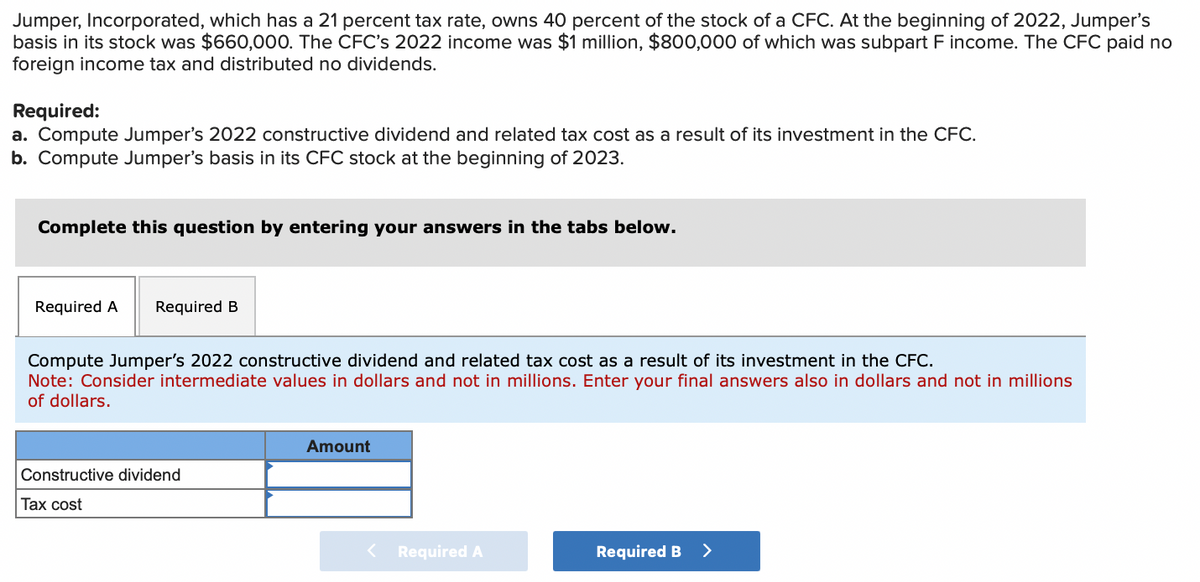

Jumper, Incorporated, which has a 21 percent tax rate, owns 40 percent of the stock of a CFC. At the beginning of 2022, Jumper's basis in its stock was $660,000. The CFC's 2022 income was $1 million, $800,000 of which was subpart F income. The CFC paid no foreign income tax and distributed no dividends. Required: a. Compute Jumper's 2022 constructive dividend and related tax cost as a result of its investment in the CFC. b. Compute Jumper's basis in its CFC stock at the beginning of 2023.

Jumper, Incorporated, which has a 21 percent tax rate, owns 40 percent of the stock of a CFC. At the beginning of 2022, Jumper's basis in its stock was $660,000. The CFC's 2022 income was $1 million, $800,000 of which was subpart F income. The CFC paid no foreign income tax and distributed no dividends. Required: a. Compute Jumper's 2022 constructive dividend and related tax cost as a result of its investment in the CFC. b. Compute Jumper's basis in its CFC stock at the beginning of 2023.

Chapter25: Taxation Of International Transact Ions

Section: Chapter Questions

Problem 12CE

Related questions

Question

Transcribed Image Text:Jumper, Incorporated, which has a 21 percent tax rate, owns 40 percent of the stock of a CFC. At the beginning of 2022, Jumper's

basis in its stock was $660,000. The CFC's 2022 income was $1 million, $800,000 of which was subpart F income. The CFC paid no

foreign income tax and distributed no dividends.

Required:

a. Compute Jumper's 2022 constructive dividend and related tax cost as a result of its investment in the CFC.

b. Compute Jumper's basis in its CFC stock at the beginning of 2023.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute Jumper's 2022 constructive dividend and related tax cost as a result of its investment in the CFC.

Note: Consider intermediate values in dollars and not in millions. Enter your final answers also in dollars and not in millions

of dollars.

Constructive dividend

Tax cost

Amount

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you