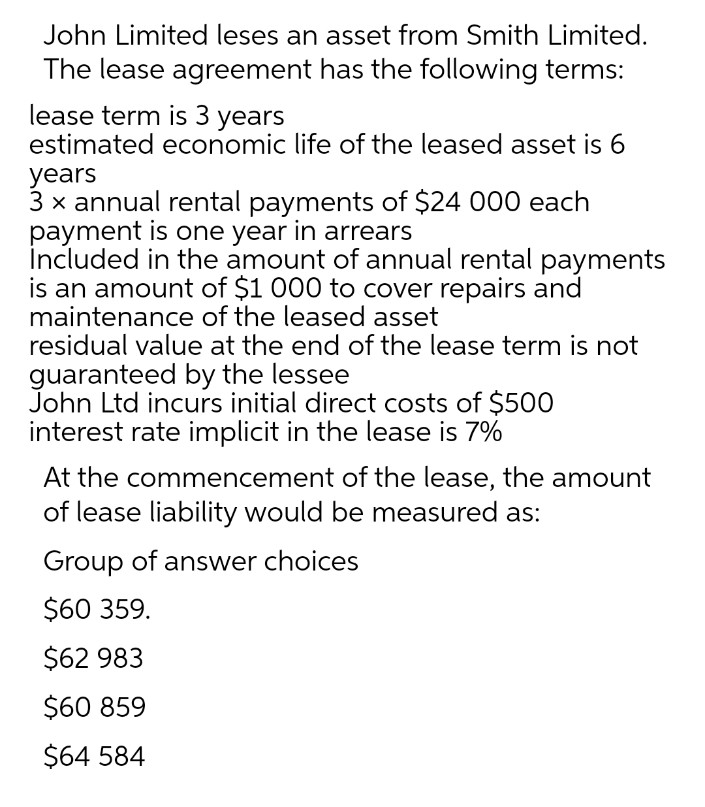

John Limited leses an asset from Smith Limited. The lease agreement has the following terms: lease term is 3 years estimated economic life of the leased asset is 6 years 3 x annual rental payments of $24 000 each payment is one year in arrears İncluded in the amount of annual rental payments is an amount of $1 000 to cover repairs and maintenance of the leased asset residual value at the end of the lease term is not guaranteed by the lessee John Ltd incurs initial direct costs of $500 interest rate implicit in the lease is 7% At the commencement of the lease, the amount of lease liability would be measured as: Group of answer choices $60 359. $62 983 $60 859 $64 584

John Limited leses an asset from Smith Limited. The lease agreement has the following terms: lease term is 3 years estimated economic life of the leased asset is 6 years 3 x annual rental payments of $24 000 each payment is one year in arrears İncluded in the amount of annual rental payments is an amount of $1 000 to cover repairs and maintenance of the leased asset residual value at the end of the lease term is not guaranteed by the lessee John Ltd incurs initial direct costs of $500 interest rate implicit in the lease is 7% At the commencement of the lease, the amount of lease liability would be measured as: Group of answer choices $60 359. $62 983 $60 859 $64 584

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.9E: Leased Assets Koffman and Sons signed a four-year lease for a forklift on January 1, 2016. Annual...

Related questions

Question

Transcribed Image Text:John Limited leses an asset from Smith Limited.

The lease agreement has the following terms:

lease term is 3 years

estimated economic life of the leased asset is 6

years

3 x annual rental payments of $24 000 each

payment is one year in arrears

İncluded in the amount of annual rental payments

is an amount of $1 000 to cover repairs and

maintenance of the leased asset

residual value at the end of the lease term is not

guaranteed by the lessee

John Ltd incurs initial direct costs of $500

interest rate implicit in the lease is 7%

At the commencement of the lease, the amount

of lease liability would be measured as:

Group of answer choices

$60 359.

$62 983

$60 859

$64 584

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning