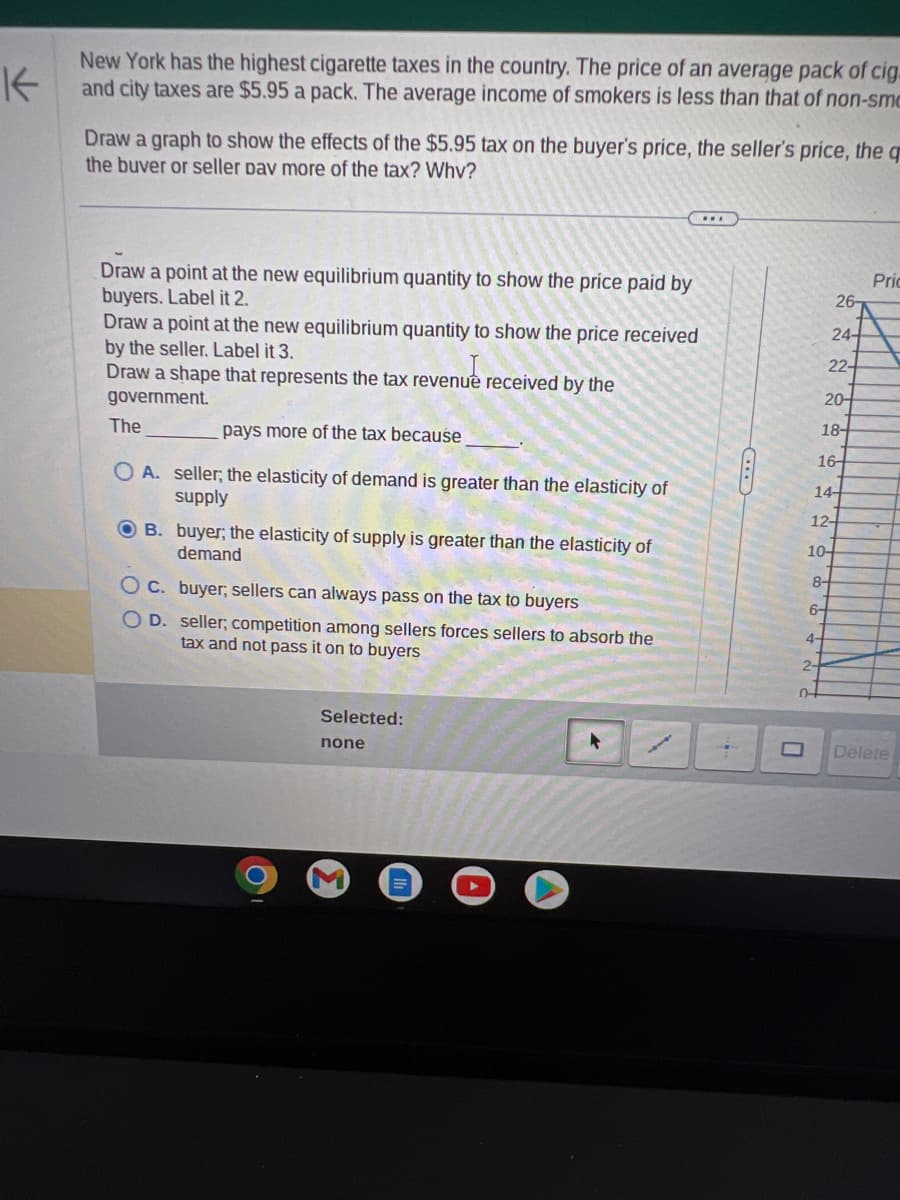

K New York has the highest cigarette taxes in the country. The price of an average pack of cig. and city taxes are $5.95 a pack. The average income of smokers is less than that of non-smo Draw a graph to show the effects of the $5.95 tax on the buyer's price, the seller's price, the q the buver or seller pay more of the tax? Why? Draw a point at the new equilibrium quantity to show the price paid by buyers. Label it 2. Draw a point at the new equilibrium quantity to show the price received by the seller. Label it 3. Draw a shape that represents the tax revenue received by the government. The pays more of the tax because OA. seller; the elasticity of demand is greater than the elasticity of supply OB. buyer; the elasticity of supply is greater than the elasticity of demand O c. buyer; sellers can always pass on the tax to buyers OD. seller, competition among sellers forces sellers to absorb the tax and not pass it on to buyers Selected: none 6- 4- 16- 14- 12- 10- 8- 2- 0 26- 24- 22- 20- 18- Pric Delete

K New York has the highest cigarette taxes in the country. The price of an average pack of cig. and city taxes are $5.95 a pack. The average income of smokers is less than that of non-smo Draw a graph to show the effects of the $5.95 tax on the buyer's price, the seller's price, the q the buver or seller pay more of the tax? Why? Draw a point at the new equilibrium quantity to show the price paid by buyers. Label it 2. Draw a point at the new equilibrium quantity to show the price received by the seller. Label it 3. Draw a shape that represents the tax revenue received by the government. The pays more of the tax because OA. seller; the elasticity of demand is greater than the elasticity of supply OB. buyer; the elasticity of supply is greater than the elasticity of demand O c. buyer; sellers can always pass on the tax to buyers OD. seller, competition among sellers forces sellers to absorb the tax and not pass it on to buyers Selected: none 6- 4- 16- 14- 12- 10- 8- 2- 0 26- 24- 22- 20- 18- Pric Delete

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section6.2: Taxes

Problem 2QQ

Related questions

Question

Help please

29

Transcribed Image Text:K

New York has the highest cigarette taxes in the country. The price of an average pack of cig.

and city taxes are $5.95 a pack. The average income of smokers is less than that of non-smo

Draw a graph to show the effects of the $5.95 tax on the buyer's price, the seller's price, the q

the buver or seller pay more of the tax? Why?

Draw a point at the new equilibrium quantity to show the price paid by

buyers. Label it 2.

Draw a point at the new equilibrium quantity to show the price received

by the seller. Label it 3.

Draw a shape that represents the tax revenue received by the

government.

The

pays more of the tax because

OA. seller; the elasticity of demand is greater than the elasticity of

supply

OB. buyer; the elasticity of supply is greater than the elasticity of

demand

O c.

O D.

buyer; sellers can always pass on the tax to buyers

seller, competition among sellers forces sellers to absorb the

tax and not pass it on to buyers

Selected:

none

6-

4-

16-

14

12-

10-

8-

2-

D

26-

24-

22-

20-

18-

Pric

Delete

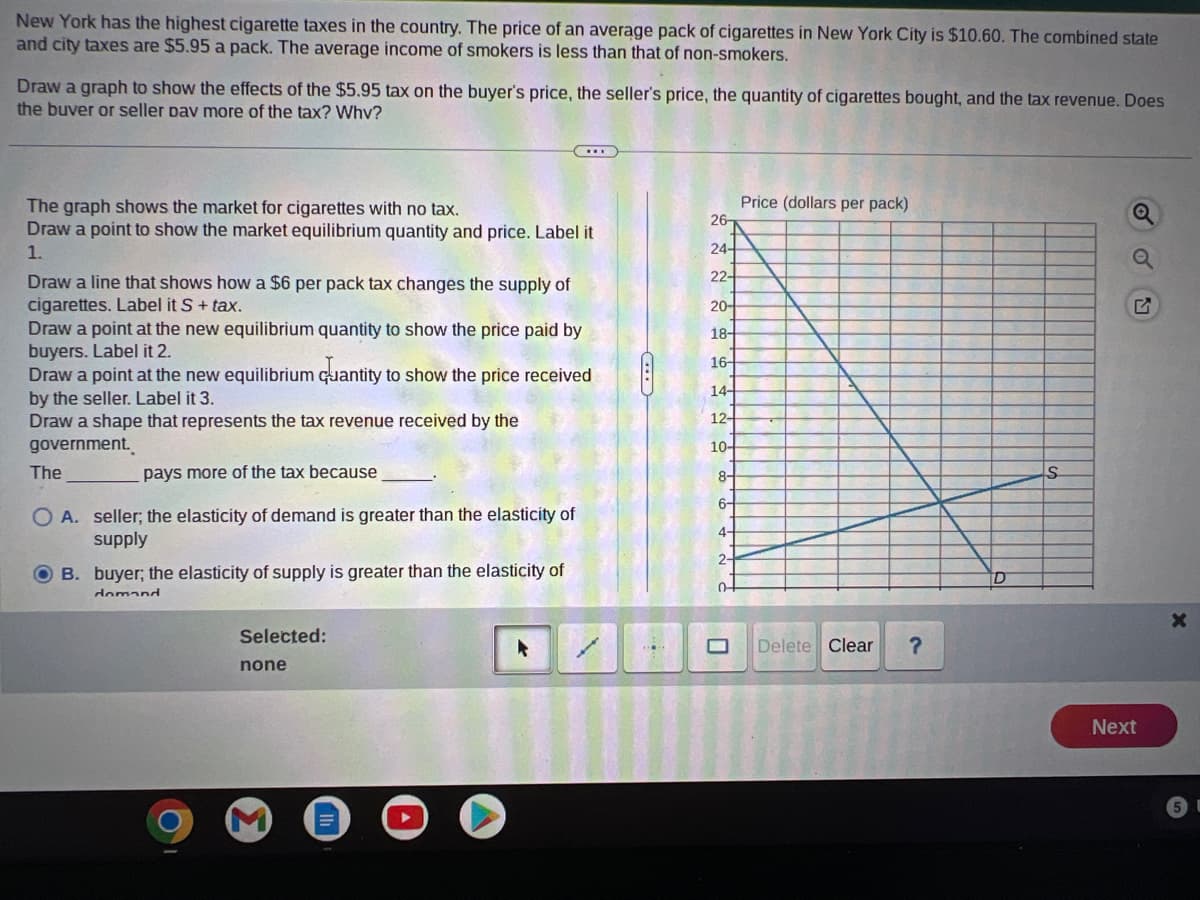

Transcribed Image Text:New York has the highest cigarette taxes in the country. The price of an average pack of cigarettes in New York City is $10.60. The combined state

and city taxes are $5.95 a pack. The average income of smokers is less than that of non-smokers.

Draw a graph to show the effects of the $5.95 tax on the buyer's price, the seller's price, the quantity of cigarettes bought, and the tax revenue. Does

the buver or seller Dav more of the tax? Why?

The graph shows the market for cigarettes with no tax.

Draw a point to show the market equilibrium quantity and price. Label it

1.

Draw a line that shows how a $6 per pack tax changes the supply of

cigarettes. Label it S + tax.

Draw a point at the new equilibrium quantity to show the price paid by

buyers. Label it 2.

Draw a point at the new equilibrium quantity to show the price received

by the seller. Label it 3.

Draw a shape that represents the tax revenue received by the

government.

The

pays more of the tax because

O A. seller; the elasticity of demand is greater than the elasticity of

supply

OB. buyer; the elasticity of supply is greater than the elasticity of

domand

Selected:

none

▸

8

26-

24-

22-

20-

18-

16-

14-

12-

10-

8-

6-

4-

2-

0

U

Price (dollars per pack)

Delete Clear ?

D

S

Q

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning