wages that will be charged to the Work in Process account, assuming that the overtime worked was due to a rush order on the FASB job is:

Joel Williams works at Allentown Company where he assembles components for small appliances and earns $16 per hour with "time-an-a-half" for overtime. During the week ended July 25, Joel worked 43 hours as follows: Job XBRL Job FASB 20.5 hours 14.5 hours 2.0 hours 6.0 hours Idle time due to power outage Machine maintenance The amount of Joel's wages that will be charged to the Work in Process account, assuming that the overtime worked was due to a rush order on the FASB job is:

Chapter2: Computing Wages And Salaries

Section: Chapter Questions

Problem 8PA

Related questions

Question

Transcribed Image Text:Joel Williams works at Allentown Company where he assembles components for small appliances and earns $16 per hour

with "time-an-a-half" for overtime. During the week ended July 25, Joel worked 43 hours as follows:

Job XBRL

20.5 hours

Job FASB

14.5 hours

Idle time due to power outage

Machine maintenance

2.0 hours

6.0 hours

The amount of Joel's wages that will be charged to the Work in Process account, assuming that the overtime worked was

due to a rush order on the FASB job is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub