Concept explainers

NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFat’s controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)—a toxic waste cleanup company—offered to buy 10,000 pounds of olestra from NoFat during December for a price of $2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that “This is another way to use our expensive olestra plant!”

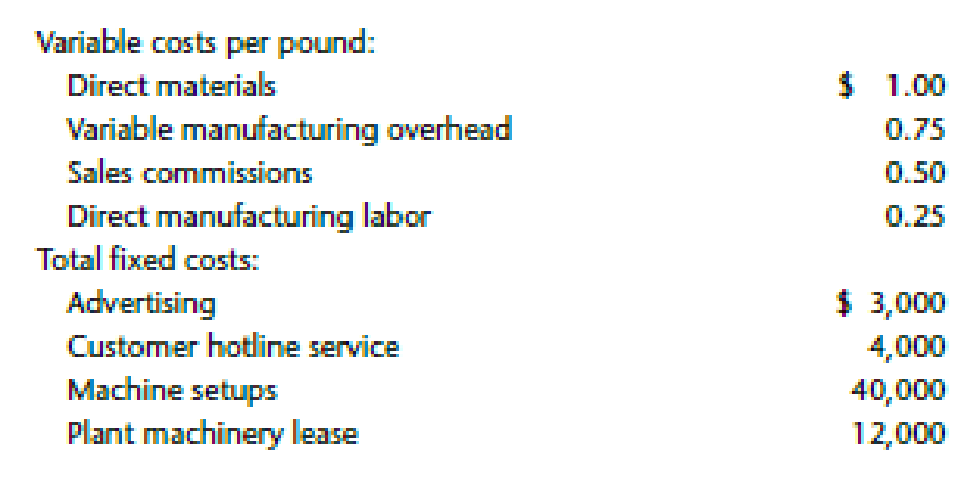

The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows:

In addition, Allyson met with several of NoFat’s key production managers and discovered the following information:

- The special order could be produced without incurring any additional marketing or customer service costs.

- NoFat owns the aging plant facility that it uses to manufacture olestra.

- NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year.

- NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra.

- PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the $1,000 cost of the inspection team.

Assume for this question that NoFat rejected PU’s special sales offer because the $2.20 price suggested by PU was too low. In response to the rejection, PU asked NoFat to determine the price at which it would be willing to accept the special sales offer. For its regular sales, NoFat sets prices by marking up variable costs by 10%.

If Allyson decides to use NoFat’s 10% markup pricing method to set the price for PU’s special sales offer,

- a. Calculate the price that NoFat would charge PU for each pound of olestra.

- b. Calculate the relevant profit that NoFat would earn if it set the special sales price by using its markup pricing method. (Hint: Use the estimate of relevant costs that you calculated in response to Requirement 1b.)

- c. Explain why NoFat should accept or reject the special sales offer if it uses its markup pricing method to set the special sales price.

Trending nowThis is a popular solution!

Chapter 12 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Assume for this question that Allysons relevant analysis reveals that NoFat would earn a positive relevant profit of 10,000 from the special sale (i.e., the special sales alternative). However, after conducting this traditional, short-term relevant analysis, Allyson wonders whether it might be more profitable over the long term to downsize the company by reducing its manufacturing capacity (i.e., its plant machinery and plant facility). She is aware that downsizing requires a multiyear time horizon because companies usually cannot increase or decrease fixed plant assets every year. Therefore, Allyson has decided to use a 5-year time horizon in her long-term decision analysis. She has identified the following information regarding capacity downsizing (i.e., the downsizing alternative): The plant facility consists of several buildings. If it chooses to downsize its capacity, NoFat can immediately sell one of the buildings to an adjacent business for 30,000. If it chooses to downsize its capacity, NoFats annual lease cost for plant machinery will decrease to 9,000. Therefore, Allyson must choose between these two alternatives: Accept the special sales offer each year and earn a 10,000 relevant profit for each of the next 5 years or reject the special sales offer and downsize as described above. Assume that NoFat pays for all costs with cash. Also, assume a 10% discount rate, a 5-year time horizon, and all cash flows occur at the end of the year. Using an NPV approach to discount future cash flows to present value, a. Calculate the NPV of accepting the special sale with the assumed positive relevant profit of 10,000 per year (i.e., the special sales alternative). b. Calculate the NPV of downsizing capacity as previously described (i.e., the downsizing alternative). c. Based on the NPV of Requirements 5a and 5b, identify and explain which of these two alternatives is best for NoFat to pursue in the long term.arrow_forwardBienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forwardPoleski Manufacturing, which maintains the same level of inventory at the end of each year, provided the following information about expenses anticipated for next year: The selling price of Poleskis single product is 16. In recent years, profits have fallen and Poleskis management is now considering a number of alternatives. Poleski wants to have a net income next year of 250,000, but expects to sell only 120,000 units unless some changes are made. The president of Poleski has asked you to calculate the companys projected net income (assuming 120,000 units are sold) and the sales needed to achieve the companys net income objective for next year. Also, compute Poleskis contribution margin per unit, contribution margin ratio, and break-even point for next year. The worksheet CVP has been provided to assist you. Note that the data from the problem have already been entered into the Data Section of the worksheet.arrow_forward

- Oberweis Dairy switched from delivery trucks with regular gasoline engines to ones with diesel engines. The diesel trucks cost $6,000 more than the ordinary gasoline trucks but costs $1,800 per year less to operate. Assume that Oberweis saves the operating costs at the end of each month. If Oberweis uses a discount rate of 1% per month, approximately how many months, at a minimum, must the diesel trucks remain in service for the switch to be sensible?arrow_forwardOttis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forwardNico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?arrow_forward

- This year, Hassell Company will ship 4,000,000 pounds of chocolates to customers with total order-filling costs of 900,000. There are two types of customers: those who order 50,000 pound lots (small customers) and those who order 250,000 pound lots (large customers). Each customer category is responsible for buying 1,500,000 pounds. The selling price per pound is 2 per lb for the 50,000 pound lot and 3 per lb for the larger lots, due to differences in the type of chocolate. ABC would likely assign order-filling costs to the customer type as follows: a. 450,000, small; 450,000, large (using pounds as the driver) b. 360,000, small; 540,000, large (using revenue as the driver) c. 750,000, small; 150,000, large (using number of orders as the driver) d. 450,000, small; 450,000, large (using customer type as the driver)arrow_forwardPaladin Company manufactures plain-paper fax machines in a small factory in Minnesota. Sales have increased by 50 percent in each of the past three years, as Paladin has expanded its market from the United States to Canada and Mexico. As a result, the Minnesota factory is at capacity. Beryl Adams, president of Paladin, has examined the situation and developed the following alternatives. 1. Add a permanent second shift at the plant. However, the semiskilled workers who assemble the fax machines are in short supply, and the wage rate of 15 per hour would probably have to be increased across the board to 18 per hour in order to attract sufficient workers from out of town. The total wage increase (including fringe benefits) would amount to 125,000. The heavier use of plant facilities would lead to increased plant maintenance and small tool cost. 2. Open a new plant and locate it in Mexico. Wages (including fringe benefits) would average 3.50 per hour. Investment in plant and equipment would amount to 300,000. 3. Open a new plant and locate it in a foreign trade zone, possibly in Dallas. Wages would be somewhat lower than in Minnesota, but higher than in Mexico. The advantages of postponing tariff payments on parts imported from Asia could amount to 50,000 per year. Required: Advise Beryl of the advantages and disadvantages of each of her alternatives.arrow_forwardArtisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $55,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,000 more units per year. Currently, the selling price per unit is $25 and the cost per unit is $7.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forward

- Kaune Food Products Company manufactures canned mixed nuts with an average manufacturing cost of 52 per case (a case contains 24 cans of nuts). Kaune sold 150,000 cases last year to the following three classes of customer: The supermarkets require special labeling on each can costing 0.04 per can. They order through electronic data interchange (EDI), which costs Kaune about 61,000 annually in operating expenses and depreciation. Kaune delivers the nuts to the stores and stocks them on the shelves. This distribution costs 45,000 per year. The small grocers order in smaller lots that require special picking and packing in the factory; the special handling adds 25 to the cost of each case sold. Sales commissions to the independent jobbers who sell Kaune products to the grocers average 8 percent of sales. Bad debts expense amounts to 9 percent of sales. Convenience stores also require special handling that costs 30 per case. In addition, Kaune is required to co-pay advertising costs with the convenience stores at a cost of 15,000 per year. Frequent stops are made to each convenience store by Kaune delivery trucks at a cost of 30,000 per year. Required: 1. Calculate the total cost per case for each of the three customer classes. (Round unit costs to four significant digits.) 2. Using the costs from Requirement 1, calculate the profit per case per customer class. Does the cost analysis support the charging of different prices? Why or why not? 3. What if Kaune charged the average price per case to all customer classes? How would that affect the profit percentages?arrow_forwardCinnamon Depot bakes and sells cinnamon rolls for $1.75 each. The cost of producing 500,000 rolls in the prior year was: At the start of the current year, Cinnamon Depot received a special order for 18,000 rolls to be sold for $1.50 per roll. The company estimates it will incur an additional $1,000 in total fixed costs in order to lease a special machine that forms the rolls in the shape of a heart per the customers request. This order will not affect any of its other operations. Should the company accept the special order? (Show your work.)arrow_forwardVariety Artisans has a bottleneck in their production that occurs within the engraving department. Arjun Naipul, the COO, is considering hiring an extra worker, whose salary will be $45,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,500 more units per year. Currently, the selling price per unit is $18 and the cost per unit is $5.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College