Journalize the September transactions.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following...

Related questions

Question

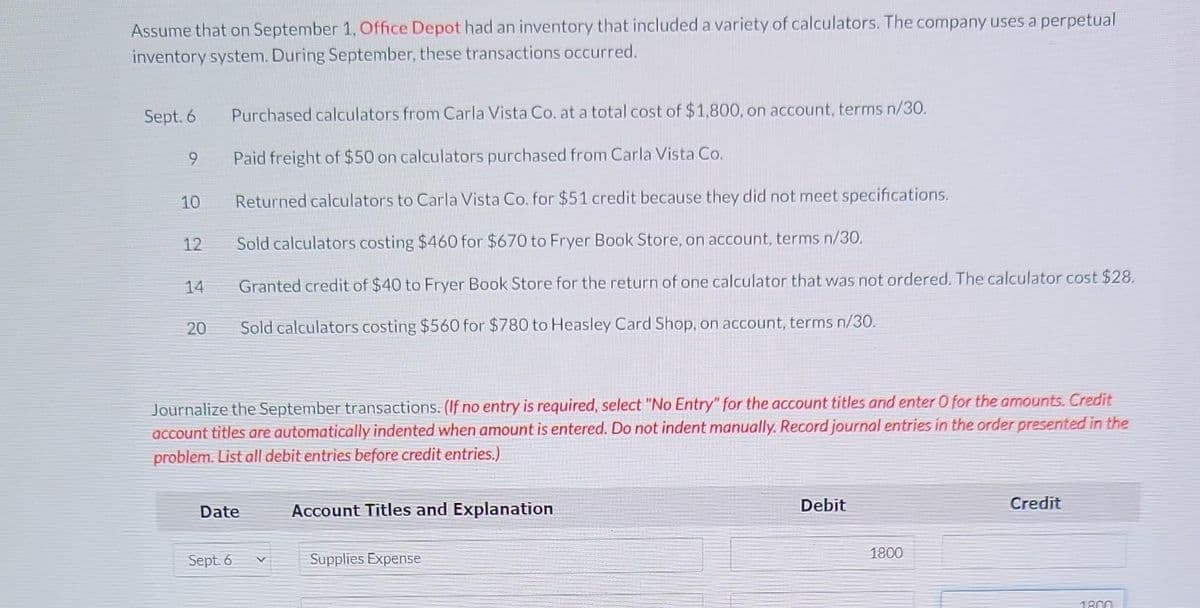

Transcribed Image Text:Assume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual

inventory system. During September, these transactions occurred.

Sept. 6

9

10

12

14

20

Purchased calculators from Carla Vista Co. at a total cost of $1,800, on account, terms n/30.

Paid freight of $50 on calculators purchased from Carla Vista Co.

Returned calculators to Carla Vista Co. for $51 credit because they did not meet specifications.

Sold calculators costing $460 for $670 to Fryer Book Store, on account, terms n/30.

Granted credit of $40 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $28.

Sold calculators costing $560 for $780 to Heasley Card Shop, on account, terms n/30.

Journalize the September transactions. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit

account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the

problem. List all debit entries before credit entries.)

Date

Sept. 6

Account Titles and Explanation

Supplies Expense

Debit

1800

Credit

1800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage