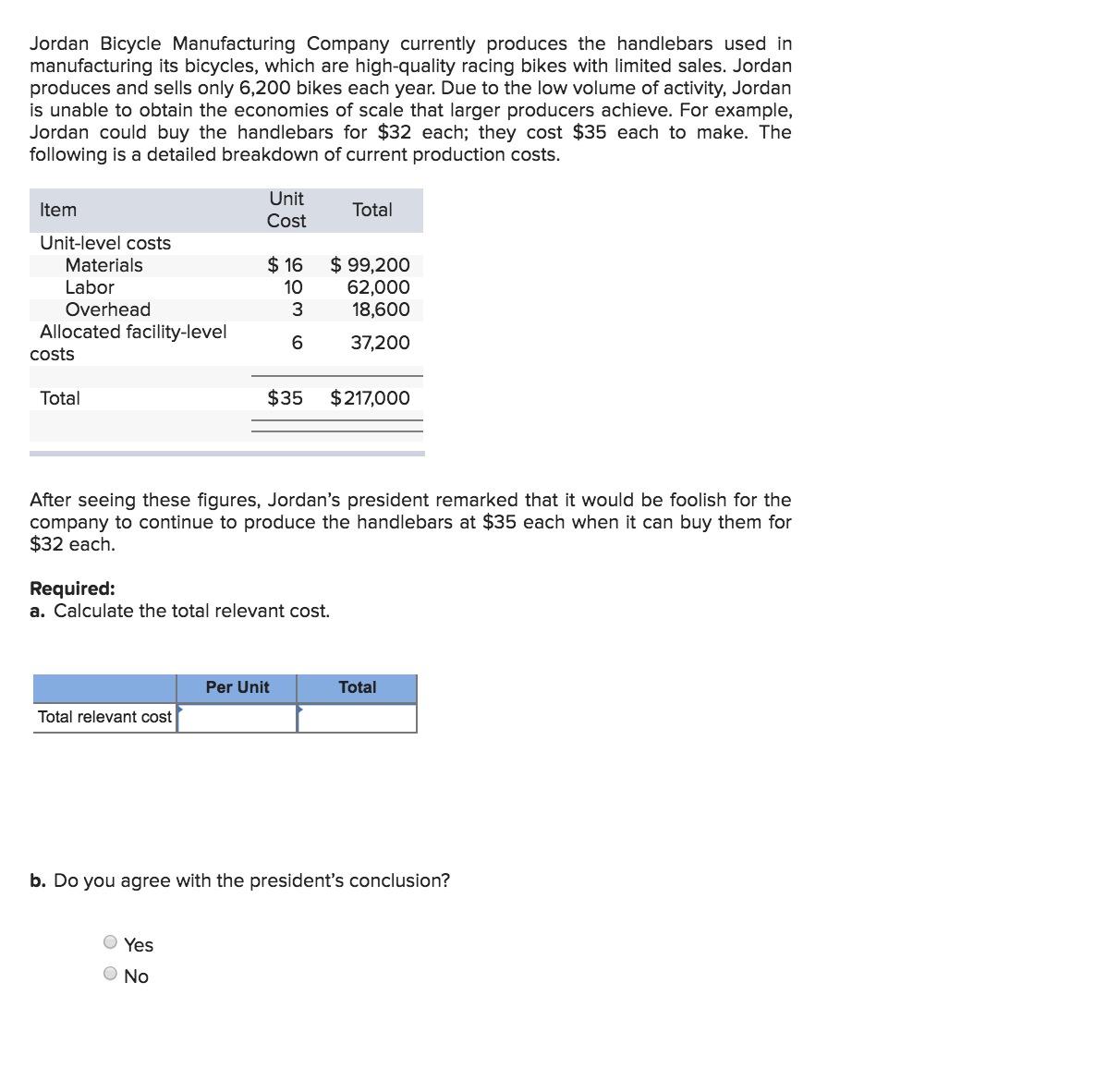

Jordan Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Jordan produces and sells only 6,200 bikes each year. Due to the low volume of activity, Jordan is unable to obtain the economies of scale that larger producers achieve. For example, Jordan could buy the handlebars for $32 each; they cost $35 each to make. The following is a detailed breakdown of current production costs Unit Cost Total Item Unit-level costs 16 99,200 62,000 18,600 Materials Labor 10 Overhead 3 Allocated facility-level 6 37,200 Costs $35 $217,000 Total After seeing these figures, Jordan's president remarked that it would be foolish for the company to continue to produce the handlebars at $35 each when it can buy them for $32 each Required: a. Calculate the total relevant cost. Per Unit Total Total relevant cost b. Do you agree with the president's conclusion? Yes ONo оо

Jordan Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Jordan produces and sells only 6,200 bikes each year. Due to the low volume of activity, Jordan is unable to obtain the economies of scale that larger producers achieve. For example, Jordan could buy the handlebars for $32 each; they cost $35 each to make. The following is a detailed breakdown of current production costs Unit Cost Total Item Unit-level costs 16 99,200 62,000 18,600 Materials Labor 10 Overhead 3 Allocated facility-level 6 37,200 Costs $35 $217,000 Total After seeing these figures, Jordan's president remarked that it would be foolish for the company to continue to produce the handlebars at $35 each when it can buy them for $32 each Required: a. Calculate the total relevant cost. Per Unit Total Total relevant cost b. Do you agree with the president's conclusion? Yes ONo оо

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 7EB: Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has...

Related questions

Question

Transcribed Image Text:Jordan Bicycle Manufacturing Company currently produces the handlebars used in

manufacturing its bicycles, which are high-quality racing bikes with limited sales. Jordan

produces and sells only 6,200 bikes each year. Due to the low volume of activity, Jordan

is unable to obtain the economies of scale that larger producers achieve. For example,

Jordan could buy the handlebars for $32 each; they cost $35 each to make. The

following is a detailed breakdown of current production costs

Unit

Cost

Total

Item

Unit-level costs

16

99,200

62,000

18,600

Materials

Labor

10

Overhead

3

Allocated facility-level

6

37,200

Costs

$35

$217,000

Total

After seeing these figures, Jordan's president remarked that it would be foolish for the

company to continue to produce the handlebars at $35 each when it can buy them for

$32 each

Required:

a. Calculate the total relevant cost.

Per Unit

Total

Total relevant cost

b. Do you agree with the president's conclusion?

Yes

ONo

оо

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub