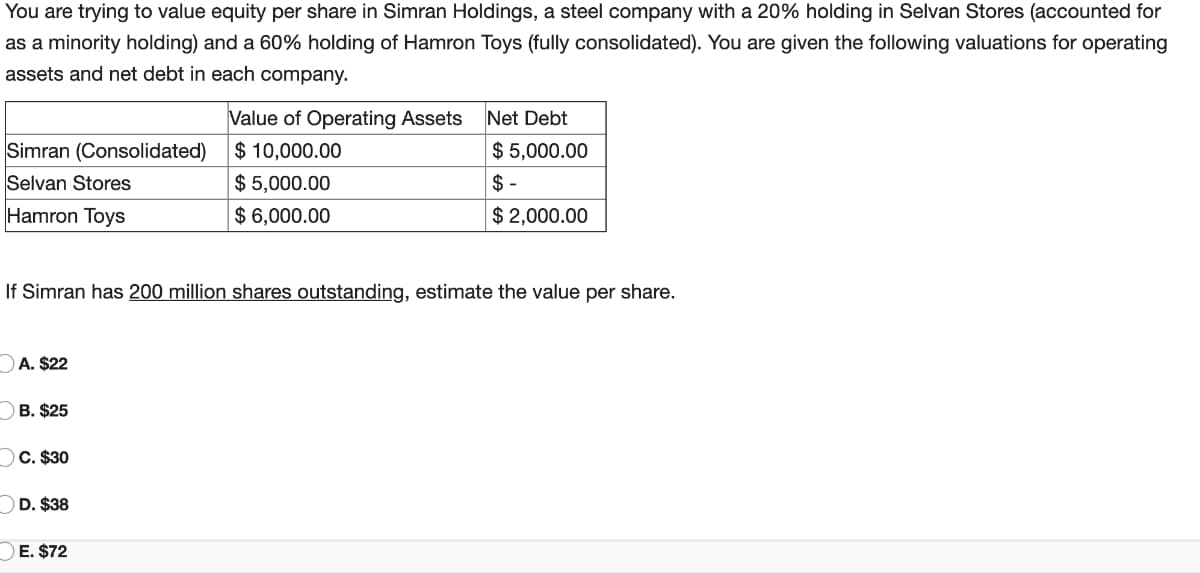

You are trying to value equity per share in Simran Holdings, a steel company with a 20% holding in Selvan Stores (accounted for as a minority holding) and a 60% holding of Hamron Toys (fully consolidated). You are given the following valuations for operating assets and net debt in each company. Simran (Consolidated) Selvan Stores Hamron Toys A. $22 B. $25 If Simran has 200 million shares outstanding, estimate the value per share. C. $30 D. $38 Value of Operating Assets $10,000.00 $5,000.00 $6,000.00 E. $72 Net Debt $5,000.00 $- $ 2,000.00

You are trying to value equity per share in Simran Holdings, a steel company with a 20% holding in Selvan Stores (accounted for as a minority holding) and a 60% holding of Hamron Toys (fully consolidated). You are given the following valuations for operating assets and net debt in each company. Simran (Consolidated) Selvan Stores Hamron Toys A. $22 B. $25 If Simran has 200 million shares outstanding, estimate the value per share. C. $30 D. $38 Value of Operating Assets $10,000.00 $5,000.00 $6,000.00 E. $72 Net Debt $5,000.00 $- $ 2,000.00

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter18: Initial Public Offerings, Investment Banking, And Capital Formation

Section: Chapter Questions

Problem 9MC

Related questions

Question

Transcribed Image Text:You are trying to value equity per share in Simran Holdings, a steel company with a 20% holding in Selvan Stores (accounted for

as a minority holding) and a 60% holding of Hamron Toys (fully consolidated). You are given the following valuations for operating

assets and net debt in each company.

Simran (Consolidated)

Selvan Stores

Hamron Toys

A. $22

B. $25

If Simran has 200 million shares outstanding, estimate the value per share.

C. $30

D. $38

Value of Operating Assets

$10,000.00

$5,000.00

$ 6,000.00

E. $72

Net Debt

$5,000.00

$-

$ 2,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning