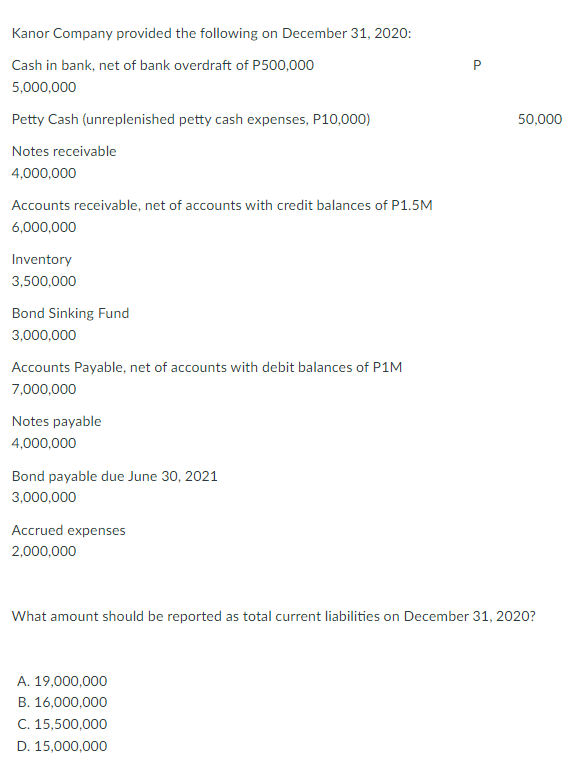

Kanor Company provided the following on December 31, 2020: Cash in bank, net of bank overdraft of P500,000 P 5,000,000 Petty Cash (unreplenished petty cash expenses, P10,000) 50,000 Notes receivable 4,000,000 Accounts receivable, net of accounts with credit balances of P1.5M 6,000,000 Inventory 3,500,000 Bond Sinking Fund 3,000,000 Accounts Payable, net of accounts with debit balances of P1M 7,000,000 Notes payable 4,000,000 Bond payable due June 30, 2021 3,000,000 Accrued expenses 2,000,000 What amount should be reported as total current liabilities on December 31, 2020? A. 19,000,000 B. 16,000,000 C. 15,500,000 D. 15,000,000

Kanor Company provided the following on December 31, 2020: Cash in bank, net of bank overdraft of P500,000 P 5,000,000 Petty Cash (unreplenished petty cash expenses, P10,000) 50,000 Notes receivable 4,000,000 Accounts receivable, net of accounts with credit balances of P1.5M 6,000,000 Inventory 3,500,000 Bond Sinking Fund 3,000,000 Accounts Payable, net of accounts with debit balances of P1M 7,000,000 Notes payable 4,000,000 Bond payable due June 30, 2021 3,000,000 Accrued expenses 2,000,000 What amount should be reported as total current liabilities on December 31, 2020? A. 19,000,000 B. 16,000,000 C. 15,500,000 D. 15,000,000

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 4QY: What is the journal entry to record an NSF check, from J. Smith for 250, that is returned with the...

Related questions

Question

Transcribed Image Text:Kanor Company provided the following on December 31, 2020:

Cash in bank, net of bank overdraft of P500,000

P

5,000,000

Petty Cash (unreplenished petty cash expenses, P10,000)

50,000

Notes receivable

4,000,000

Accounts receivable, net of accounts with credit balances of P1.5M

6,000,000

Inventory

3,500,000

Bond Sinking Fund

3,000,000

Accounts Payable, net of accounts with debit balances of P1M

7,000,000

Notes payable

4,000,000

Bond payable due June 30, 2021

3,000,000

Accrued expenses

2,000,000

What amount should be reported as total current liabilities on December 31, 2020?

A. 19,000,000

B. 16,000,000

C. 15,500,000

D. 15,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning