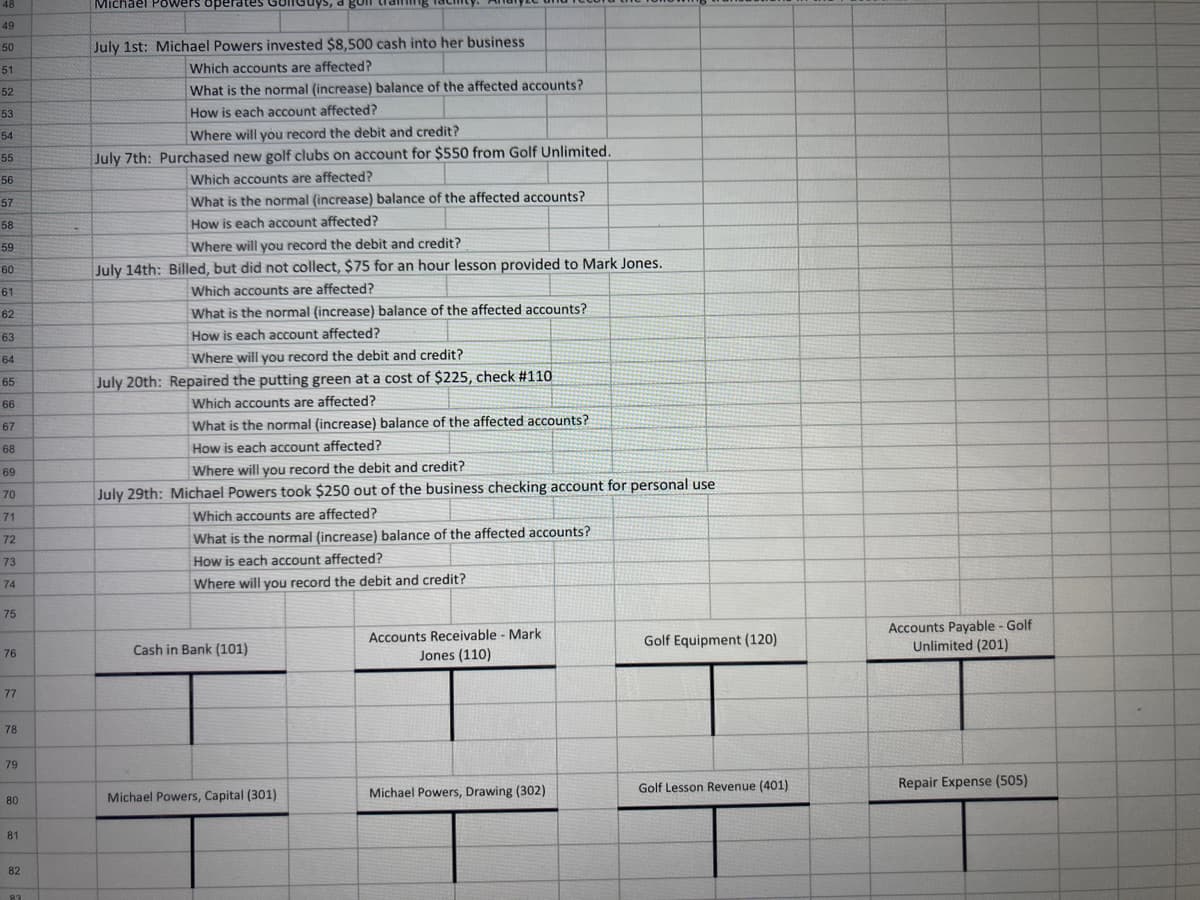

July 1st: Michael Powers invested $8,500 cash into her business Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit? July 7th: Purchased new golf clubs on account for $550 from Golf Unlimited. Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit? July 14th: Billed, but did not collect, $75 for an hour lesson provided to Mark Jones. Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit? July 20th: Repaired the putting green at a cost of $225, check #110 Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit? July 29th: Michael Powers took $250 out of the business checking account for personal use Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit?

July 1st: Michael Powers invested $8,500 cash into her business Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit? July 7th: Purchased new golf clubs on account for $550 from Golf Unlimited. Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit? July 14th: Billed, but did not collect, $75 for an hour lesson provided to Mark Jones. Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit? July 20th: Repaired the putting green at a cost of $225, check #110 Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit? July 29th: Michael Powers took $250 out of the business checking account for personal use Which accounts are affected? What is the normal (increase) balance of the affected accounts? How is each account affected? Where will you record the debit and credit?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter5: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 6CE

Related questions

Question

Answer the following questions.

Transcribed Image Text:48

Michael Powers operates

uys, d goil

49

50

July 1st: Michael Powers invested $8,500 cash into her business

51

Which accounts are affected?

52

What is the normal (increase) balance of the affected accounts?

53

How is each account affected?

54

Where will you record the debit and credit?

July 7th: Purchased new golf clubs on account for $550 from Golf Unlimited.

55

56

Which accounts are affected?

57

What is the normal (increase) balance of the affected accounts?

58

How is each account affected?

59

Where will you record the debit and credit?

60

July 14th: Billed, but did not collect, $75 for an hour lesson provided to Mark Jones.

61

Which accounts are affected?

62

What is the normal (increase) balance of the affected accounts?

63

How is each account affected?

64

Where will you record the debit and credit?

July 20th: Repaired the putting green at a cost of $225, check #110

65

66

Which accounts are affected?

67

What is the normal (increase) balance of the affected accounts?

68

How is each account affected?

69

Where will you record the debit and credit?

July 29th: Michael Powers took $250 out of the business checking account for personal use

70

71

Which accounts are affected?

72

What is the normal (increase) balance of the affected accounts?

73

How is each account affected?

74

Where will you record the debit and credit?

75

Accounts Payable - Golf

Unlimited (201)

Accounts Receivable - Mark

Golf Equipment (120)

76

Cash in Bank (101)

Jones (110)

77

78

79

Golf Lesson Revenue (401)

Repair Expense (505)

Michael Powers, Capital (301)

Michael Powers, Drawing (302)

80

81

82

83

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning