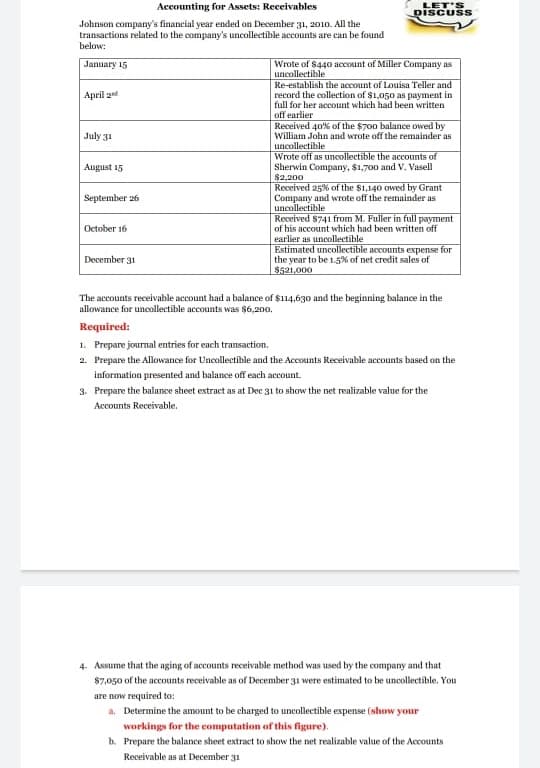

Johnson company's financial year ended on December 31, 2010. All the transactions related to the company's uncollectible accounts are can be found below: Wrote of 8440 account of Miller Company as uncollectible January 15 Re-establish the account of Louisa Teller and record the collection of $1,050 as payment in full for her account which had been written off earlier Received 40% of the $700 balance owed by William John and wrote off the remainder as uncollectible Wrote off as uneollectible the accounts of Sherwin Company, $1,700 and V. Vasell $2,200 Received 25% of the $1,140 owed by Grant Company and wrote off the remainder as uncollectible Received 8741 from M. Fuller in full payment of his account which hud been written off earlier as uneollectible Estimated uncollectible accounts expense for the year to be 1.5% of net credit sales of $521,000 April 2 July 31 August 15 September 26 October 16 December 31 The accounts receivable account had a balance of $114.630 and the beginning balance in the allowance for uncollectible accounts was $6,200. Required: 1. Prepare journal entries for each transaction. 2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account. 3. Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the Accounts Receivable. 4. Assume that the aging of accounts receivable method was used by the company and that $7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You are now required to: a. Determine the amount to be charged to uneollectible expense (show your workings for the computation of this figure). b. Prepare the balance sheet extract to show the net realizable value of the Accounts Receivable as at December 31

Johnson company's financial year ended on December 31, 2010. All the transactions related to the company's uncollectible accounts are can be found below: Wrote of 8440 account of Miller Company as uncollectible January 15 Re-establish the account of Louisa Teller and record the collection of $1,050 as payment in full for her account which had been written off earlier Received 40% of the $700 balance owed by William John and wrote off the remainder as uncollectible Wrote off as uneollectible the accounts of Sherwin Company, $1,700 and V. Vasell $2,200 Received 25% of the $1,140 owed by Grant Company and wrote off the remainder as uncollectible Received 8741 from M. Fuller in full payment of his account which hud been written off earlier as uneollectible Estimated uncollectible accounts expense for the year to be 1.5% of net credit sales of $521,000 April 2 July 31 August 15 September 26 October 16 December 31 The accounts receivable account had a balance of $114.630 and the beginning balance in the allowance for uncollectible accounts was $6,200. Required: 1. Prepare journal entries for each transaction. 2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account. 3. Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the Accounts Receivable. 4. Assume that the aging of accounts receivable method was used by the company and that $7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You are now required to: a. Determine the amount to be charged to uneollectible expense (show your workings for the computation of this figure). b. Prepare the balance sheet extract to show the net realizable value of the Accounts Receivable as at December 31

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter14: Accounting For Uncollectible Accounts Receivable

Section: Chapter Questions

Problem 1AP

Related questions

Question

I need help with part 4

Transcribed Image Text:Accounting for Assets: Receivables

LET'S

DISCUSS

Johnson company's financial year ended on December 31, 2010. All the

transactions related to the company's uncollectible accounts are can be found

below:

January 15

Wrote of 8440 account of Miller Company as

uncollectible

Re-establish the account of Louisa Teller and

record the collection of $1,050 as payment in

full for her account which had been written

off earlier

April 2

Received 40% of the $700 balance owed by

William John and wrote off the remainder as

uncollectible

Wrote off as uncollectible the accounts of

Sherwin Company, $1,700 and V. Vasell

$2,200

Received 25% of the $1,140 owed by Grant

Company and wrote off the remainder as

uncollectible

Received $741 from M. Fuller in full payment

of his account which hud been written off

earlier as uncollectible

Estimated uncollectible accounts expense for

the year to be 1.5% of net credit sales of

$521,000

July 31

August 15

September 26

October 16

December 31

The accounts receivable account had a balance of $114,630 and the beginning balance in the

allowance for uncollectible accounts was $6,200.

Required:

1. Prepare journal entries for each transaction.

2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the

information presented and balance off each account.

3. Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the

Accounts Receivable.

4. Assume that the aging of accounts receivable method was used by the company and that

$7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You

are now required to:

a. Determine the amount to be charged to uncollectible expense (show your

workings for the computation of this figure).

b. Prepare the balance sheet extract to show the net realizable value of the Accounts

Receivable as at December 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning