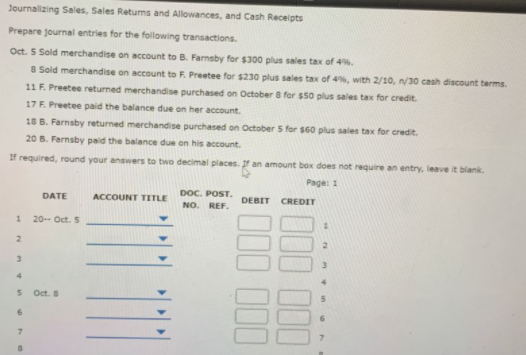

Journalizing Sales, Sales Returms and Allowances, and Cash Receipts Prepare journal entries for the following transactions. Oct. 5 Sold merchandise on account to B. Farnsby for $300 plus sales tax of 4%. 8 Sold merchandise on account to F. Preetee for $230 plus sales tax of 4%, with 2/10, /30 cash discount terms. 11 F. Preetee returned merchandise purchased on October 8 for $50 plus sales tax for credit. 17 F. Preetee paid the balance due on her account. 18 B. Farnsby returned merchandise purchased on October 5 for $60 plus sales tax for credit. 20 B. Farnsby paid the balance due on his account. If required, round your answers to two decimal places. an amount box does not require an entry, leave it blank. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- Oct. 5 4. Oct. 8 000 000

Journalizing Sales, Sales Returms and Allowances, and Cash Receipts Prepare journal entries for the following transactions. Oct. 5 Sold merchandise on account to B. Farnsby for $300 plus sales tax of 4%. 8 Sold merchandise on account to F. Preetee for $230 plus sales tax of 4%, with 2/10, /30 cash discount terms. 11 F. Preetee returned merchandise purchased on October 8 for $50 plus sales tax for credit. 17 F. Preetee paid the balance due on her account. 18 B. Farnsby returned merchandise purchased on October 5 for $60 plus sales tax for credit. 20 B. Farnsby paid the balance due on his account. If required, round your answers to two decimal places. an amount box does not require an entry, leave it blank. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- Oct. 5 4. Oct. 8 000 000

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter10: Accounting For Sales And Cash Receipts

Section: Chapter Questions

Problem 2CE: Prepare journal entries for the following sales and cash receipts transactions. (a) Merchandise is...

Related questions

Question

Transcribed Image Text:Journalizing Sales, Sales Returms and Allowances, and Cash Receipts

Prepare journal entries for the following transactions.

Oct. 5 Sold merchandise on account to B. Farnsby for $300 plus sales tax of 4%.

8 Sold merchandise on account to F. Preetee for $230 plus sales tax of 4%, with 2/10, /30 cash discount terms.

11 F. Preetee returned merchandise purchased on October 8 for $50 plus sales tax for credit.

17 F. Preetee paid the balance due on her account.

18 B. Farnsby returned merchandise purchased on October 5 for $60 plus sales tax for credit.

20 B. Farnsby paid the balance due on his account.

If required, round your answers to two decimal places. an amount box does not require an entry, leave it blank.

Page: 1

DOC. POST.

NO. REF.

DATE

ACCOUNT TITLE

DEBIT

CREDIT

20-- Oct. 5

4.

Oct. 8

000 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub