Robert Williams, Marigold & Michael Fabricators' budget director, has received budget information from several managers and is preparing the company's cash budget. January February March Quarter Collections from sales 477,200 560,860 637,720 1,675,780 Payments for direct materials 80,505 253,125 274,730 608,360 Payments for direct labor 98,640 103,680 116,640 318,960 Payments for manufacturing overheads 78,490 78,980 80,240 237,710 Payments for Selling & administrative expenses 111,400 116,440 123,160 351,000 In addition to the information he received from these managers, Robert knows the following: Marigold & Michael plans to have $32,400 in its cash account on January 1 Marigold & Michael plans to purchase and pay cash for a piece of land in January at a cost of $86,000. Marigold & Michael plans to make a cash purchase of equipment in March at a cost of $31,000. Marigold &. Michael's income taxes from last quarter totaling $26,400 will be paid in January. Marigold & Michael is required to maintain a minimum cash balance of $50,000 in its account at First National Bank. Marigold & Michael has negotiated with the First National Bank to provide a $175,000 line of credit that can be borrowed against in $1,000 increments on the first day of the month. Any repayments on the line of credit must also be made in $1,000 increments and are made on the last day of the month when cash is available. The annual interest rate on this line of credit is 6%. Any tỉme a principal payment is made, all accrued interest to date is repaid.

Robert Williams, Marigold & Michael Fabricators' budget director, has received budget information from several managers and is preparing the company's cash budget. January February March Quarter Collections from sales 477,200 560,860 637,720 1,675,780 Payments for direct materials 80,505 253,125 274,730 608,360 Payments for direct labor 98,640 103,680 116,640 318,960 Payments for manufacturing overheads 78,490 78,980 80,240 237,710 Payments for Selling & administrative expenses 111,400 116,440 123,160 351,000 In addition to the information he received from these managers, Robert knows the following: Marigold & Michael plans to have $32,400 in its cash account on January 1 Marigold & Michael plans to purchase and pay cash for a piece of land in January at a cost of $86,000. Marigold & Michael plans to make a cash purchase of equipment in March at a cost of $31,000. Marigold &. Michael's income taxes from last quarter totaling $26,400 will be paid in January. Marigold & Michael is required to maintain a minimum cash balance of $50,000 in its account at First National Bank. Marigold & Michael has negotiated with the First National Bank to provide a $175,000 line of credit that can be borrowed against in $1,000 increments on the first day of the month. Any repayments on the line of credit must also be made in $1,000 increments and are made on the last day of the month when cash is available. The annual interest rate on this line of credit is 6%. Any tỉme a principal payment is made, all accrued interest to date is repaid.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 4PA: Budgeted income statement and supporting budgets for three months Bellaire Inc. gathered the...

Related questions

Question

Transcribed Image Text:January

February

March

Quarter

24

$

24

24

24

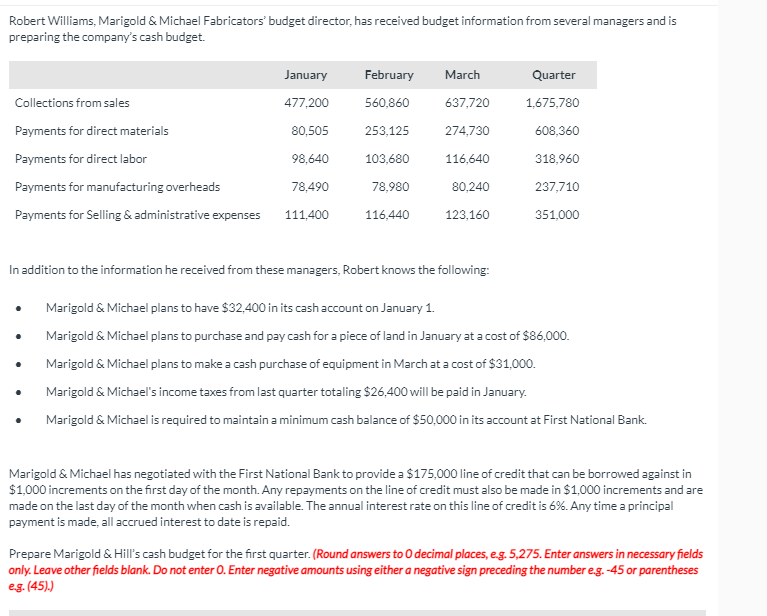

Transcribed Image Text:Robert Williams, Marigold & Michael Fabricators' budget director, has received budget information from several managers and is

preparing the company's cash budget.

January

February

March

Quarter

Collections from sales

477,200

560,860

637,720

1,675,780

Payments for direct materials

80,505

253,125

274,730

608,360

Payments for direct labor

98,640

103,680

116,640

318,960

Payments for manufacturing overheads

78,490

78,980

80,240

237,710

Payments for Selling & administrative expenses

111,400

116,440

123,160

351,000

In addition to the information he received from these managers, Robert knows the following:

Marigold & Michael plans to have $32,400 in its cash account on January 1.

Marigold & Michael plans to purchase and pay cash for a piece of land in January at a cost of $86,000.

Marigold & Michael plans to make a cash purchase of equipment in March at a cost of $31,000.

Marigold & Michael's income taxes from last quarter totaling $26,400 will be paid in January.

Marigold & Michael is required to maintain a minimum cash balance of $50,000 in its account at First National Bank.

Marigold & Michael has negotiated with the First National Bank to provide a $175,000 line of credit that can be borrowed against in

$1,000 increments on the first day of the month. Any repayments on the line of credit must also be made in $1,000 increments and are

made on the last day of the month when cash is available. The annual interest rate on this line of credit is 6%. Any time a principal

payment is made, all accrued interest to date is repaid.

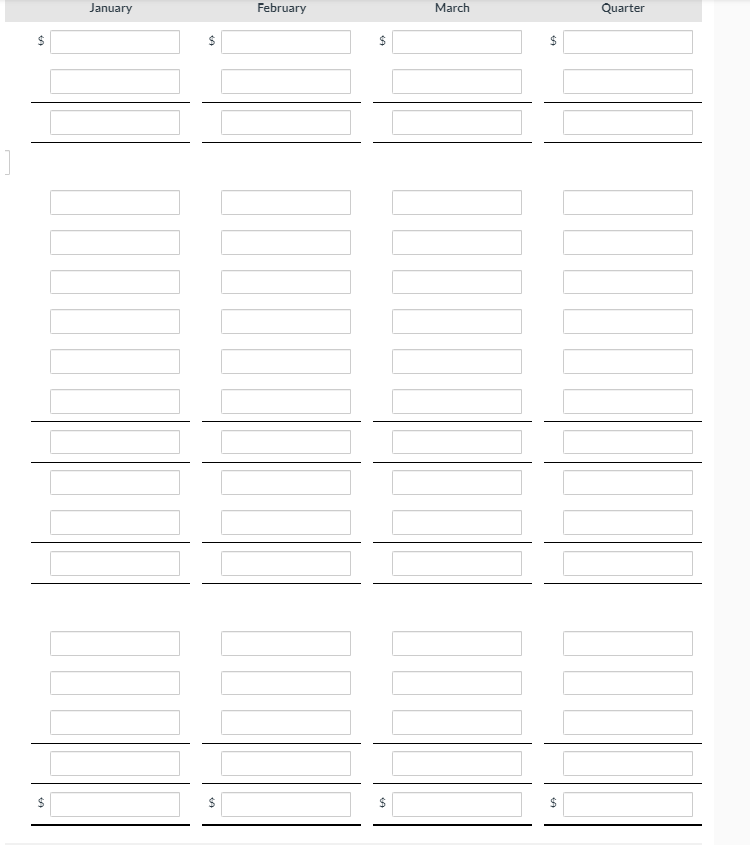

Prepare Marigold & Hill's cash budget for the first quarter. (Round answers to 0 decimal places, e.g. 5,275. Enter answers in necessary fields

only. Leave other fields blank. Do not enter 0. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses

eg. (45).)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College