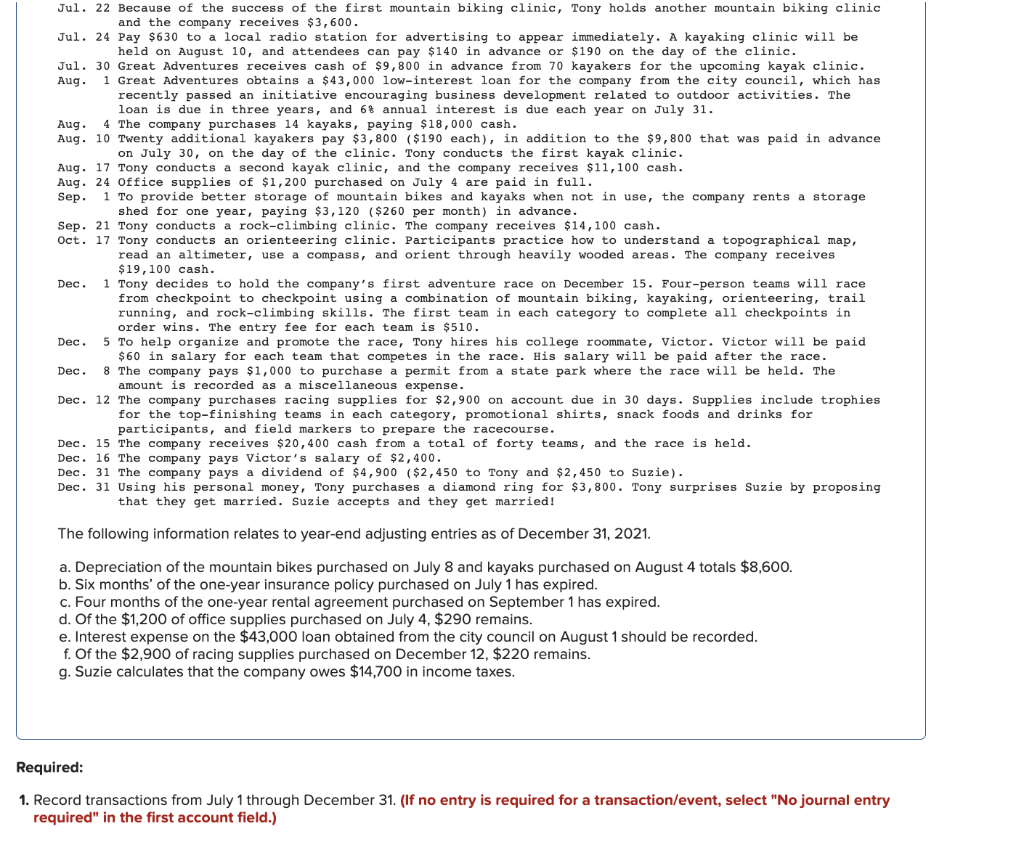

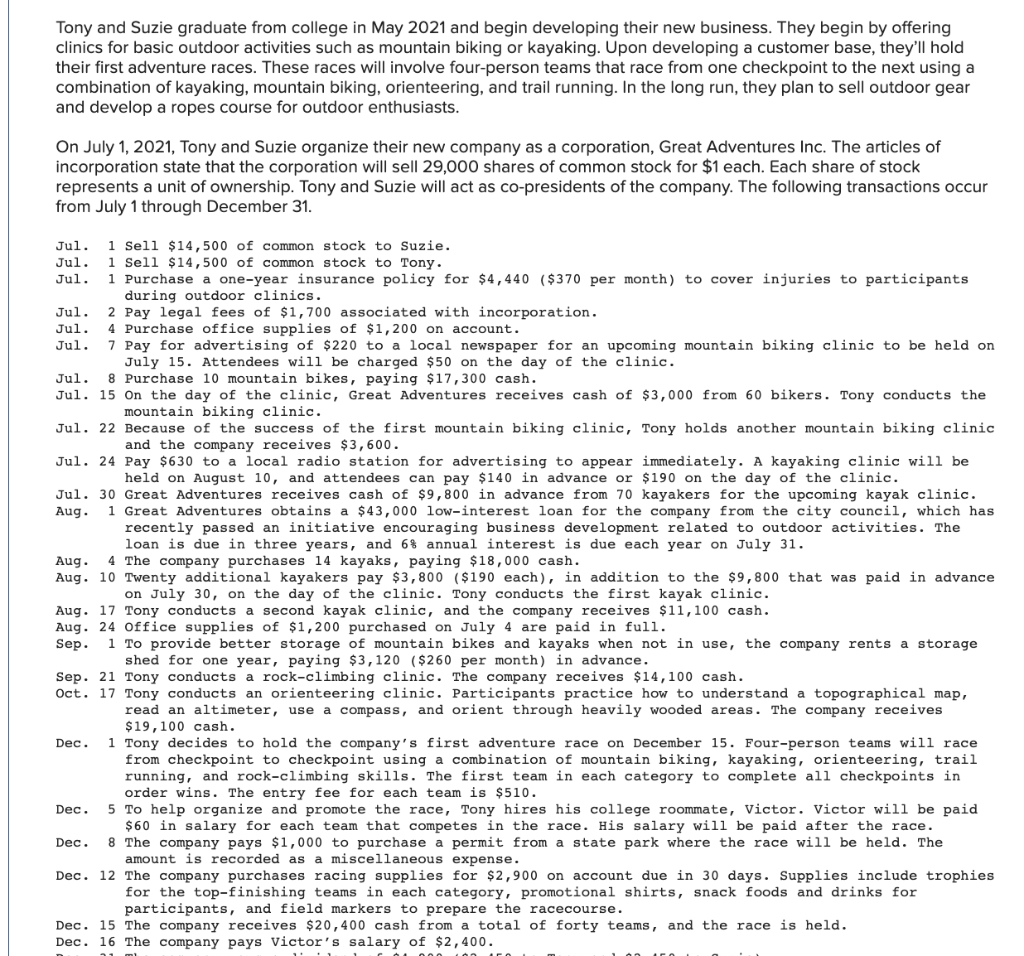

Jul. 22 Because of the success of the first mountain biking clinic, Tony holds another mountain biking clinic and the company receives $3,600. Jul. 24 Pay $630 to a local radio station for advertising to appear immediately. A kayaking clinic will be held on August 10, and attendees can pay $140 in advance or $190 on the day of the clinic. Jul. 30 Great Adventures receives cash of $9,800 in advance from 70 kayakers for the upcoming kayak clinic. Aug. 1 Great Adventures obtains a $43,000 low-interest loan for the company from the city council, which has recently passed an initiative encouraging business development related to outdoor activities. The loan is due in three years, and 6% annual interest is due each year on July 31. Aug. 4 The company purchases 14 kayaks, paying $18,000 cash. Aug. 10 Twenty additional kayakers pay $3,800 ($190 each), in addition to the $9,800 that was paid in advance on July 30, on the day of the clinic. Tony conducts the first kayak clinic. Aug. 17 Tony conducts a second kayak clinic, and the company receives $11,100 cash. Aug. 24 Office supplies of $1,200 purchased on July 4 are paid in full. Sep. 1 To provide better storage of mountain bikes and kayaks when not in use, the company rents a storage shed for one year, paying $3,120 ($260 per month) in advance. Sep. 21 Tony conducts a rock-climbing clinic. The company receives $14,100 cash. Oct. 17 Tony conducts an orienteering clinic. Participants practice how to understand a topographical map, read an altimeter, use a compass, and orient through heavily wooded areas. The company receives $19,100 cash. Dec. 1 Tony decides to hold the company's first adventure race on December 15. Four-person teams will race from checkpoint to checkpoint using a combination of mountain biking, kayaking, orienteering, trail running, and rock-climbing skills. The first team in each category to complete all checkpoints in order wins. The entry fee for each team is $510. Dec. 5 To help organize and promote the race, Tony hires his college roommate, Victor. Victor will be paid $60 in salary for each team that competes in the race. His salary will be paid after the race. Dec. 8 The company pays $1,000 to purchase a permit from a state park where the race will be held. The amount is recorded as a miscellaneous expense. Dec. 12 The company purchases racing supplies for $2,900 on account due in 30 days. Supplies include trophies for the top-finishing teams in each category, promotional shirts, snack foods and drinks for participants, and field markers to prepare the racecourse. Dec. 15 The company receives $20,400 cash from a total of forty teams, and the race is held. Dec. 16 The company pays Victor's salary of $2,400. Dec. 31 The company pays a dividend of $4,900 ($2,450 to Tony and $2,450 to Suzie). Dec. 31 Using his personal money, Tony purchases a diamond ring for $3,800. Tony surprises Suzie by proposing that they get married. Suzie accepts and they get married! The following information relates to year-end adjusting entries as of December 31, 2021. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $8,600. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,200 of office supplies purchased on July 4, $290 remains. e. Interest expense on the $43,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,900 of racing supplies purchased on December 12, $220 remains. g. Suzie calculates that the company owes $14,700 in income taxes. Required: 1. Record transactions from July 1 through December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Reporting Cash Flows

Reporting of cash flows means a statement of cash flow which is a financial statement. A cash flow statement is prepared by gathering all the data regarding inflows and outflows of a company. The cash flow statement includes cash inflows and outflows from various activities such as operating, financing, and investment. Reporting this statement is important because it is the main financial statement of the company.

Balance Sheet

A balance sheet is an integral part of the set of financial statements of an organization that reports the assets, liabilities, equity (shareholding) capital, other short and long-term debts, along with other related items. A balance sheet is one of the most critical measures of the financial performance and position of the company, and as the name suggests, the statement must balance the assets against the liabilities and equity. The assets are what the company owns, and the liabilities represent what the company owes. Equity represents the amount invested in the business, either by the promoters of the company or by external shareholders. The total assets must match total liabilities plus equity.

Financial Statements

Financial statements are written records of an organization which provide a true and real picture of business activities. It shows the financial position and the operating performance of the company. It is prepared at the end of every financial cycle. It includes three main components that are balance sheet, income statement and cash flow statement.

Owner's Capital

Before we begin to understand what Owner’s capital is and what Equity financing is to an organization, it is important to understand some basic accounting terminologies. A double-entry bookkeeping system Normal account balances are those which are expected to have either a debit balance or a credit balance, depending on the nature of the account. An asset account will have a debit balance as normal balance because an asset is a debit account. Similarly, a liability account will have the normal balance as a credit balance because it is amount owed, representing a credit account. Equity is also said to have a credit balance as its normal balance. However, sometimes the normal balances may be reversed, often due to incorrect journal or posting entries or other accounting/ clerical errors.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images