Joshua Hill, Oriole & Hill Fabricators' production manager, has just completed the company's production budget and direct labor budget for the first quarter. January February March Quarter Budgeted unit sales + Budgeted ending inventory 22,000 28,000 32,000 82,000 8,400 9,600 10,800 10,800 Total units required 30,400 37,600 42,800 92,800 - Beginning inventory Budgeted production 2,600 8,400 9,600 2,600 90,200 27,800 29,200 33,200 January February March Quarter Budgeted production Standard DLH per unit 27,800 29,200 33,200 90,200 0.30 0.30 0.30 0.30 Total DLH required 8,340 8,760 9,960 27,060 Standard wage rate Budgeted DL cost $17 $460,020 $17 $17 $17 $141,780 $148,920 $169,320 He has identified the following monthly expenses that will be needed to support the company's manufacturing process. Fixed Overhead Variable Overhead per month per DLH Depreciation $33,000 Indirect materials 18,500 $1.20 Indirect labor 26,000 $0.20 Utilities 19,000 $0.15 Property taxes 4,300 Maintenance 4,000 $0.20 The company applies manufacturing overhead based on direct labor hours, and the current predetermined rates are $13.00 per direct labor hour for fixed manufacturing overhead and $1.75 per direct labor hour for variable manufacturing overhead. Prepare Oriole & Hill's manufacturing overhead budget for the first quarter. (Round per unit answers to 2 decimal places, e-g. 52.75 and all other answers to 0 decimal places, eg. 5,275.) January February March %24 %24 > > > >

Joshua Hill, Oriole & Hill Fabricators' production manager, has just completed the company's production budget and direct labor budget for the first quarter. January February March Quarter Budgeted unit sales + Budgeted ending inventory 22,000 28,000 32,000 82,000 8,400 9,600 10,800 10,800 Total units required 30,400 37,600 42,800 92,800 - Beginning inventory Budgeted production 2,600 8,400 9,600 2,600 90,200 27,800 29,200 33,200 January February March Quarter Budgeted production Standard DLH per unit 27,800 29,200 33,200 90,200 0.30 0.30 0.30 0.30 Total DLH required 8,340 8,760 9,960 27,060 Standard wage rate Budgeted DL cost $17 $460,020 $17 $17 $17 $141,780 $148,920 $169,320 He has identified the following monthly expenses that will be needed to support the company's manufacturing process. Fixed Overhead Variable Overhead per month per DLH Depreciation $33,000 Indirect materials 18,500 $1.20 Indirect labor 26,000 $0.20 Utilities 19,000 $0.15 Property taxes 4,300 Maintenance 4,000 $0.20 The company applies manufacturing overhead based on direct labor hours, and the current predetermined rates are $13.00 per direct labor hour for fixed manufacturing overhead and $1.75 per direct labor hour for variable manufacturing overhead. Prepare Oriole & Hill's manufacturing overhead budget for the first quarter. (Round per unit answers to 2 decimal places, e-g. 52.75 and all other answers to 0 decimal places, eg. 5,275.) January February March %24 %24 > > > >

Chapter7: Budgeting

Section: Chapter Questions

Problem 3PB: TIB makes custom guitars and prepared the following sales budget for the second quarter It also has...

Related questions

Question

100%

Question 7

Please fill in the blanks and explain.

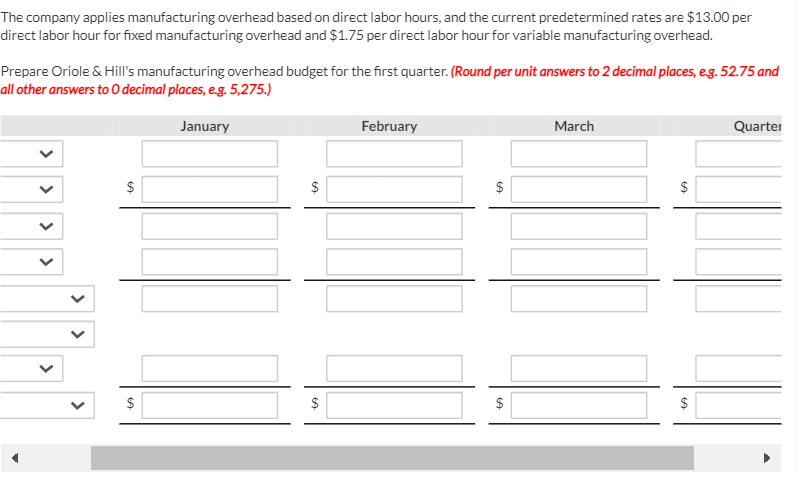

Transcribed Image Text:The company applies manufacturing overhead based on direct labor hours, and the current predetermined rates are $13.00 per

direct labor hour for fixed manufacturing overhead and $1.75 per direct labor hour for variable manufacturing overhead.

Prepare Oriole & Hill's manufacturing overhead budget for the first quarter. (Round per unit answers to 2 decimal places, eg. 52.75 and

all other answers to 0 decimal places, e.g. 5,275.)

January

February

March

Quarter

$

$

$

$

$

$

$

%24

%24

%24

%24

%24

>

>

>

>

>

>

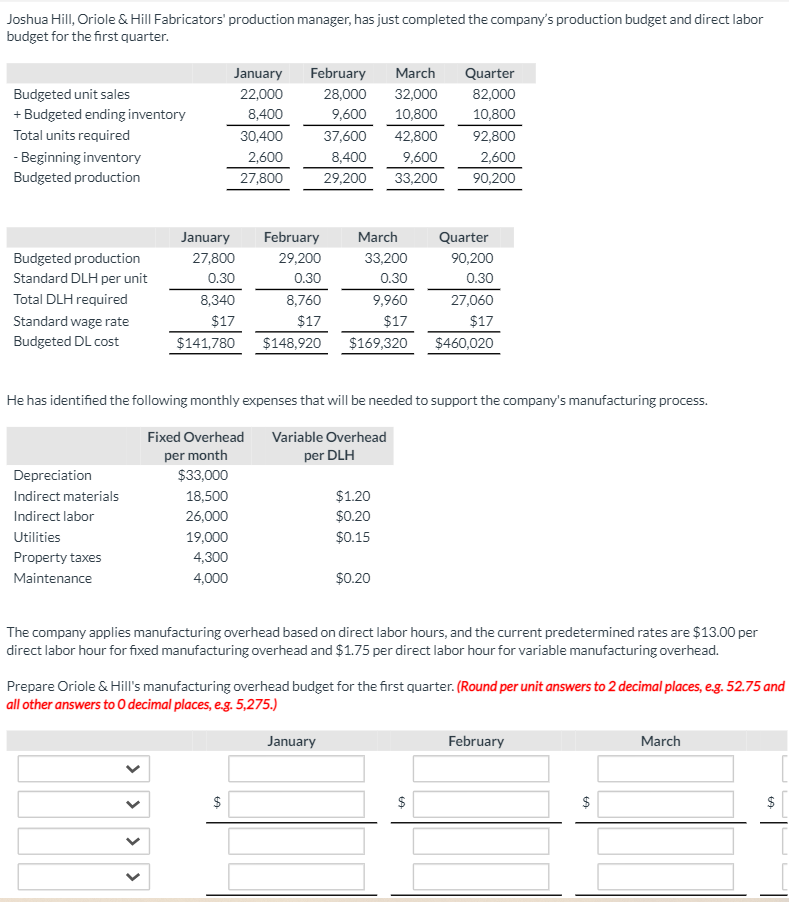

Transcribed Image Text:Joshua Hill, Oriole & Hill Fabricators' production manager, has just completed the company's production budget and direct labor

budget for the first quarter.

January

February

March

Quarter

Budgeted unit sales

22,000

28,000

32,000

82,000

+ Budgeted ending inventory

8,400

9,600

10,800

10,800

Total units required

30,400

37,600

42,800

92,800

- Beginning inventory

Budgeted production

2,600

8,400

9,600

2,600

27,800

29,200

33,200

90,200

January

February

March

Quarter

Budgeted production

27,800

29,200

33,200

90,200

Standard DLH per unit

0.30

0.30

0.30

0.30

Total DLH required

8,340

8,760

9,960

27,060

Standard wage rate

$17

$17

$17

$17

Budgeted DL cost

$141,780

$148,920

$169,320

$460,020

He has identified the following monthly expenses that will be needed to support the company's manufacturing process.

Fixed Overhead

Variable Overhead

per month

per DLH

Depreciation

$33,000

Indirect materials

18,500

$1.20

Indirect labor

26,000

$0.20

Utilities

19,000

$0.15

Property taxes

4,300

Maintenance

4,000

$0.20

The company applies manufacturing overhead based on direct labor hours, and the current predetermined rates are $13.00 per

direct labor hour for fixed manufacturing overhead and $1.75 per direct labor hour for variable manufacturing overhead.

Prepare Oriole & Hill's manufacturing overhead budget for the first quarter. (Round per unit answers to 2 decimal places, eg. 52.75 and

all other answers to 0 decimal places, e.g. 5,275.)

January

February

March

$

$

$

%24

%24

%24

%24

>

>

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,