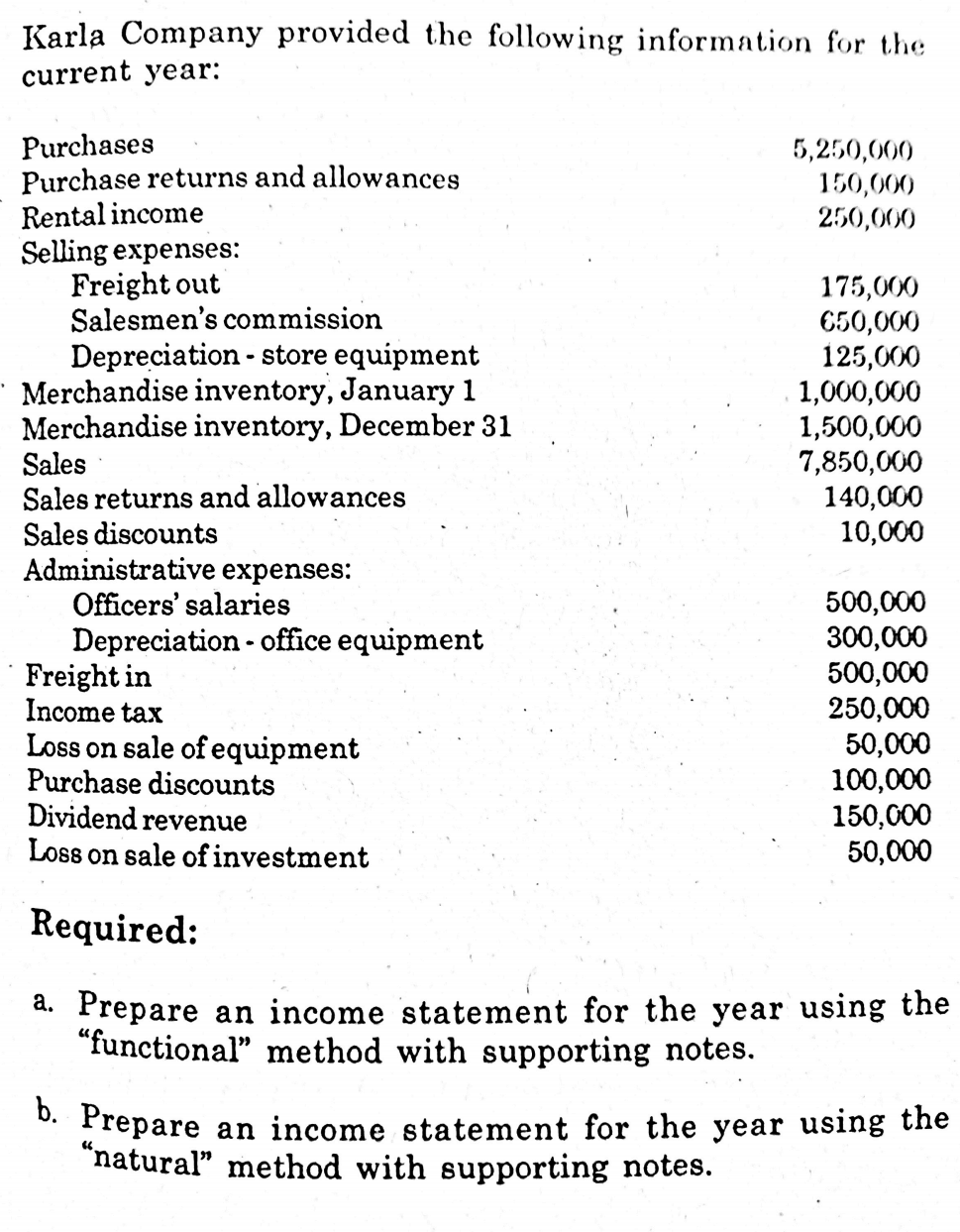

Karla Company provided the following information for the current year: Purchases Purchase returns and allowances Rental income Selling expenses: Freight out Salesmen's commission Depreciation - store equipment Merchandise inventory, January 1 Merchandise inventory, December 31 Sales Sales returns and allowances Sales discounts Administrative expenses: Officers' salaries Depreciation - office equipment Freight in Income tax 5,250,000 150,000 250,000 175,000 C50,000 125,000 1,000,000 1,500,000 7,850,000 140,000 10,000 500,000 300,000 500,000 250,000 50,000 100,000 150,000 50,000 Loss on sale of equipment Purchase discounts Dividend revenue Loss on sale of investment Required: a. Prepare an income statement for the year using the "functional" method with supporting notes. D. Prepare an income statement for the year using the "natural" method with supporting notes.

Karla Company provided the following information for the current year: Purchases Purchase returns and allowances Rental income Selling expenses: Freight out Salesmen's commission Depreciation - store equipment Merchandise inventory, January 1 Merchandise inventory, December 31 Sales Sales returns and allowances Sales discounts Administrative expenses: Officers' salaries Depreciation - office equipment Freight in Income tax 5,250,000 150,000 250,000 175,000 C50,000 125,000 1,000,000 1,500,000 7,850,000 140,000 10,000 500,000 300,000 500,000 250,000 50,000 100,000 150,000 50,000 Loss on sale of equipment Purchase discounts Dividend revenue Loss on sale of investment Required: a. Prepare an income statement for the year using the "functional" method with supporting notes. D. Prepare an income statement for the year using the "natural" method with supporting notes.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 41E: Cost of goods sold and related items The following data were extracted from the accounting records...

Related questions

Question

Prepare a Statement of Comprehensive Income using (1) single-step approach and (2) multi-step approach. Make sure that they prepared in good form WITH corresponding Notes to Comprehensive Income. Thank you.

Transcribed Image Text:Karla Company provided the following information for the

current year:

Purchases

Purchase returns and allowances

Rental income

Selling expenses:

Freight out

Salesmen's commission

Depreciation - store equipment

Merchandise inventory, January 1

Merchandise inventory, December 31

Sales

Sales returns and allowances

Sales discounts

Administrative expenses:

Officers' salaries

5,250,000

150,000

250,000

175,000

650,000

125,000

1,000,000

1,500,000

7,850,000

140,000

10,000

500,000

300,000

500,000

250,000

50,000

100,000

150,000

50,000

Depreciation - office equipment

Freight in

Income tax

Loss on sale of equipment

Purchase discounts

Dividend revenue

Loss on sale of investment

Required:

a. Prepare an income statement for the year using the

"functional" method with supporting notes.

b. Prepare

"natural" method with supporting notes.

an income statement for the year using the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning