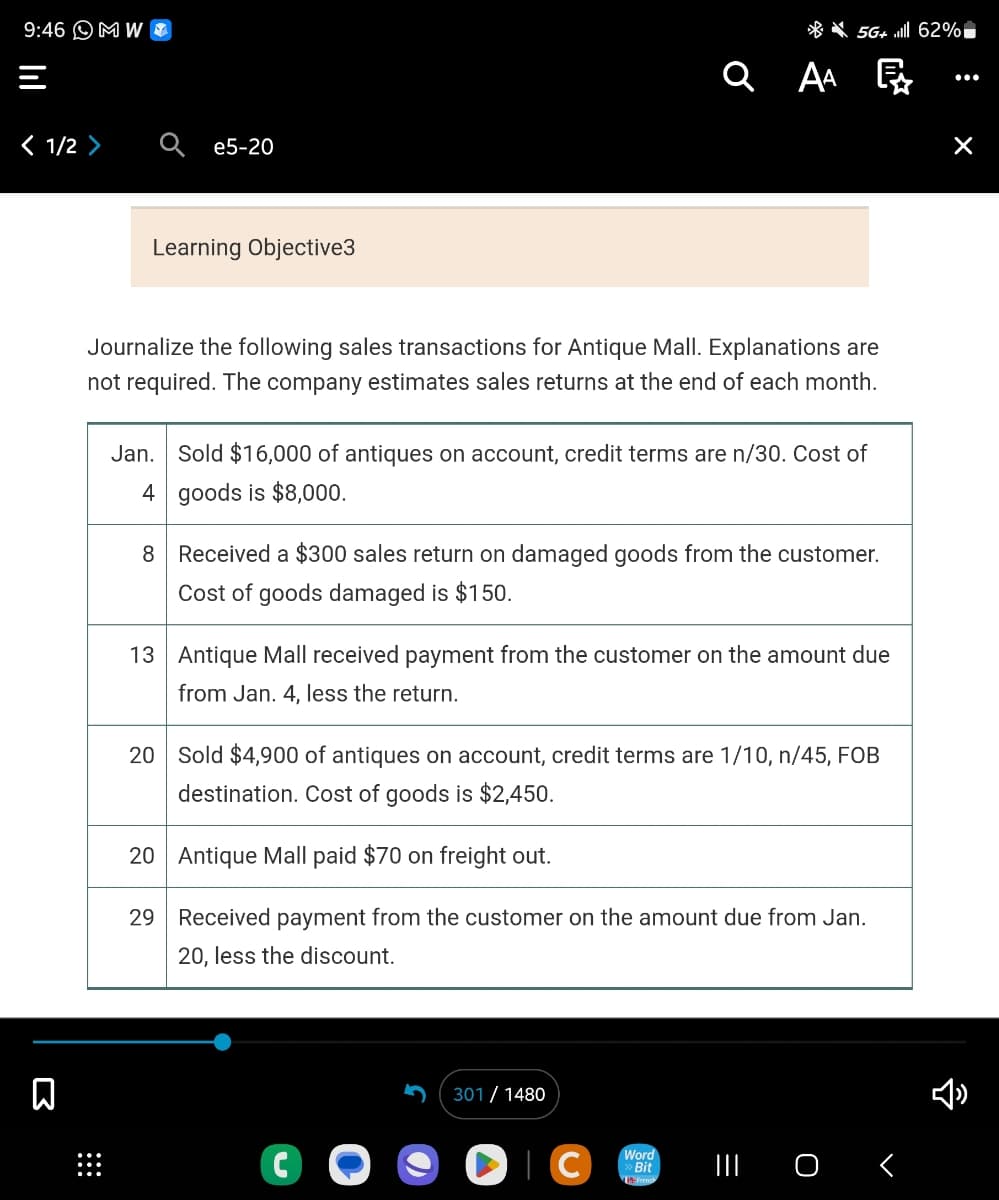

Journalize the following sales transactions for Antique Mall. Explanations are not required. The company estimates sales returns at the end of each month. Jan. Sold $16,000 of antiques on account, credit terms are n/30. Cost of 4 goods is $8,000. 8 Received a $300 sales return on damaged goods from the customer. Cost of goods damaged is $150. 13 Antique Mall received payment from the customer on the amount due from Jan. 4, less the return. 20 Sold $4,900 of antiques on account, credit terms are 1/10, n/45, FOB destination. Cost of goods is $2,450. 20 Antique Mall paid $70 on freight out. 29 Received payment from the customer on the amount due from Jan. 20, less the discount.

Journalize the following sales transactions for Antique Mall. Explanations are not required. The company estimates sales returns at the end of each month. Jan. Sold $16,000 of antiques on account, credit terms are n/30. Cost of 4 goods is $8,000. 8 Received a $300 sales return on damaged goods from the customer. Cost of goods damaged is $150. 13 Antique Mall received payment from the customer on the amount due from Jan. 4, less the return. 20 Sold $4,900 of antiques on account, credit terms are 1/10, n/45, FOB destination. Cost of goods is $2,450. 20 Antique Mall paid $70 on freight out. 29 Received payment from the customer on the amount due from Jan. 20, less the discount.

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter5: Accounting For Retailing Businesses

Section: Chapter Questions

Problem 5.41EX: Appendix Cost of goods sold and related items The following data were extracted from the accounting...

Related questions

Question

Transcribed Image Text:9:46 MW

< 1/2 >

Σ

e5-20

Learning Objective3

Journalize the following sales transactions for Antique Mall. Explanations are

not required. The company estimates sales returns at the end of each month.

Jan. Sold $16,000 of antiques on account, credit terms are n/30. Cost of

4 goods is $8,000.

8

QAA

Received a $300 sales return on damaged goods from the customer.

Cost of goods damaged is $150.

5G+ lll 62%

Ę

13 Antique Mall received payment from the customer on the amount due

from Jan. 4, less the return.

C

20 Sold $4,900 of antiques on account, credit terms are 1/10, n/45, FOB

destination. Cost of goods is $2,450.

20

Antique Mall paid $70 on freight out.

29

Received payment from the customer on the amount due from Jan.

20, less the discount.

301/ 1480

►C

Word

Bit

||| 0 <

:

×

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning