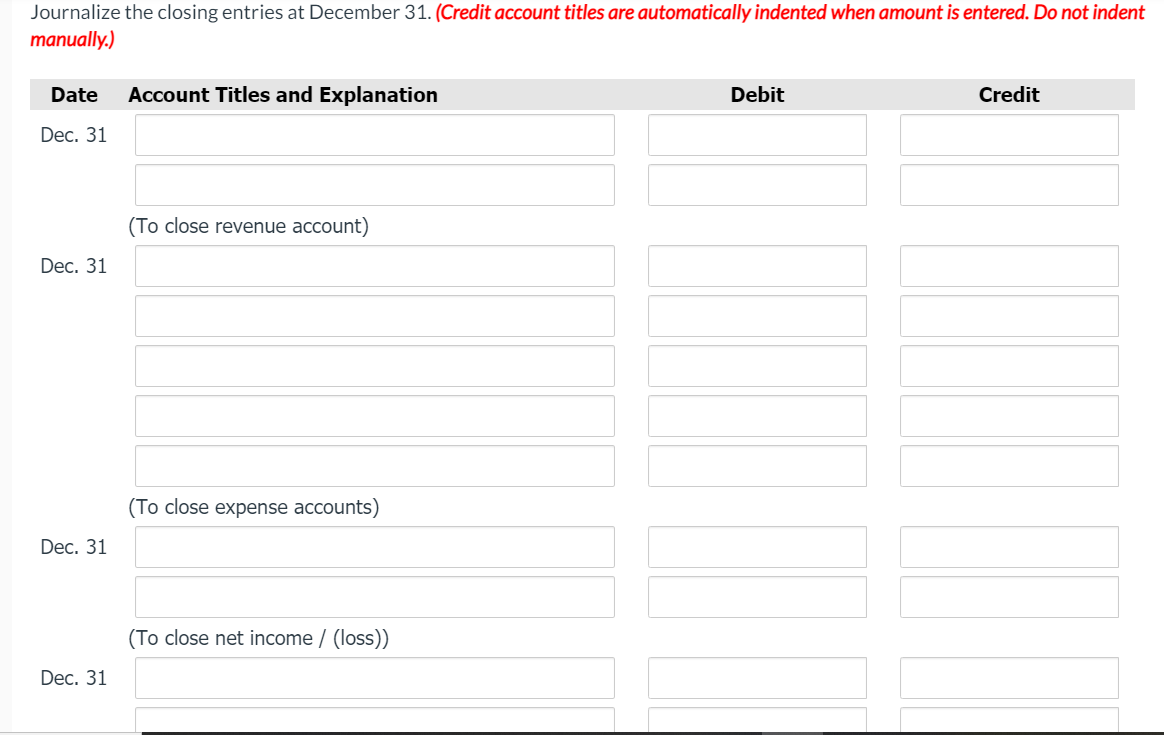

Journalize the closing entries at December 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 (To close revenue account) Dec. 31 (To close expense accounts) Dec. 31 (To close net income / (loss)) Dec. 31

Journalize the closing entries at December 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 (To close revenue account) Dec. 31 (To close expense accounts) Dec. 31 (To close net income / (loss)) Dec. 31

Chapter5: Completing The Accounting Cycle

Section: Chapter Questions

Problem 3PB: The following selected accounts and normal balances existed at year-end. Notice that expenses exceed...

Related questions

Topic Video

Question

Sheridan Company shows the following balances in selected accounts of its adjusted

|

Supplies

|

$30,900 |

Service Revenue

|

$116,000 | |||

|---|---|---|---|---|---|---|

|

Supplies Expense

|

5,100 |

Salaries and Wages Expense

|

36,000 | |||

|

|

11,600 |

Utilities Expense

|

8,700 | |||

|

Owner’s Drawings

|

23,000 |

Rent Expense

|

18,300 | |||

|

Owner’s Capital

|

74,000 |

List of Accounts

- Accounts Payable

- Accounts Receivable

- Accumulated

Depreciation -Buildings - Accumulated Depreciation-Equipment

- Accumulated Depreciation-Delivery Trucks

- Advertising Expense

- Buildings

- Cash

- Debt Investments

- Delivery Trucks

- Depreciation Expense

- Equipment

- Gasoline Expense

- Income Summary

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Long-term Debt

- Long-term Investments

- Maintenance and Repairs Expense

- Miscellaneous Expense

- Mortgage Payable

- Notes Payable

- Owner's Capital

- Owner's Drawings

- Patent Needs

- Prepaid Insurance

- Prepaid Rent

- Rent Expense

- Rent Revenue

- Salaries and Wages Expense

- Salaries and Wages Payable

- Service Revenue

- Short-Term Investments

- Stock Investments

- Supplies

- Supplies Expense

- Ticket Revenue

- Unearned Rent Revenue

- Unearned Service Revenue

- Utilities Expense

Transcribed Image Text:Journalize the closing entries at December 31. (Credit account titles are automatically indented when amount is entered. Do not indent

manually.)

Date

Account Titles and Explanation

Debit

Credit

Dec. 31

(To close revenue account)

Dec. 31

(To close expense accounts)

Dec. 31

(To close net income / (loss))

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub