"%, should the proposed discount be offered? (Not

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 5P

Related questions

Question

Dd.114.

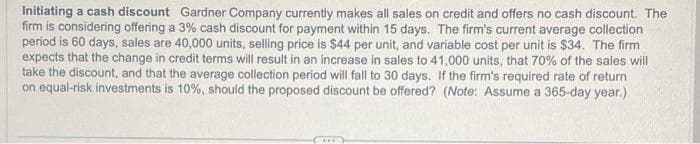

Transcribed Image Text:Initiating a cash discount Gardner Company currently makes all sales on credit and offers no cash discount. The

firm is considering offering a 3% cash discount for payment within 15 days. The firm's current average collection

period is 60 days, sales are 40,000 units, selling price is $44 per unit, and variable cost per unit is $34. The firm

expects that the change in credit terms will result in an increase in sales to 41,000 units, that 70% of the sales will

take the discount, and that the average collection period will fall to 30 days. If the firm's required rate of return

on equal-risk investments is 10%, should the proposed discount be offered? (Note: Assume a 365-day year.).

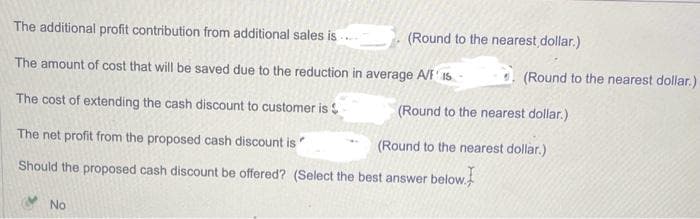

Transcribed Image Text:The additional profit contribution from additional sales is

The amount of cost that will be saved due to the reduction in average A/F IS

The cost of extending the cash discount to customer is $

The net profit from the proposed cash discount is

Should the proposed cash discount be offered? (Select the best answer below.

No

(Round to the nearest dollar.)

(Round to the nearest dollar.)

(Round to the nearest dollar.)

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning