Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 5P

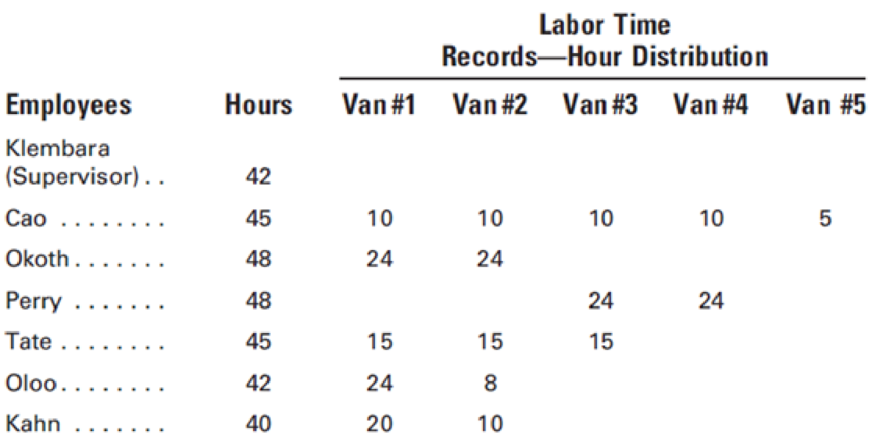

A rush order was accepted by Bartley's Conversions for five van conversions. The labor time records for the week ended January 27 show the following (Hours not worked on vans are idle time and are not charged to the job.):

All employees are paid $20 per hour, except Klembara, who receives $25 per hour. All overtime premium pay, except Klembara's, is chargeable to the job, and all employees, including Klembara, receive time-and-a-half for overtime hours.

Required:

- 1. Calculate the total payroll and total net earnings for the week. Assume that an 18% deduction for federal income tax is required in addition to FICA deductions. Assume that none of the employees has achieved the maximums for FICA and unemployment taxes.

- 2. Prepare the journal entries to record and pay the payroll.

- 3. Prepare the

journal entry to distribute the payroll to the appropriate accounts. - 4. Determine the dollar amount of labor that is chargeable to each van, assuming that the overtime costs are proportionate to the regular hours used on the vans. (First compute an average labor rate for each worker, including overtime premium, and then use that rate to charge all workers' hours to vans.) Round the labor rates to the nearest whole cent.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Alex worked 52 hours during the week. His normal working week consists of 40 hours, of which 36 hours were spent on production while the remaining 4 hours were idle time.

Overtime is paid at time and a half. However, it is the policy of the company to pay staff 200% of the normal wage rate after the first three hours of overtime on any working day.

Alex worked 6 hours of overtime on a job for which the customer required the work to be completed on the same day. Alex’s normal wage rate is $12 per hour. The rest of the week Alex did not work more than three hours of overtime on any one day.

How much of Alex’s gross pay would be charged as direct labour?

Select one:

a.

$714

b.

$576

c.

None of the above

d.

$624

e.

$696

Hi there, can you help me about the calculation?The correct answer should be $576

The regular working days in a factory are Monday to Friday. Pete and Bec who are being paid 25 and 27 per hour, respectively, worked on Jobs 31 and 32 for the period August 4 to 10. The weekly time records and summary of the job tickets show the following: Total number of hours time in: Pete = 45, Bec = 43; Overtime: Pete = 6, Bec = 5; Expended on the jobs: No 31: Pete = 26, Bec = 17; No. 32: Pete = 20, Bec = 21. Pete was authorized to work on overtime on job no. 31 because of its rush nature; Bec had to work on overtime on job no. 32 to make up for a machine breakdown during the week. Overtime premium is 25%. Factory overhead is 60% of direct labor cost and materials cost comprises 80% of total production cost. What should be the respective production costs of job nos. 31 and 32?

During the last week in October, Ezekiel worked a total of 45 hours and had no idle time. He is paid P500 per hour for regular time, and is paid an additional of 50% of the regular rate for all hours in excess of 35 hours per week. How much of Ezekiel’s wages lat week should be included in manufacturing overhead cost

Chapter 3 Solutions

Principles of Cost Accounting

Ch. 3 - What is the difference between direct and indirect...Ch. 3 - Prob. 2QCh. 3 - Prob. 3QCh. 3 - In production work teams, output is dependent upon...Ch. 3 - Define productivity.Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - What are the sources for posting direct labor cost...

Ch. 3 - What are the sources for posting indirect labor...Ch. 3 - In accounting for labor costs, what is the...Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Besides FICA, FUTA and state unemployment taxes,...Ch. 3 - Prob. 16QCh. 3 - Prob. 17QCh. 3 - Prob. 18QCh. 3 - What is a shift premium, and how is it usually...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - Prob. 22QCh. 3 - Prob. 23QCh. 3 - Prob. 24QCh. 3 - Prob. 25QCh. 3 - R. Herbert of Crestview Manufacturing Co. is paid...Ch. 3 - Recording payroll Using the earnings data...Ch. 3 - Prob. 3ECh. 3 - Peggy Nolan earns 20 per hour for up to 300 units...Ch. 3 - Overtime Allocation Arlin Fabrication Company...Ch. 3 - Prob. 6ECh. 3 - Davis, Inc. paid wages to its employees during the...Ch. 3 - Recording the payroll and payroll taxes Using the...Ch. 3 - Prob. 9ECh. 3 - The total wages and salaries earned by all...Ch. 3 - The total wages and salaries earned by all...Ch. 3 - A weekly payroll summary made from labor time...Ch. 3 - Prob. 13ECh. 3 - Accounting for bonus and vacation pay Cathy Muench...Ch. 3 - Prob. 15ECh. 3 - Prob. 16ECh. 3 - Payroll computation with incentive bonus Fifteen...Ch. 3 - Prob. 2PCh. 3 - Prob. 3PCh. 3 - Payroll for piece-rate wage system Collier...Ch. 3 - A rush order was accepted by Bartley's Conversions...Ch. 3 - The following form is used by Matsuto...Ch. 3 - Payment and distribution of payroll The general...Ch. 3 - Prob. 8PCh. 3 - An analysis of the payroll for the month of...Ch. 3 - Prob. 10PCh. 3 - Prob. 11PCh. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - Using the information in P3-13, prepare the...Ch. 3 - Pan-Am Manufacturing Co. prepares cost estimates...Ch. 3 - Incentive wage plan David Kelley is considering...Ch. 3 - Huron Manufacturing Co. uses a job order cost...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Huron Manufacturing Co. uses a job order cost system to cost its products. It recently signed a new contract with the union that calls for time-and-a-half for all work over 40 hours a week and double-time for Saturday and Sunday. Also, a bonus of 1% of the employees earnings for the year is to be paid to the employees at the end of the fiscal year. The controller, the plant manager, and the sales manager disagree as to how the overtime pay and the bonus should be allocated. An examination of the first months payroll under the new union contract provisions shows the following: Analysis of the supporting payroll documents revealed the following: a. More production was scheduled each day than could be handled in a regular workday, resulting in the need for overtime. b. The Saturday and Sunday hours resulted from rush orders with special contract arrangements with the customers. The controller believes that the overtime premiums and the bonus should be charged to factory overhead and spread over all production of the accounting period, regardless of when the jobs were completed. The plant manager favors charging the overtime premiums directly to the jobs worked on during overtime hours and the bonus to administrative expense. The sales manager states that the overtime premiums and bonus are not factory costs chargeable to regular production but are costs created from administrative policies and, therefore, should be charged only to administrative expense. Required: 1. Evaluate each positionthe controllers, the plant managers, and the sales managers. If you disagree with all of the positions taken, present your view of the appropriate allocation. 2. Prepare the journal entries to illustrate the position you support, including the accrual for the bonus.arrow_forwardKyle Forman worked 47 hours during the week for Erickson Company at two different jobs. His pay rate was 14.00 for the first 40 hours, and his pay rate was 11.80 for the other 7 hours. Determine his gross pay for that week if the company uses the one-half average rate method. a. Gross pay__________ b. If prior agreement existed that overtime would be paid at the rate for the job performed after the 40th hour, the gross pay would be________arrow_forwardR. Herbert of Crestview Manufacturing Co. is paid at the rate of 20 an hour for an eight-hour day, with time-and-a-half for overtime and double-time for Sundays and holidays. Regular employment is on the basis of 40 hours a week, five days a week. At the end of a week, the labor time record shows the following: Because jobs are randomly scheduled for the overtime period, any overtime premium is charged to Factory Overhead. a. Compute Herberts total earnings for the week. b. Present the journal entry to distribute Herberts total earnings. (Note: These single journal entries here and in E3-2, E3-3, E3-4, E3-8 and E3-9 are for the purpose of illustrating the principle involved. Normally, the entries would be made for the total factory payroll plus the administrative and sales payroll.)arrow_forward

- Potts, Inc., recently converted from a 5-day, 40-hour workweek to a 4-day, 40-hour workweek, with overtime continuing to be paid at one and one-half times the regular hourly rate for all hours worked beyond 40 in the week. In this company, time is recorded under the continental system, as shown on the time card on the following page. Sue Ellen Boggs is part of the Group B employees whose regular workweek is Tuesday through Friday. The working hours each day are 800 to 1200; 1230 to 1630; and 1800 to 2000. The company disregards any time before 800, between 1200 and 1230, and between 1630 and 1800, and permits employees to ring in up to 10 minutes late before any deduction is made for tardiness. Deductions are made to the nearest of an hour for workers who are more than 10 minutes late in ringing in. Refer to the time card and compute: a. The daily total hours ..........................................................................___________ b. The total hours for the week ...............................................................___________ c. The regular weekly earnings ................................................................___________ d. The overtime earnings (company rounds O.T. rate to 3 decimal places)___________ e. The total weekly earnings .....................................................................__________arrow_forwardHunter Sobitson, a waiter at the Twentieth Hole restaurant, worked 43 hours this week and collected over 650 in tips. The restaurant uses the full tip credit against the minimum wage and pays Sobitson the minimum required for tipped employees. Determine his gross pay from the restaurant. a. Pay for the 40 hours_________ b. Pay for overtime hours_________arrow_forwardGabrielle Hunter, a waitress at the Hole-in-the-Wall restaurant, worked 42 hours this week and collected over 500 in tips. The restaurant uses the full tip credit against the minimum wage and pays Hunter the minimum required for tipped employees. Determine her gross pay from the restaurant. a. Pay for the 40 hours_________ b. Pay for the overtime hours_________arrow_forward

- Jody Baush is a salaried employee who normally works a 35-hour week and is paid a weekly salary of 735.00. The agreement that he has with his employer states that his salary is to cover all hours worked up to and including 40. This week, Baush worked 42 hours. Calculate his gross pay. Gross pay_________arrow_forwardLuna Manufacturing Inc. completed Job 2525 on May 31, and there were no jobs in process in the plant. Prior to June 1, the predetermined overhead application rate for June was computed from the following data, based on an estimate of 5,000 direct labor hours: The factory has one production department and uses the direct labor hour method to apply factory overhead. Three jobs are started during the month, and postings are made daily to the job cost sheets from the materials requisitions and labor-time records. The following schedule shows the jobs and amounts posted to the job cost sheets: The factory overhead control account was debited during the month for actual factory overhead expenses of 27,000. On June 11, Job 2526 was completed and delivered to the customer using a mark-on percentage of 50% on manufacturing cost. On June 24, Job 2527 was completed and transferred to Finished Goods. On June 30, Job 2528 was still in process. Required: 1. Prepare job cost sheets for Jobs 2526, 2527, and 2528, including factory overhead applied when the job was completed or at the end of the month for partially completed jobs. 2. Prepare journal entries as of June 30 for the following: a. Applying factory overhead to production. b. Closing the applied factory overhead account. c. Closing the factory overhead account. d. Transferring the cost of the completed jobs to finished goods. e. Recording the cost of the sale and the sale of Job 2526.arrow_forwardBruce Eaton is paid 10 cents per unit under the piece-rate system. During one week, Eaton worked 46 hours and produced 5,520 units. Compute the following: 1. The piecework earnings ________ 2. The regular hourly rate ________ 3. The overtime hourly rate ________ 4. The overtime earnings ________ 5. The total earnings ________arrow_forward

- Mack Banta, a nonexempt account representative, worked extra hours this week as a call operator. A number of operators were out for the week and Banta was asked to pick up some of their hours. Can the company pay Banta at a lower pay rate for the hours he worked as an operator? These extra hours also pushed Bantas work time over 40 hours. How should the company calculate Bantas overtime pay?arrow_forwardThe total wages and salaries earned by all employees of Langen Electronics, Ltd. during March, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows: a. Prepare a journal entry to distribute the wages earned during March. b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that two administrative employees with combined earnings this period of 3,000 have exceeded 8,000 in earnings prior to the period?arrow_forwardPeggy Nolan earns 20 per hour for up to 300 units of production per day. If she produces more than 300 units per day, she will receive an additional piece rate of .5333 per unit. Assume that her hours worked and pieces finished for the week just ended were as follows: a. Determine Nolans earnings for each day and for the week. (Round piece-rate computations to the nearest whole dollar.) b. Prepare the journal entry to distribute the payroll, assuming that any make-up guarantees are charged to Factory Overhead.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Step 5: Base Pay Structure; Author: GreggU;https://www.youtube.com/watch?v=CnBsWsY6O7k;License: Standard Youtube License