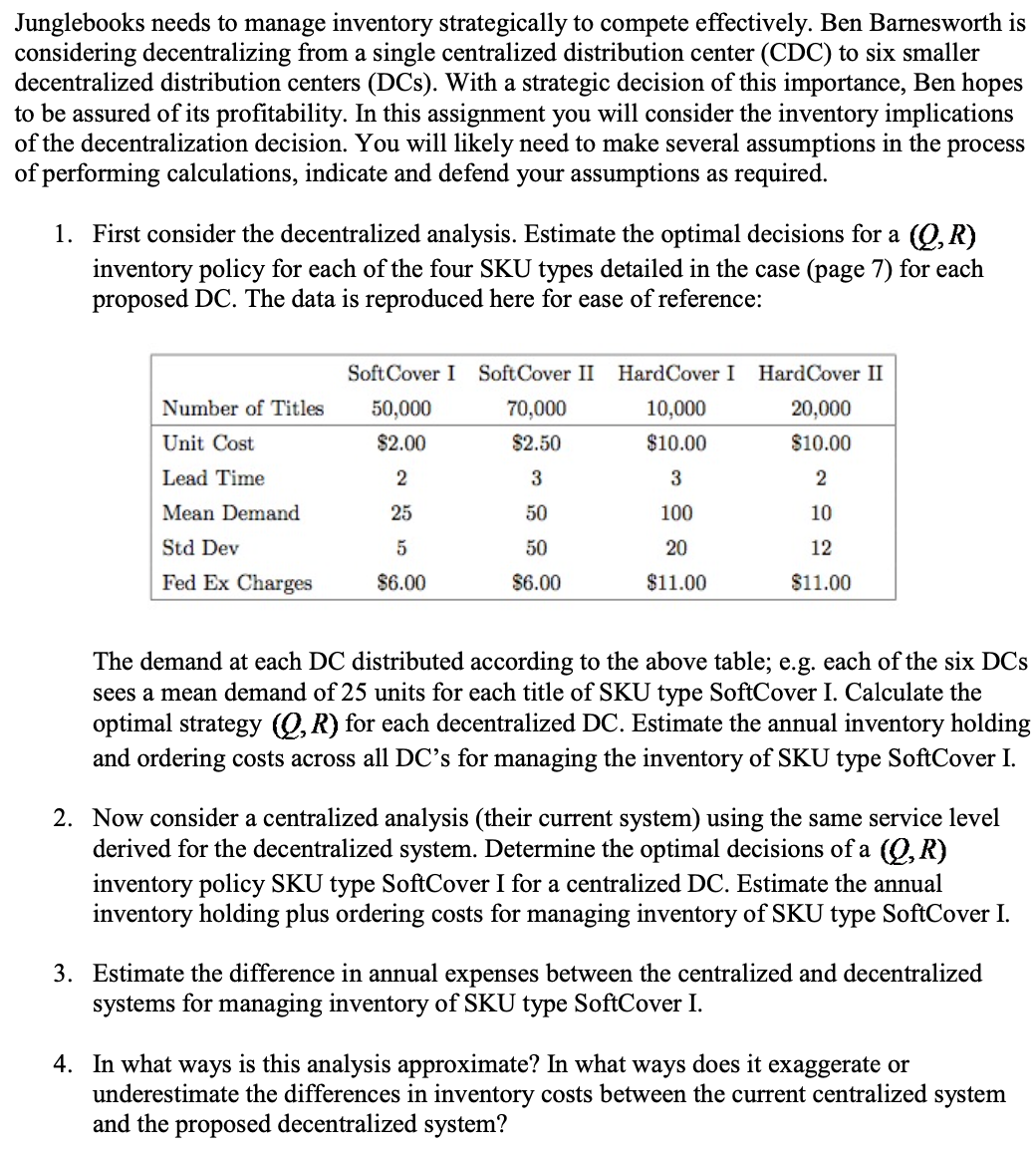

Junglebooks needs to manage inventory strategically to compete effectively. Ben Barnesworth is considering decentralizing from a single centralized distribution center (CDC) to six smaller decentralized distribution centers (DCs). With a strategic decision of this importance, Ben hopes to be assured of its profitability. In this assignment you will consider the inventory implications of the decentralization decision. You will likely need to make several assumptions in the process of performing calculations, indicate and defend your assumptions as required. 1. First consider the decentralized analysis. Estimate the optimal decisions for a (Q, R) inventory policy for each of the four SKU types detailed in the case (page 7) for each proposed DC. The data is reproduced here for ease of reference: Number of Titles Unit Cost Lead Time Mean Demand Std Dev Fed Ex Charges Soft Cover I Soft Cover II HardCover I HardCover II 70,000 10,000 20,000 $2.50 $10.00 $10.00 3 3 2 50 100 10 50 20 12 $6.00 $11.00 $11.00 50,000 $2.00 2 25 5 $6.00 The demand at each DC distributed according to the above table; e.g. each of the six DCs sees a mean demand of 25 units for each title of SKU type SoftCover I. Calculate the optimal strategy Q, R) for each decentralized DC. Estimate the annual inventory holding and ordering costs across all DC's for managing the inventory of SKU type SoftCover I. 2. Now consider a centralized analysis (their current system) using the same service level derived for the decentralized system. Determine the optimal decisions of a (Q, R) inventory policy SKU type SoftCover I for a centralized DC. Estimate the annual inventory holding plus ordering costs for managing inventory of SKU type SoftCover I.

Junglebooks needs to manage inventory strategically to compete effectively. Ben Barnesworth is considering decentralizing from a single centralized distribution center (CDC) to six smaller decentralized distribution centers (DCs). With a strategic decision of this importance, Ben hopes to be assured of its profitability. In this assignment you will consider the inventory implications of the decentralization decision. You will likely need to make several assumptions in the process of performing calculations, indicate and defend your assumptions as required. 1. First consider the decentralized analysis. Estimate the optimal decisions for a (Q, R) inventory policy for each of the four SKU types detailed in the case (page 7) for each proposed DC. The data is reproduced here for ease of reference: Number of Titles Unit Cost Lead Time Mean Demand Std Dev Fed Ex Charges Soft Cover I Soft Cover II HardCover I HardCover II 70,000 10,000 20,000 $2.50 $10.00 $10.00 3 3 2 50 100 10 50 20 12 $6.00 $11.00 $11.00 50,000 $2.00 2 25 5 $6.00 The demand at each DC distributed according to the above table; e.g. each of the six DCs sees a mean demand of 25 units for each title of SKU type SoftCover I. Calculate the optimal strategy Q, R) for each decentralized DC. Estimate the annual inventory holding and ordering costs across all DC's for managing the inventory of SKU type SoftCover I. 2. Now consider a centralized analysis (their current system) using the same service level derived for the decentralized system. Determine the optimal decisions of a (Q, R) inventory policy SKU type SoftCover I for a centralized DC. Estimate the annual inventory holding plus ordering costs for managing inventory of SKU type SoftCover I.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter11: Strategic Cost Management

Section: Chapter Questions

Problem 9E

Related questions

Question

Hi, previously I had asked questions one at a time so I'm sending all 4 since they all relate together but I'd appreiciate it if you could focus on #1 and 2. *These are not graded questions*

Transcribed Image Text:Junglebooks needs to manage inventory strategically to compete effectively. Ben Barnesworth is

considering decentralizing from a single centralized distribution center (CDC) to six smaller

decentralized distribution centers (DCs). With a strategic decision of this importance, Ben hopes

to be assured of its profitability. In this assignment you will consider the inventory implications

of the decentralization decision. You will likely need to make several assumptions in the

of performing calculations, indicate and defend your assumptions as required.

process

1. First consider the decentralized analysis. Estimate the optimal decisions for a (Q, R)

inventory policy for each of the four SKU types detailed in the case (page 7) for each

proposed DC. The data is reproduced here for ease of reference:

EITIT

Soft Cover I SoftCover II HardCover I HardCover II

Number of Titles

50,000

70,000

10,000

20,000

Unit Cost

$2.00

$2.50

$10.00

$10.00

Lead Time

2

3

3

2

Mean Demand

25

50

100

10

Std Dev

5

50

20

12

Fed Ex Charges

$6.00

$6.00

$11.00

$11.00

The demand at each DC distributed according to the above table; e.g. each of the six DCs

sees a mean demand of 25 units for each title of SKU type SoftCover I. Calculate the

optimal strategy (Q, R) for each decentralized DC. Estimate the annual inventory holding

and ordering costs across all DC's for managing the inventory of SKU type SoftCover I.

2. Now consider a centralized analysis (their current system) using the same service level

derived for the decentralized system. Determine the optimal decisions of a (Q, R)

inventory policy SKU type SoftCover I for a centralized DC. Estimate the annual

inventory holding plus ordering costs for managing inventory of SKU type SoftCover I.

3. Estimate the difference in annual expenses between the centralized and decentralized

systems for managing inventory of SKU type SoftCover I.

4. In what ways is this analysis approximate? In what ways does it exaggerate or

underestimate the differences in inventory costs between the current centralized system

and the proposed decentralized system?

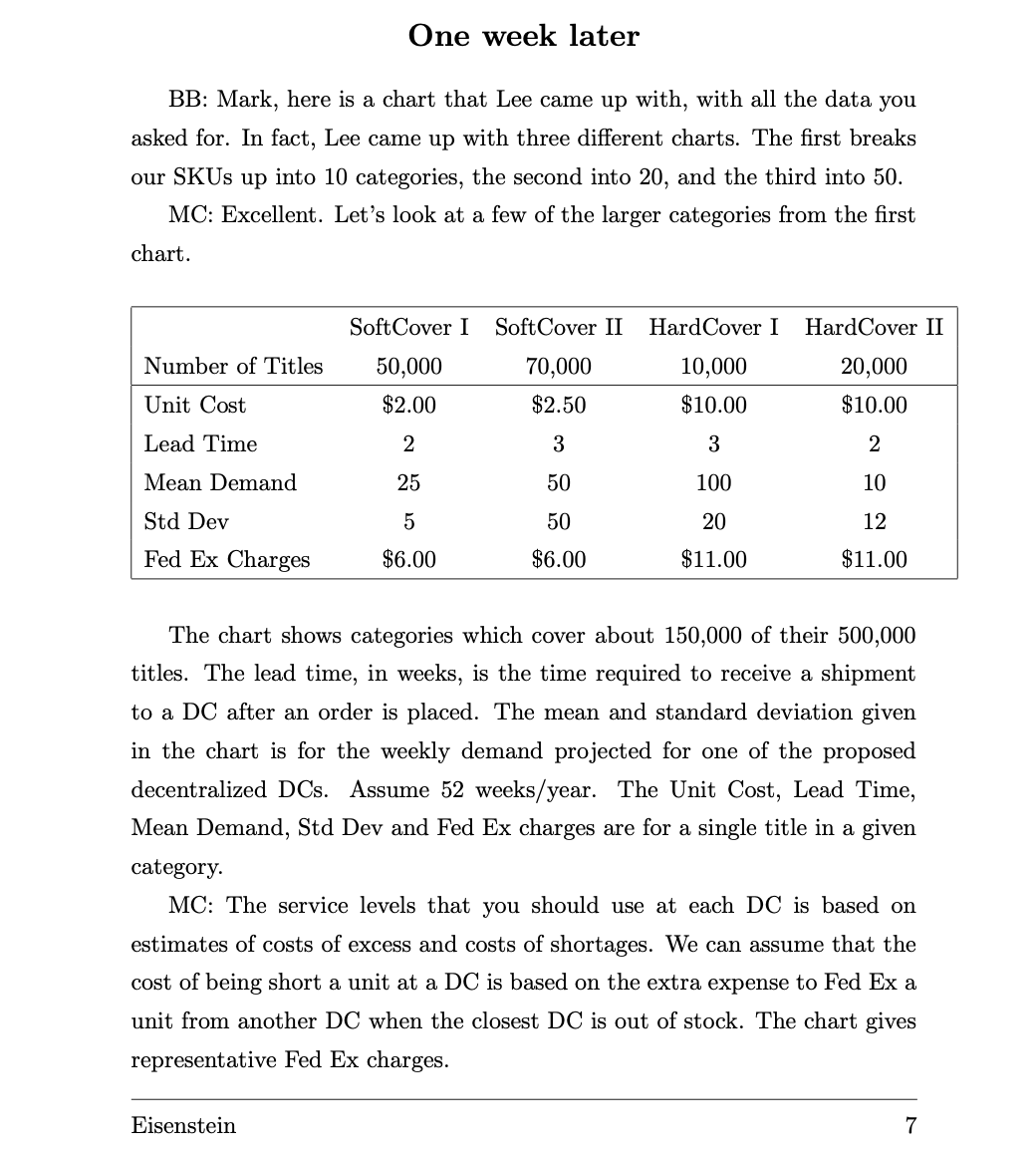

Transcribed Image Text:One week later

BB: Mark, here is a chart that Lee came up with, with all the data you

asked for. In fact, Lee came up with three different charts. The first breaks

our SKUS up into 10 categories, the second into 20, and the third into 50.

MC: Excellent. Let's look at a few of the larger categories from the first

chart.

SoftCover I

SoftCover II

HardCover I

HardCover II

Number of Titles

50,000

70,000

10,000

20,000

Unit Cost

$2.00

$2.50

$10.00

$10.00

Lead Time

2

3

3

2

Mean Demand

25

50

100

10

Std Dev

50

20

12

Fed Ex Charges

$6.00

$6.00

$11.00

$11.00

The chart shows categories which cover about 150,000 of their 500,000

titles. The lead time, in weeks, is the time required to receive a shipment

to a DC after an order is placed. The mean and standard deviation given

in the chart is for the weekly demand projected for one of the proposed

decentralized DCs. Assume 52 weeks/year. The Unit Cost, Lead Time,

Mean Demand, Std Dev and Fed Ex charges are for a single title in a given

category.

MC: The service levels that you should use at each DC is based on

estimates of costs of excess and costs of shortages. We can assume that the

cost of being short a unit at a DC is based on the extra expense to Fed Ex a

unit from another DC when the closest DC is out of stock. The chart gives

representative Fed Ex charges.

Eisenstein

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning