John Porter is an hourly employee of Motter Company located in New York City. This week, Porter had to travel to the company's regional office in Albany. He left Sunday at noon and arrived in Albany at 3:00 P.M. During the week, he worked his normal 40 hours in the Albany office (Monday through Friday-9 A.M. to 5 P.M.). In addition, he attended the company's mandatory 5- hour work training session on Wednesday evening. Porter's hourly rate of pay is $14.70 per hour. Round the overtime rate to two decimal places and use the rounded amount in subsequent computations. Round the final answers to the nearest cent. a. Porter's overtime earnings for the week are b. Porter's total earnings for the week are

John Porter is an hourly employee of Motter Company located in New York City. This week, Porter had to travel to the company's regional office in Albany. He left Sunday at noon and arrived in Albany at 3:00 P.M. During the week, he worked his normal 40 hours in the Albany office (Monday through Friday-9 A.M. to 5 P.M.). In addition, he attended the company's mandatory 5- hour work training session on Wednesday evening. Porter's hourly rate of pay is $14.70 per hour. Round the overtime rate to two decimal places and use the rounded amount in subsequent computations. Round the final answers to the nearest cent. a. Porter's overtime earnings for the week are b. Porter's total earnings for the week are

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 11P: Dollar-Value LIFO Retail Intella Inc. adopted the dollar-value retail LIFO method on January 1,...

Related questions

Question

Transcribed Image Text:еВook

4 Show Me How

Print Item

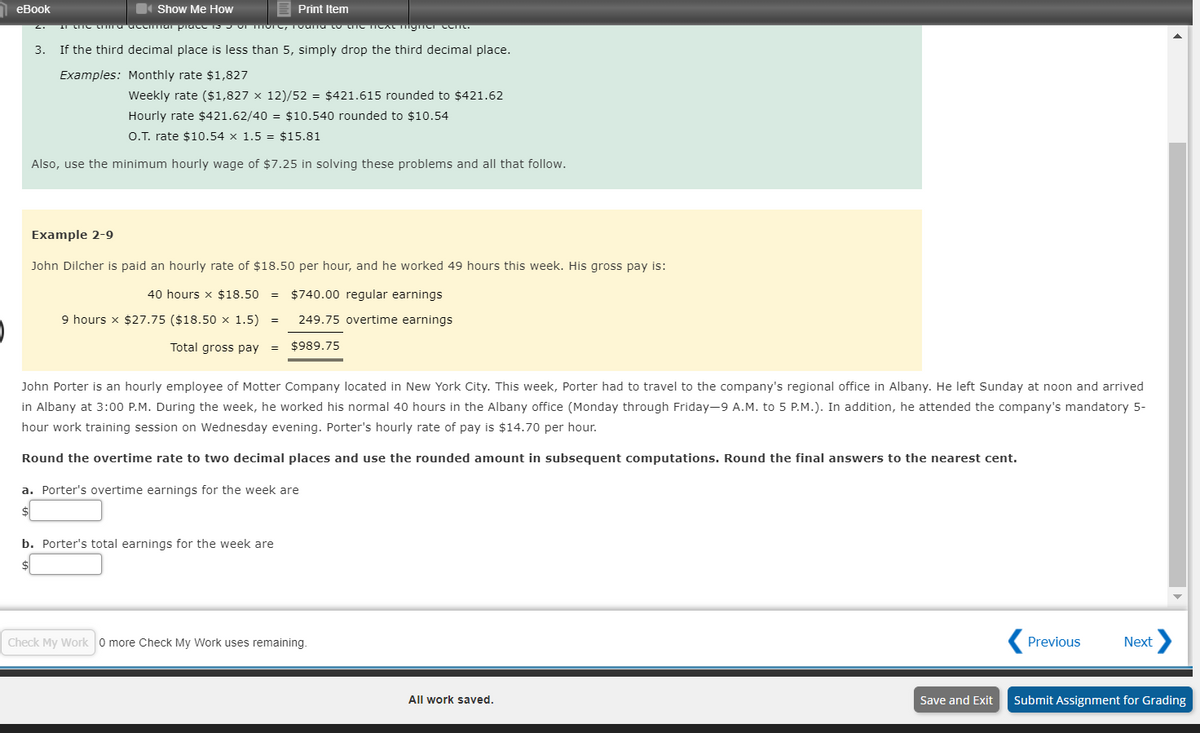

3. If the third decimal place is less than 5, simply drop the third decimal place.

Examples: Monthly rate $1,827

Weekly rate ($1,827 x 12)/52 = $421.615 rounded to $421.62

Hourly rate $421.62/40 = $10.540 rounded to $10.54

O.T. rate $10.54 x 1.5 = $15.81

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

Example 2-9

John Dilcher is paid an hourly rate of $18.50 per hour, and he worked 49 hours this week. His gross pay is:

40 hours x $18.50

$740.00 regular earnings

9 hours x $27.75 ($18.50 × 1.5)

249.75 overtime earnings

Total gross pay

$989.75

John Porter is an hourly employee of Motter Company located in New York City. This week, Porter had to travel to the company's regional office in Albany. He left Sunday at noon and arrived

in Albany at 3:00 P.M. During the week, he worked his normal 40 hours in the Albany office (Monday through Friday-9 A.M. to 5 P.M.). In addition, he attended the company's mandatory 5-

hour work training session on Wednesday evening. Porter's hourly rate of pay is $14.70 per hour.

Round the overtime rate to two decimal places and use the rounded amount in subsequent computations. Round the final answers to the nearest cent.

a. Porter's overtime earnings for the week are

b. Porter's total earnings for the week are

Check My Work 0 more Check My Work uses remaining.

( Previous

Next

All work saved.

Save and Exit

Submit Assignment for Grading

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning